Apollo Silver to Option Cinco de Mayo Project, Chihuahua, Mexico

Apollo Silver Corp. (TSX.V:APGO, OTCQB:APGOF) has entered into an option agreement with MAG Silver Corp. to acquire the Cinco de Mayo Project in Chihuahua, Mexico. The project comprises 29 concessions totaling approximately 25,000 hectares and hosts carbonate replacement type deposits, including the Upper Manto Pb-Zn-Ag (Au) deposit and the Pozo Seco Mo-Au deposit.

Key points:

- Historical inferred resource for Upper Manto: 12.45 million tonnes at 132 g/t Ag, 2.86% Pb, 6.47% Zn, 0.24 g/t Au

- Pozo Seco historical indicated resource: 29.1 million tonnes at 0.147% Mo and 0.25 g/t Au

- Apollo Silver must obtain necessary licensing and complete 20,000 m of exploratory drilling within five years

- Upon exercise of the option, Apollo will issue shares to MAG equivalent to 19.9% of the company

Apollo Silver Corp. (TSX.V:APGO, OTCQB:APGOF) ha stipulato un accordo di opzione con MAG Silver Corp. per acquisire il Progetto Cinco de Mayo in Chihuahua, Messico. Il progetto comprende 29 concessioni per un totale di circa 25.000 ettari e ospita depositi di tipo sostituzione di carbonati, inclusi il deposito Upper Manto Pb-Zn-Ag (Au) e il deposito Pozo Seco Mo-Au.

Punti chiave:

- Risorsa storica inferita per Upper Manto: 12,45 milioni di tonnellate a 132 g/t di Ag, 2,86% di Pb, 6,47% di Zn, 0,24 g/t di Au

- Risorsa storica indicata per Pozo Seco: 29,1 milioni di tonnellate a 0,147% di Mo e 0,25 g/t di Au

- Apollo Silver deve ottenere le licenze necessarie e completare 20.000 m di perforazioni esplorative entro cinque anni

- All'esercizio dell'opzione, Apollo emetterà azioni a favore di MAG equivalenti al 19,9% della società

Apollo Silver Corp. (TSX.V:APGO, OTCQB:APGOF) ha firmado un acuerdo de opción con MAG Silver Corp. para adquirir el Proyecto Cinco de Mayo en Chihuahua, México. El proyecto comprende 29 concesiones que totalizan aproximadamente 25,000 hectáreas y presenta depósitos de tipo reemplazo de carbonatos, incluyendo el depósito Upper Manto Pb-Zn-Ag (Au) y el depósito Pozo Seco Mo-Au.

Puntos clave:

- Recurso inferido histórico para Upper Manto: 12.45 millones de toneladas a 132 g/t de Ag, 2.86% de Pb, 6.47% de Zn, 0.24 g/t de Au

- Recurso indicado histórico para Pozo Seco: 29.1 millones de toneladas a 0.147% de Mo y 0.25 g/t de Au

- Apollo Silver debe obtener las licencias necesarias y completar 20,000 m de perforación exploratoria en cinco años

- Al ejercer la opción, Apollo emitirá acciones a favor de MAG equivalentes al 19.9% de la compañía

아폴로 실버 코프(Apollo Silver Corp.) (TSX.V:APGO, OTCQB:APGOF)는 멕시코 치와와에 있는 Cinco de Mayo 프로젝트를 인수하기 위해 MAG 실버 코프(MAG Silver Corp.)와 옵션 계약을 체결했습니다. 이 프로젝트는 약 25,000헥타르에 해당하는 29개의 양허를 포함하며, 상부맨토 Pb-Zn-Ag(Au) 매장지 및 포소 세코 Mo-Au 매장지를 포함한 탄산염 대체형 광상입니다.

주요 사항:

- 상부맨토에 대한 역사적 추정 자원: 1,245만 톤, Ag 132 g/t, Pb 2.86%, Zn 6.47%, Au 0.24 g/t

- 포소 세코 역사적 보고된 자원: 2,910만 톤, Mo 0.147%, Au 0.25 g/t

- 아폴로 실버는 필요한 허가를 얻고 5년 이내에 20,000m의 탐사 드릴링을 완료해야 합니다.

- 옵션 행사 시, 아폴로는 MAG에 회사의 19.9%에 해당하는 주식을 발행할 것입니다.

Apollo Silver Corp. (TSX.V:APGO, OTCQB:APGOF) a conclu un accord d'option avec MAG Silver Corp. pour acquérir le Projet Cinco de Mayo au Chihuahua, Mexique. Le projet comprend 29 concessions totalisant environ 25 000 hectares et comporte des dépôts de type remplacement carbonate, y compris le dépôt Upper Manto Pb-Zn-Ag (Au) et le dépôt Pozo Seco Mo-Au.

Points clés :

- Ressource historique inférée pour Upper Manto : 12,45 millions de tonnes à 132 g/t Ag, 2,86 % Pb, 6,47 % Zn, 0,24 g/t Au

- Ressource historique indiquée pour Pozo Seco : 29,1 millions de tonnes à 0,147 % Mo et 0,25 g/t Au

- Apollo Silver doit obtenir les licences nécessaires et réaliser 20 000 m de forages exploratoires dans un délai de cinq ans

- Lors de l'exercice de l'option, Apollo émettra des actions à MAG représentant 19,9 % de la société

Apollo Silver Corp. (TSX.V:APGO, OTCQB:APGOF) hat einen Optionsvertrag mit MAG Silver Corp. unterzeichnet, um das Cinco de Mayo Projekt in Chihuahua, Mexiko, zu erwerben. Das Projekt umfasst 29 Konzessionen mit einer Gesamtfläche von etwa 25.000 Hektar und beherbergt Ablagerungen vom Typ Carbonat-Ersatz, einschließlich des Upper Manto Pb-Zn-Ag (Au) Vorkommens und des Pozo Seco Mo-Au Vorkommens.

Wichtige Punkte:

- Historische geschätzte Ressource für Upper Manto: 12,45 Millionen Tonnen bei 132 g/t Ag, 2,86% Pb, 6,47% Zn, 0,24 g/t Au

- Pozo Seco historische angegebene Ressource: 29,1 Millionen Tonnen bei 0,147% Mo und 0,25 g/t Au

- Apollo Silver muss die erforderlichen Lizenzen erhalten und innerhalb von fünf Jahren 20.000 m Explorationsbohrungen abschließen

- Bei Ausübung der Option wird Apollo Aktien an MAG ausgeben, die 19,9% des Unternehmens entsprechen.

- Acquisition of Cinco de Mayo Project diversifies Apollo Silver's portfolio

- Project hosts significant historical mineral resources in two deposits

- Potential for new discovery in the high-priority Pegaso Zone

- Option agreement allows Apollo to earn 100% interest in the project

- Access to the project is currently restricted by the local ejido assembly

- No modern work has been conducted on the project since 2012

- Significant exploration and community relations work required to advance the project

- Potential share dilution upon exercise of the option agreement

Insights

Analyzing...

VANCOUVER, British Columbia, Sept. 23, 2024 (GLOBE NEWSWIRE) -- Apollo Silver Corp. (“Apollo Silver” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) has entered into an exploration, earn-in and option agreement (the “Option Agreement”), dated effective September 20, 2024, with MAG Silver Corp. (“MAG”) (TSX:MAG) and its subsidiary, Minera Pozo Seco, S.A. de C.V. (“MPS”), pursuant to which Apollo Silver has the option (the “Transaction”) to acquire the Cinco de Mayo Project (the “Project” or “Cinco de Mayo”).

“This is an exciting time for Apollo Silver as the addition of Cinco de Mayo marks the beginning of our transformation as a Company. We have successfully mitigated single asset risk by now boasting a portfolio of two exciting projects in two pro-mining jurisdictions,” commented Chairman and Interim CEO, Andrew Bowering. “Much of our group has considerable experience in Mexico and we are excited to begin the work to unlock value at Cinco de Mayo for all our stakeholders.”

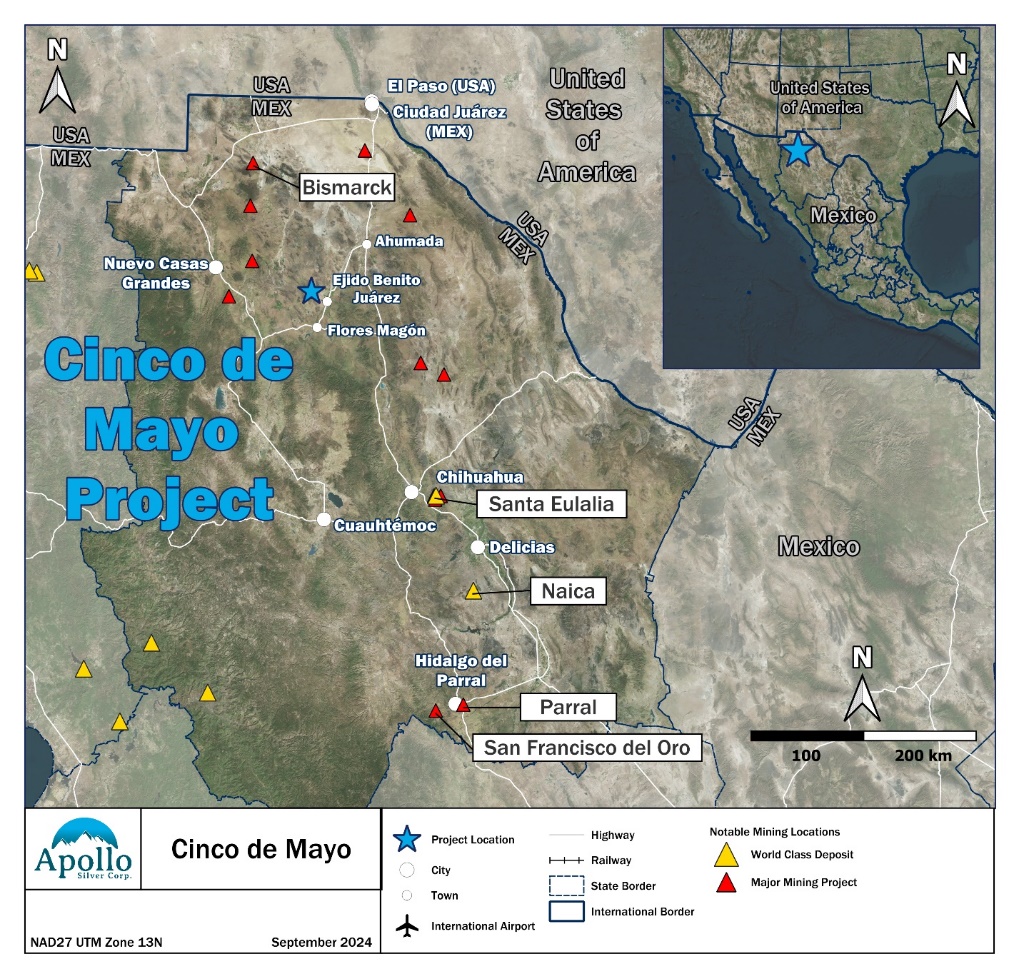

Cinco de Mayo comprises 29 concessions totaling approximately 25,000 hectares and is located in the north central part of Chihuahua State, Mexico approximately 190 kilometres (“km”) northwest of the state capital of Chihuahua City in the Municipio de Buenaventura. The Project area is located immediately west of the village of Benito Juárez and for the purposes of exploration, benefits from excellent access via local dirt roads.

Figure 1: Regional Map showing the location of the Cinco de Mayo Project and other significant deposits

The Project is prospective for and hosts carbonate replacement type deposits (CRD) including the Upper Manto Pb-Zn-Ag (Au) deposit, which consists of two parallel and overlapping manto deposits referred to as the Jose Manto and the Bridge Zone. The Project also hosts the Pozo Seco Molybdenum-Gold (Mo-Au) deposit. The two deposits host distinctly different mineralization with different commodities and are separated by four (4) km.

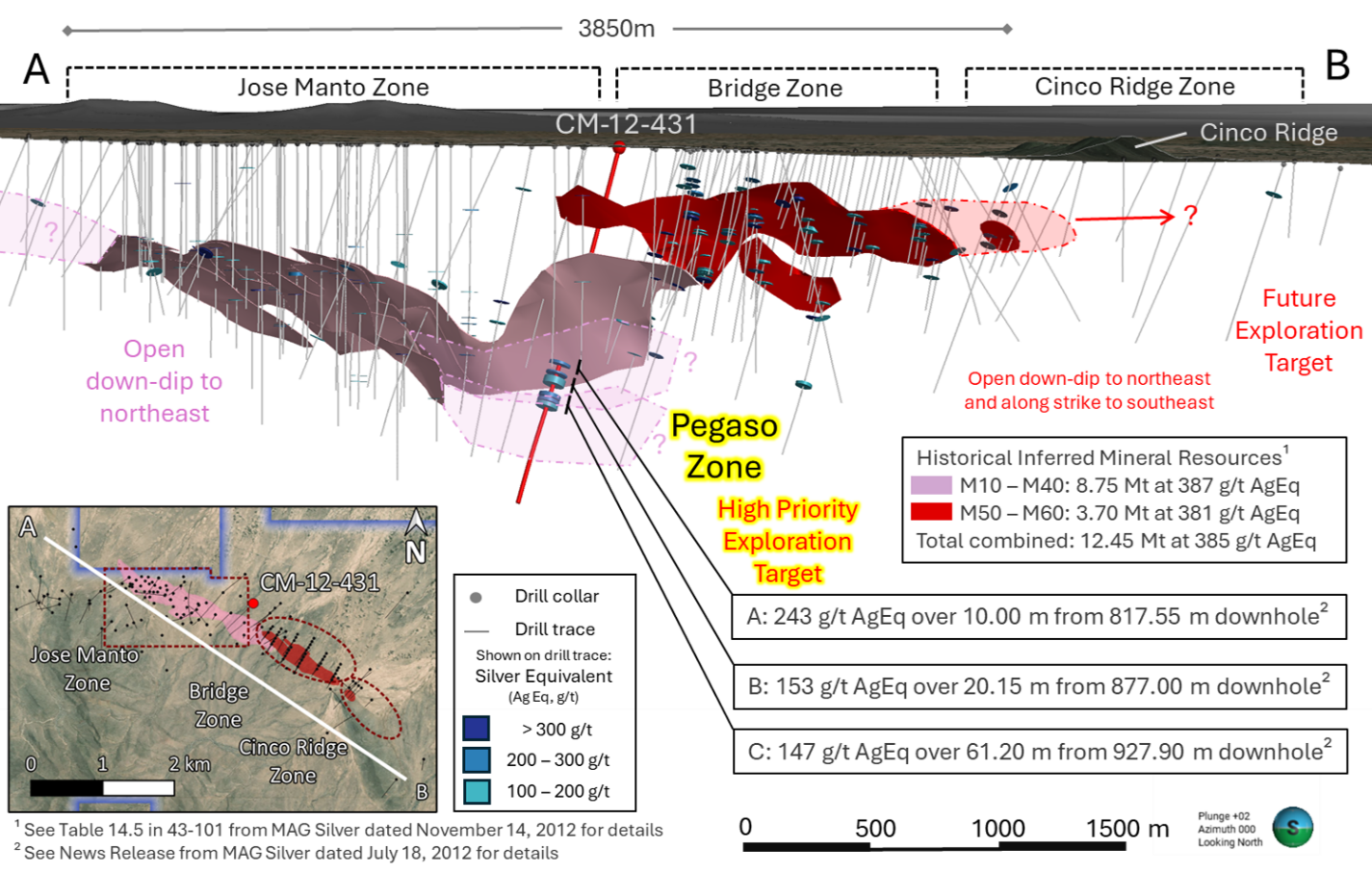

As of September 1, 2012, 445 holes totaling 213,591 metres (“m”) had been drilled on the Project by the previous operators, with no work completed since. Of these, 151 holes totaling 97,610 m are located at or nearby the Upper Manto deposit and were used to model the mineralization. Roscoe Postle Associates Inc. (“RPA”) prepared a technical report on the Project, dated November 14, 2012, which includes a now historical inferred mineral resource. At an NSR cut-off of US

Figure 2: Oblique View Section highlighting the high priority Pegaso Target and historical resource estimate on the Project

A potential new discovery, called the Pegaso Zone, was drilled in 2012. Consisting of 61.6 m of massive sulphide in a deeper hole (CM-12-431), it was not included in the 2012 historical resource estimate (Figure 2). This intercept is considered a high priority target and has potential to be a significant new discovery. The Company’s initial review of historical data suggests that the Pegaso Zone could indicate a larger and higher-grade resource at depth.

As previously indicated, the Project also hosts the Pozo Seco Mo-Au deposit, for which RPA prepared a historical mineral resource estimate in 2010. At a cut-off grade of

Table 1: Historical Resource Estimates for the Cinco de Mayo Project

Upper Manto Deposit, September 1, 2012, Mag Silver Corporation (1) | |||||||||||||

| | Tonnage (Mt) | Gold (g/t) | Silver (g/t) | Zinc (%) | Lead (%) | AgEq (g/t) | Gold (oz) | Silver (Moz) | Zinc (Mlb) | Lead (Mlb) | |||

Inferred | 12.45 | 0.24 | 132 | 6.47 | 2.86 | 385 | 96,000 | 52.7 | 1,777 | 785 | |||

Pozo Seco Deposit, July 12, 2010, Mag Silver Corporation (2) | |||||||||||||

| | Tonnage (Mt) | Gold (g/t) | Molybdenum (%) | Gold (oz) | Molybdenum (Mlb) | ||||||||

Indicated | 29.1 | 0.25 | 0.147 | 230,000 | 94.0 | ||||||||

Inferred | 23.4 | 0.17 | 0.103 | 129,000 | 53.2 | ||||||||

1 The Upper Manto historical mineral resource was estimated by RPA with an effective date of September 1, 2012. Mineral resources are estimated at an NSR cut-off value of US

2 The Pozo Seco historical mineral resource was estimated by RPA with an effective date of July 12, 2010. The cut-off grade of

The historical mineral resources for the Upper Manto and Pozo Seco deposits, discussed in this news release were calculated prior to the implementation of current CIM standards for mineral resource estimation (as defined by the CIM Definition Standard on Mineral Resources and Ore Reserves dated May 10, 2014). The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. The historical resources have been included simply to demonstrate the mineral potential of the Project. As part of the initial phase of work on the Project, the Company intends to do a thorough review of all historical data performed by a qualified person, along with additional exploration work to confirm results, in order to produce a current mineral resource estimate for the deposits. The Company is not aware of any more recent estimates prepared for the Project.

The Project has not seen any modern work since 2012 when the previous operators, MAG, lost access to the property due to a number of reasons involving community relations with local stakeholders and social licensing requirements. Access to the Project is currently restricted by the ejido assembly in the region. Following completion of the Transaction, the Company intends to actively work with the assembly and the local community to regain access and obtain the necessary licensing to continue exploration activities on the Project.

Transaction Terms

Pursuant to the terms of the Transaction, the Company has been granted an option (the “Option”) to acquire all of the outstanding share capital of 0890887 B.C. Ltd. (“NumberCo”), a wholly-owned subsidiary of MAG, which itself is the indirect controlling shareholder of MPS. MPS is the sole registered and beneficial owner of the mineral concessions comprising the Project. In order to exercise the Option, the Company is required to obtain the necessary licensing to access and conduct mining activities on the Project, and subsequently complete no less than 20,000 m of exploratory drilling, all within a five-year period (the “Option Term”). Upon exercise of the Option, and subject to the final approval of the TSX Venture Exchange, the Company will issue to MAG common shares (the “Consideration Shares”) equivalent to

During the Option Term, the Company will control all exploration and development activities on the Project and will be responsible for all expenses associated with maintaining the Project in good standing. Following exercise of the Option, MAG will be granted certain rights allowing it to participate in subsequent equity interests to maintain its percentage ownership interest in the Company. The Consideration Shares will be subject to a four-month statutory hold period in accordance with applicable securities laws.

The Company is at arms-length from MAG and MPS, and no finders’ fees or commissions are payable in connection with the entering into of the Option Agreement. In the event the option is exercised, and the Project is acquired by the Company, a finders’ fee equivalent to

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo Silver’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Minerals Projects and is not an independent of the Company.

About Apollo Silver

Apollo Silver has assembled an experienced and technically strong leadership team who have joined to advance world class precious metals projects in tier-one jurisdictions. The Company is focused on advancing its portfolio of two significant silver exploration and resource development projects, the Calico Project, in San Bernardino County, California and the Cinco de Mayo Project, in Chihuahua State, Mexico.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Andrew Bowering

Chairman and Interim President & Chief Executive Officer

For further information, please contact:

Andrew Bowering

Chairman and Interim Chief Executive Officer

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the potential Transaction; the potential to obtaining the necessary licensing to operate and perform exploration activities; the potential to advance community relations and regain access to the project, the potential to locate and identify a larger and higher grade resource at depth; the potential for new discoveries; geological interpretations and historical resource estimates for the Project; future silver recoveries; timing, successful commencement and execution of future planned drilling and exploration activities. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective manner; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8187f49a-2284-4368-ba71-d07e98519ee2

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0655a9e-25b0-40db-bc4b-e8c31ab00742