Aon Unveils D&O Risk Analyzer to Advance the Management of Executive Officer Risks

Rhea-AI Summary

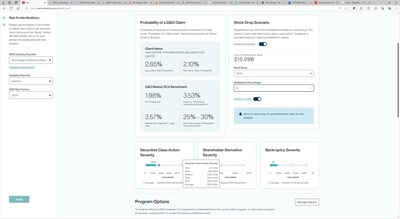

Aon plc (NYSE: AON) has launched its Directors and Officers (D&O) Risk Analyzer, a digital tool for U.S.-listed public companies to assess and mitigate executive risks. This release joins Aon's Property Risk and Casualty Risk analyzers in a suite of analytics tools. The D&O Risk Analyzer offers:

- Real-time analytics for quantifying potential D&O losses

- Risk exposure and loss models

- Stock price drop analysis

- Total cost of risk visualizations

These features enable real-time loss forecasting and facilitate discussions between risk managers and brokers about potential risks. The tool aims to help clients make better decisions in an evolving risk landscape, particularly in light of rising litigation costs, market volatility, and changing regulatory frameworks.

Positive

- Launch of a new digital tool (D&O Risk Analyzer) to enhance risk assessment capabilities

- Expansion of Aon's analytics suite, potentially increasing service offerings and client value

- Real-time analytics and customizable risk models to improve decision-making for clients

- Enhanced ability to quantify and communicate D&O risks, potentially leading to better insurance program design

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, AON gained 0.70%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

– Tool enables risk managers and brokers to assess corporate executive risks and tailor more impactful insurance programs

– Joins Aon's Property Risk and Casualty Risk analyzers in a growing suite of analytics tools for clients

"Rising litigation and defense costs, equity market volatility and shifting regulatory frameworks have added complexity for corporate officer risks," said Timothy Fletcher, CEO of Aon's financial services group. "It is more important than ever for risk managers to assess D&O liability and the role of insurance in protecting public officers and board directors. Our D&O Risk Analyzer, together with Aon's brokers, provide a holistic analysis of the D&O risk landscape, helping clients make better decisions."

Aon's D&O Risk Analyzer provides clients and brokers quick access to:

- Real-time analytics, which help clients quantify the likelihood and magnitude of potential D&O losses with data-driven insights on risk retention, risk transfer and maximizing the value of insurance. The risk models can be adjusted in real time based on new client information to provide revised insights on view of risk.

- Risk exposure and loss models, which provide a better understanding of exposure to adverse events, from small to catastrophic impact. Brokers and clients can explore the factors driving D&O litigation and exposure (including stock volatility, liquidity issues, disputed mergers and acquisitions and regulatory matters).

- Stock price drop analysis, which measures how varying stock drops for clients may result in theoretical D&O loss based on historical settlement data.

- Total cost of risk (TCOR) visualizations of all client's potential insurance options, which help clients explore actionable options to determine value, optimize limits and design the best potential insurance programs in the market, enabling not only better decisions but also the ability to best communicate those decisions.

These features enable real-time loss forecasting to iterate and quantify D&O risk exposures and loss scenarios, allowing discussions between risk managers and brokers about the extent of potential risk, elevating the focus beyond expected loss and empowering risk managers to better covey risk retention and risk transfer options to the C-suite.

Empowering Clients with Actionable Insights

The launch of Aon's D&O Risk Analyzer follows the 2024 debuts of the firm's Property Risk Analyzer and Casualty Risk Analyzer, which provide exposure visualizations and model potential losses to help Aon clients make informed decisions about their risk and insurance options. Aon will unveil additional risk analyzer tools in the coming months to provide data-driven insights on key risks. All Aon analytics tools are designed by Aon's Risk Capital and Human Capital capabilities in collaboration with Aon Business Services to provide Aon clients with actionable insights that allow for greater control over their insurance program structure.

"Aon's D&O Risk Analyzer exemplifies our firm's commitment to serve clients as they make data-informed decisions," said Joe Peiser, global CEO of Commercial Risk Solutions for Aon. "As the risk landscape grows more complex, we will continue to provide actionable analytics solutions that enable our clients to confidently assess risks and insurance offerings."

About Aon

Aon plc (NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues provide clients in over 120 countries with the clarity and confidence to make better risk and people decisions that protect and grow their businesses.

Follow Aon on LinkedIn, X, Facebook and Instagram. Stay up-to-date by visiting Aon's newsroom and sign up for news alerts here.

Media Contact

mediainquiries@aon.com

Toll-free (

International: +1 312 381 3024

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aon-unveils-do-risk-analyzer-to-advance-the-management-of-executive-officer-risks-302225303.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aon-unveils-do-risk-analyzer-to-advance-the-management-of-executive-officer-risks-302225303.html

SOURCE Aon plc