Anaconda Mining Intersects 2.73 g/t Gold over 6.5 metres and 4.57 g/t Gold over 3.0 metres and Identifies New Shallow Mineralization at Goldboro

Anaconda Mining Inc. announced positive results from its infill diamond drill program at the Goldboro Gold Project, aimed at upgrading mineral resources between two proposed open pits. The program included 19 drill holes totaling 2,585 meters, revealing multiple new zones of near-surface gold mineralization. Key highlights include significant gold grades, with up to 34.80 g/t over intervals. The project feasibility study revealed a combined resource of 2.58 million ounces, demonstrating strong economic viability with a pre-tax NPV of $484 million and an IRR of 31.2%. Future drilling is planned to enhance value.

- Successful infill drilling revealed several new near-surface gold mineralization zones.

- Assay results indicated high gold grades, with 34.80 g/t and 26.10 g/t gold reported.

- Combined Measured and Indicated Mineral Resources estimated at 2,581,000 ounces.

- Feasibility Study shows a pre-tax NPV of $484 million and IRR of 31.2%, indicating strong project viability.

- Potential for underground mining phase highlighted by deeper resource drilling.

- None.

TORONTO, ON / ACCESSWIRE / January 13, 2022 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to announce final results from an infill diamond drill program (the "Infill Drill Program") completed at the Company's

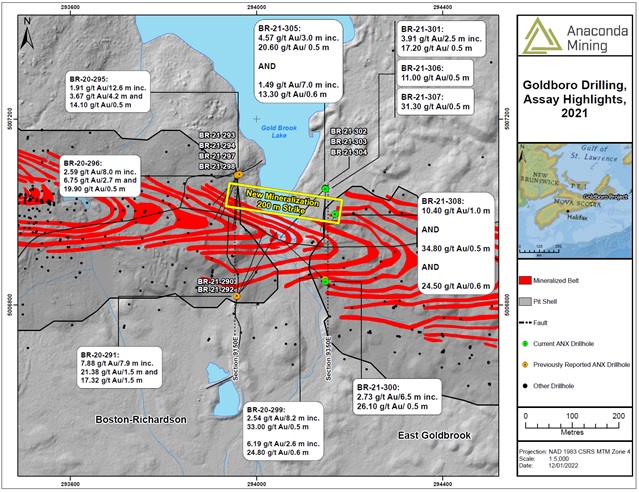

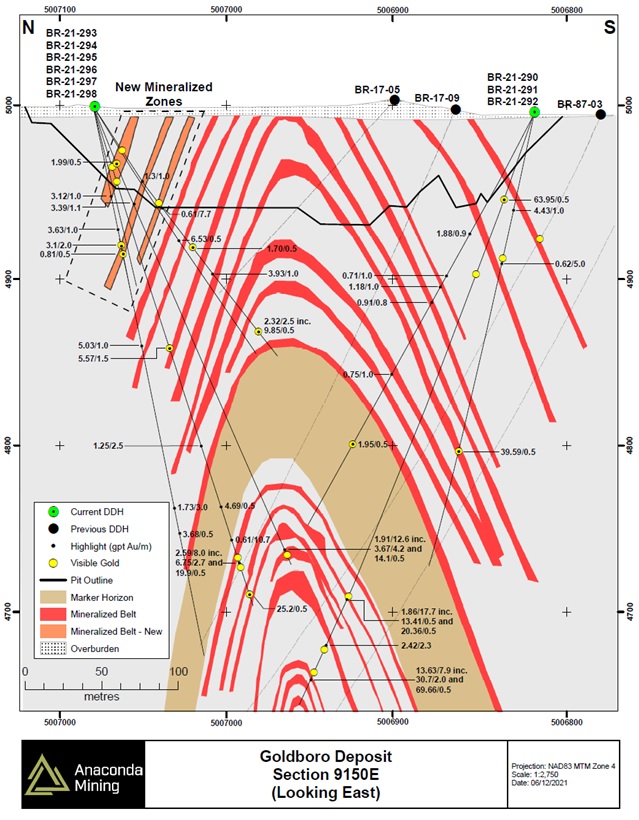

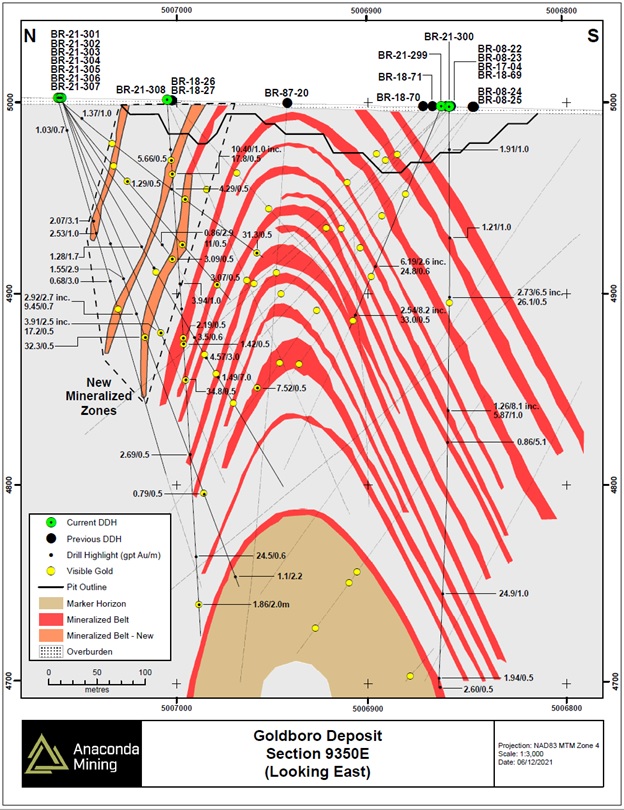

The Infill Drill Program successfully intersected several new zones of near-surface gold mineralization on the northern side of the Goldboro Deposit between the two proposed open pits, over a strike length of 200 metres, as well as infilled deeper sections of the Goldboro Deposit (Exhibits A, B, C). The new near-surface mineralized zones were not included within the Mineral Resource Estimate announced on December 16, 2021, and present near-term potential to upgrade both near surface and underground Inferred Mineral Resources, further optimize the pit design outlined in the Feasibility Study, reduce the strip ratio, and positively impact the value of the Project. Successful intersection and infill drilling of deeper, underground Inferred Mineral Resource further highlights the potential for an underground mining phase for the Project. Only 5 of the 19 drill holes completed in this program were included in the recent Mineral Resource Estimate update with the remainder to contribute to future updates.

Selected composited highlights (core length) from the drill program include:

- 26.10 grams per tonne ("g/t") over 0.5 metres within a broader zone consisting of 2.73 g/t gold over 6.5 metres (94.5 to 101.0 metres) in diamond drill hole BR-21-300;

- 17.20 g/t gold over 0.5 metres within a broader zone consisting of 3.91 g/t gold over 2.5 metres (137.5 to 140.0 metres) in diamond drill hole BR-21-301;

- 20.60 g/t gold over 0.5 metres within a broader zone consisting of 4.57 g/t gold over 3.0 metres (148.1 to 151.1 metres) in diamond drill hole BR-21-305;

- 13.30 g/t gold over 0.6 metres within a broader zone consisting of 1.49 g/t gold over 7.0 metres (157.5 to 164.5 metres) in diamond drill hole BR-21-305;

- 11.00 g/t gold over 0.5 metres (94.7 to 95.2 metres) in diamond drill hole BR-21-306;

- 31.30 g/t gold over 0.5 metres (126.2 to 126.7 metres) in diamond drill hole BR-21-307;

- 10.40 g/t gold over 1.0 metre (38.0 to 39.0 metres) in diamond drill hole BR-21-308;

- 34.80 g/t gold over 0.5 metres (145.7 to 146.2 metres) in diamond drill hole BR-21-308; and

- 24.50 g/t gold over 0.6 metres (235.6 to 236.2 metres) in diamond drill hole BR-21-308.

"This infill drill program and the related results highlight the tremendous potential that continues to exist for the Goldboro Gold Project. Since acquiring the Project in 2017, we have grown the deposit significantly, culminating in the recent Mineral Resource Estimate update which demonstrates a combined open pit and underground Measured and Indicated Mineral Resource of 2,581,000 ounces and a combined open pit and underground Inferred Mineral Resource of 484,000 ounces. In the fall 2021 we recognized an opportunity to target and potentially upgrade inferred near-surface and underground mineral resources in the area between the two open pits outlined in the Goldboro Feasibility Study. Several new zones of near surface mineralization were encountered within and between the two open pits over a strike length of 200 metres, demonstrating the potential to upgrade near-surface Inferred Resources and reduce the strip ratio. The assay results from the drill program also show continuity of high-grade gold within broader mineralized envelopes within the underground resource, indicating the potential to further upgrade underground Mineral Resources. Looking ahead to the new year, we are excited to commence further drill programs to both upgrade and expand the Goldboro Mineral Resource, which has the near-term potential to further increase value to what is already a robust, economically valuable Project."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc

Highlights of the Goldboro Project Feasibility Study*

- Total gold recovered of over 1.10 million ounces over an approximately 11-year open pit life of mine with average gold production of 100,000 ounces per annum, at an average diluted grade of 2.26 g/t gold;

- Pre-tax Net Present Value at a

5% discount rate ("NPV5% ") of$484 million and a pre-tax Internal Rate of Return ("IRR") of31.2% , with a projected pre-tax payback of 2.7 years; - After-tax NPV

5% of$328 million and an after-tax IRR of25.5% , projected after-tax payback of 2.9 years; - Maiden Probable Mineral Reserves of 1,150,200 ounces of gold (15.8 Mt at 2.26 g/t gold)

- Combined open pit and underground Measured and Indicated Mineral Resources of 2,581,000 ounces (21.5 Mt at 3.72 g/t gold) and Inferred Mineral Resources of 484,000 ounces (3.19 Mt at 4.73 g/t gold);

- Initial capital cost ("Capex") of

$271 million , resulting in an after-tax NPV5% to Capex ratio of 1.3, and LOM sustaining capital of$63.1 million ; - Life-of-Mine Operating Cash Costs of

$966 (US$772) per ounce sold1 and All-In Sustaining Costs ("AISC") of$1,062 (US$850) per ounce sold1; - Projected creation of approximately 345 direct full-time jobs during construction and 215 direct full-time jobs during operations, while generating in excess of

$226 million in federal and provincial tax payments; - Mill capacity of 4,000 tonnes per day ("tpd") based on a combined gravity and leaching circuit, yielding an average gold recovery of

95.8% ; and - At a gold price of

$2,200 (~US$1,760) , Goldboro could generate cumulative after-tax net cash flows of approximately$684 million , an after-tax NPV5% of over$442 million and an after-tax IRR of31.7% .

* Please refer to Press Release dated December 16, 2021 at www.anacondamining.com

1 Refer to Non-IFRS Financial Measures below.

Goldboro Gold Project - Mineral Resource Estimate

The Mineral Resource Estimate presented was prepared by Independent Qualified Person Glen Kuntz, P. Geo., of Nordmin Engineering Ltd. The Mineral Resource Estimate is based on validated results of 681 surface and underground drill holes for a total of 121,540 metres of diamond drilling completed between 1984 and the effective date of November 15, 2021, including 55,803 metres conducted by Anaconda.

Mineral Resource Estimate for the Goldboro Gold Project - Effective Date November 15, 2021

Resource Type | Gold Cut-off (g/t gold) | Category | Tonnes | Grade (g/t gold) | Gold Troy Ounces |

| Open Pit | 0.45 | Measured | 7,680,000 | 2.76 | 681,000 |

Indicated | 7,988,000 | 2.89 | 741,000 | ||

Measured + Indicated | 15,668,000 | 2.82 | 1,422,000 | ||

Inferred | 975,000 | 2.11 | 66,000 | ||

| Underground | 2.40 | Measured | 1,576,000 | 7.45 | 377,000 |

Indicated | 4,350,000 | 5.59 | 782,000 | ||

Measured + Indicated | 5,925,000 | 6.09 | 1,159,000 | ||

Inferred | 2,206,000 | 5.89 | 418,000 | ||

| Combined Open Pit and Underground* | 0.45 and 2.40 | Measured | 9,255,000 | 3.56 | 1,058,000 |

Indicated | 12,338,000 | 3.84 | 1,523,000 | ||

Measured + Indicated | 21,593,000 | 3.72 | 2,581,000 | ||

Inferred | 3,181,000 | 4.73 | 484,000 |

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.45 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.40 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are inclusive of Mineral Reserves.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.45 g/t gold that is based on a gold price of C

$2,000 /oz (~US$1,600 /oz) and a metallurgical recovery factor of89% around cut-off as calculated from ((GRADE-(0.0262*LN(GRADE)+0.0712))/GRADE*100)-0.083. - Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of C

$2,000 /oz (~US$1,600 /oz) and a gold processing recovery factor of97% . - Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Effective date of the Mineral Resource Estimate is November 15, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

Table of selected composites from the Goldboro Drill Program

Hole ID | From (m) | To (m) | Interval (m) | Gold (g/t) | Visible Gold |

BR-21-300 | 20.2 | 21.2 | 1.0 | 1.91 | |

and | 65.6 | 66.6 | 1.0 | 1.21 | |

and | 94.5 | 101.0 | 6.5 | 2.73 | VG |

including | 99.0 | 99.5 | 0.5 | 26.10 | VG |

and | 150.4 | 158.5 | 8.1 | 1.26 | |

including | 151.4 | 152.4 | 1.0 | 5.87 | |

and | 170.4 | 175.5 | 5.1 | 0.86 | |

and | 248.8 | 249.8 | 1.0 | 24.90 | |

BR-21-301 | 137.5 | 140.0 | 2.5 | 3.91 | VG |

including | 138.5 | 139.0 | 0.5 | 17.20 | VG |

and | 178.8 | 179.7 | 0.9 | 3.19 | |

and | 205.1 | 206.1 | 1.0 | 3.64 | |

BR-21-302 | 101.4 | 104.3 | 2.9 | 0.86 | |

and | 110.8 | 111.3 | 0.5 | 3.09 | VG |

and | 200.2 | 200.7 | 0.5 | 7.52 | VG |

BR-21-303 | 14.9 | 15.6 | 0.7 | 1.03 | |

and | 63.9 | 67.0 | 3.1 | 2.07 | |

and | 71.7 | 72.7 | 1.0 | 2.53 | |

and | 97.2 | 100.2 | 3.0 | 0.68 | |

BR-21-304 | 94.3 | 97.2 | 2.9 | 1.55 | |

and | 114.0 | 116.7 | 2.7 | 2.92 | |

including | 114.0 | 114.7 | 0.7 | 9.45 | |

and | 128.0 | 128.5 | 0.5 | 32.30 | VG |

and | 214.2 | 214.7 | 0.5 | 0.79 | VG |

and | 259.4 | 261.6 | 2.2 | 1.10 | |

BR-21-305 | 82.4 | 84.1 | 1.7 | 1.28 | |

and | 94.5 | 97.8 | 3.3 | 1.37 | VG |

and | 148.1 | 151.1 | 3.0 | 4.57 | VG |

including | 148.6 | 149.1 | 0.5 | 20.60 | |

and | 157.5 | 164.5 | 7.0 | 1.49 | VG |

including | 162.9 | 163.5 | 0.6 | 13.30 | VG |

and | 176.8 | 177.3 | 0.5 | 1.92 | VG |

BR-21-306 | 51.0 | 51.5 | 0.5 | 1.29 | VG |

and | 94.7 | 95.2 | 0.5 | 11.00 | VG |

and | 122.6 | 123.1 | 0.5 | 3.07 | VG |

BR-21-307 | 12.3 | 13.3 | 1.0 | 1.37 | |

and | 71.0 | 72.0 | 1.0 | 1.18 | |

and | 79.5 | 80.0 | 0.5 | 4.29 | VG |

and | 126.2 | 126.7 | 0.5 | 31.30 | VG |

BR-21-308 | 31.2 | 31.7 | 0.5 | 5.66 | VG |

and | 38.0 | 39.0 | 1.0 | 10.40 | VG |

including | 38.5 | 39.0 | 0.5 | 17.80 | VG |

and | 94.6 | 95.6 | 1.0 | 3.94 | |

and | 107.1 | 108.9 | 1.8 | 0.86 | |

and | 123.0 | 123.5 | 0.5 | 2.19 | VG |

and | 130.0 | 130.5 | 0.5 | 1.42 | VG |

and | 145.7 | 146.2 | 0.5 | 34.80 | VG |

and | 183.2 | 183.7 | 0.5 | 2.69 | |

and | 235.6 | 236.2 | 0.6 | 24.50 | |

and | 259.4 | 261.4 | 2.0 | 1.86 | VG |

- Intervals are reported as core length only. True widths are estimated to be between

70% and90% of the core length. - All drill hole results are reported using fire assay only. See notes on QAQC procedures at the bottom of this press release.

The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Drill Program and any other programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

Qualified Person and Technical Report Notes

A Technical Report prepared in accordance with NI 43-101 for the Goldboro Gold Project Feasibility Study will be filed on SEDAR (www.sedar.com) before the end of January 2022. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource and Mineral Reserve and Feasibility Study. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

^ Composited assays shown in Exhibit A and B from the October 12, 2021 press release may vary from those presented in the original press release due to the inclusion of assays obtained using total pulp metallic analysis (see below) obtained since October 12, 2021.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

All assays in this press release are reported as fire assays only. For samples analyzing greater than 0.5 g/t Au via 30 g fire assay, these samples will be re-analyzed at Eastern Analytical Ltd. via total pulp metallics. For the total pulp metallics analysis, the entire sample is crushed to -10mesh and pulverized to

The Drill Program is funded using existing flow through funds but has also benefited from a grant received from the Government of Nova Scotia through a Mineral Resources Development Fund, shared funding exploration grant MRDF-2021-SF-11.

Kevin Bullock, P.Eng., President and Chief Executive Officer of Anaconda, and Paul McNeill, P. Geo., VP Exploration of Anaconda, are "Qualified Person(s)" as such term is defined under NI 43-101 Standards for Disclosure for Mineral Projects and have each reviewed and approved the scientific and technical information and data included in this press release. A version of this press release will be available in French on Anaconda's website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study with Mineral Reserves of 1.15 million ounces of gold (15.80 million tonnes at 2.26 g/t gold), Measured and Indicated Mineral Resources inclusive of Mineral Reserves of 2.58 million ounces (21.6 million tonnes at 3.72 g/t gold) and additional Inferred Mineral Resources of 0.48 million ounces (3.18 million tonnes at 4.73 g/t gold) (Please see Press Release dated December 16, 2021 at www.anacondamining.com). Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

NON-IFRS MEASURES

Anaconda has included certain non-IFRS performance measures as detailed below. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Operating Cash Costs per Ounce of Gold - Anaconda calculates operating cash costs per ounce by dividing operating expenses, net of by-product revenue, by payable gold ounces. Operating expenses include mine site operating costs such as mining, processing and administration as well as selling costs and royalties, however, excludes depletion and depreciation and rehabilitation costs.

All-In Sustaining Costs per Ounce of Gold - Anaconda has adopted an all-in sustaining cost ("AISC") performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. The Company defines all-in sustaining costs as the sum of operating cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), sustaining exploration, and rehabilitation and reclamation costs. All-in sustaining costs excludes initial capital expenditures, financing costs, corporate general and administrative costs and salvage value, and taxes. AISC per Ounce is calculated as AISC divided by payable gold ounces.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes, but is not limited to, disclosure regarding the economics and project parameters presented in the PEA, including, without limitation, IRR, all-in sustaining costs, NPV and other costs and economic information, possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future development and exploration activities on the Company's projects; success of development and exploration activities; permitting time lines and requirements; time lines for further studies; planned exploration and development of properties and the results thereof; and planned expenditures and budgets and the execution thereof. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including the risks outlined in this news release, risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2020, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

Exhibit A The location of the drill holes and selected assay composites reported from the full nineteen-hole drill program conducted between the western and eastern pit shells and showing the new mineralized zones intersected during the drill program.

Exhibit B. Cross Section 9150E showing drill holes and selected assay composites reported from the drill program between the western and eastern pit shells.

Exhibit C. Cross Section 9350E showing drill holes and selected assay composites reported from the drill program between the western and eastern pit shells and showing the areas of new mineralization.

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/683296/Anaconda-Mining-Intersects-273-gt-Gold-over-65-metres-and-457-gt-Gold-over-30-metres-and-Identifies-New-Shallow-Mineralization-at-Goldboro

FAQ

What were the results of Anaconda Mining's infill drill program at Goldboro on January 13, 2022?

How much mineral resource did Anaconda Mining report for Goldboro as of December 16, 2021?

What is the pre-tax NPV and IRR for the Goldboro Gold Project?

How many drill holes were completed in the infill drill program at Goldboro?