Anaconda Mining Initiates Further Infill Drilling at Goldboro Following Resource Update, Targeting Growth in M&I Resources

Anaconda Mining Inc. has launched a 3,500 metre diamond drill program at its 100%-owned Goldboro Gold Project, following a recent increase in mineral resources. The aim is to convert high-priority Inferred Resources into Measured and Indicated categories to support an ongoing Feasibility Study anticipated in Q4 2021. Highlights include 1,946,100 ounces of gold across all categories and plans to enhance open pit resources. Company’s growth strategy aims for 150,000 ounces of gold production yearly. A Technical Report will be filed by March 31, 2021.

- Initiation of a substantial 3,500 metre diamond drill program at Goldboro.

- Recent significant expansion of the mineral resource estimate, indicating potential for increased Measured and Indicated resources.

- Anticipation of Feasibility Study completion in Q4 2021, which may solidify future project economics.

- None.

TORONTO, ON / ACCESSWIRE / March 3, 2021 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is pleased to announce that it has initiated a new 3,500 metre diamond drill program ("Drill Program") at the Company's

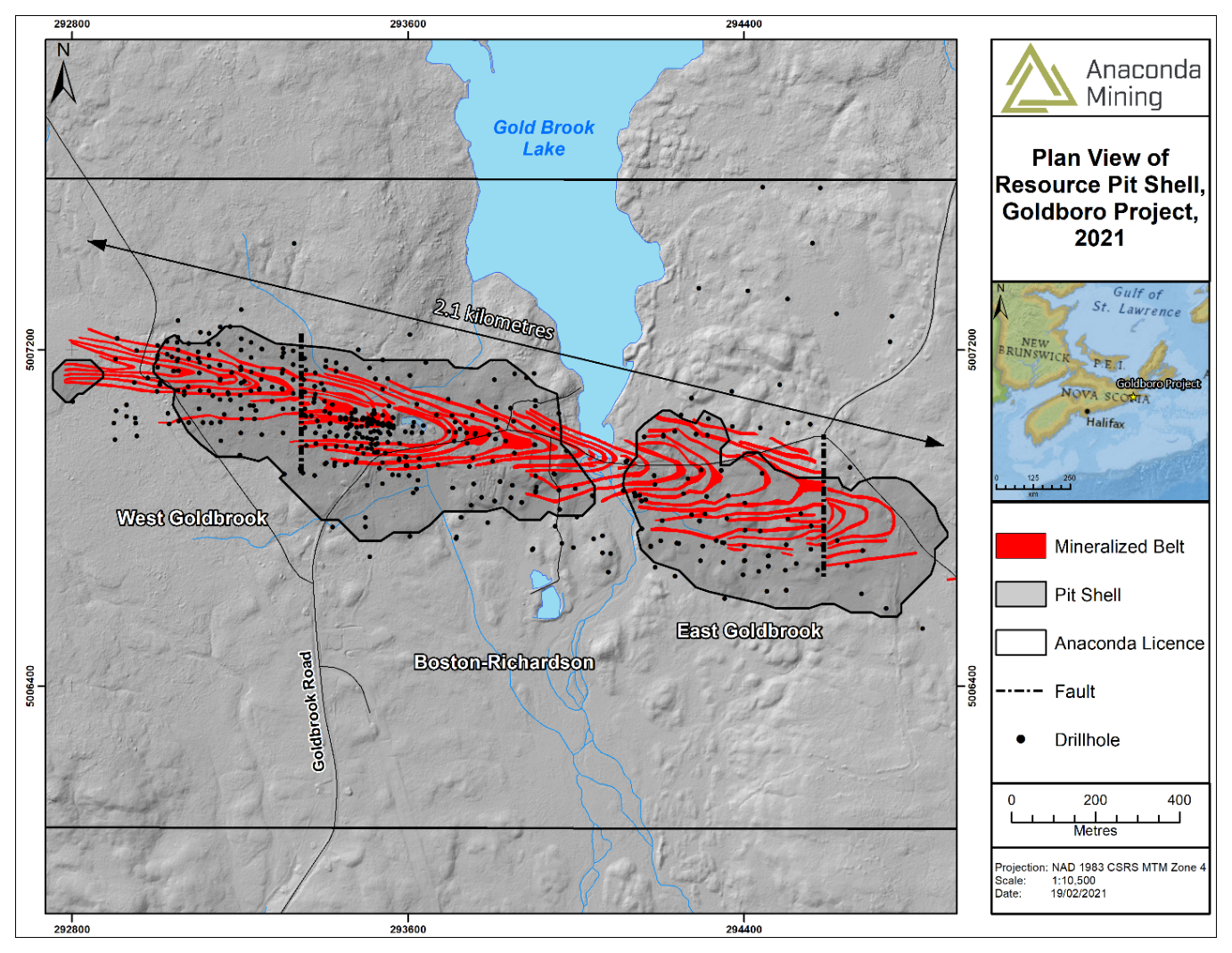

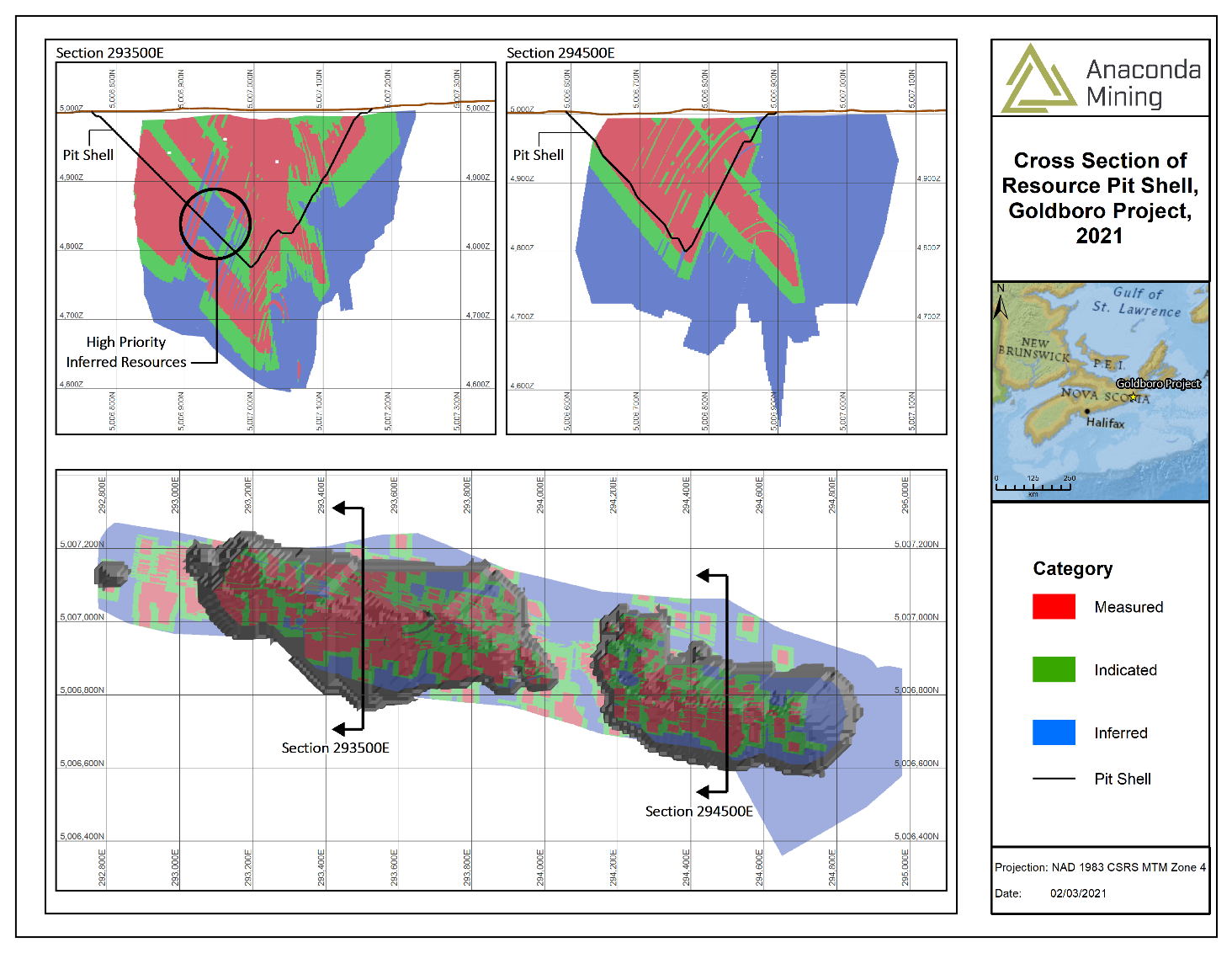

Importantly, the constrained open pits were designed using only Measured and Indicated Resources (Exhibit A), which in the process captured a portion of Inferred Resources. This infill program aims to upgrade those Inferred Resources into the Measured and Indicated categories to support the ongoing Feasibility Study (Exhibit B). The company is also evaluating further opportunities beyond this program to expand the open pit portion of the Mineral Resource, particularly by targeting Inferred Resources adjacent to the constrained open pits.

Highlights of the Goldboro Mineral Resource include:

- Overall, 1,946,100 ounces of gold (16,036,000 million tonnes at an average grade of 3.78 grams per tonne ("g/t") within the combined open pit and underground, Measured and Indicated Mineral Resource categories;

- Overall, 798,100 ounces of gold (5,306,000 tonnes at 4.68 g/t gold) within the combined open pit and underground, Inferred Mineral Resource category;

- 1,089,900 ounces of gold (11,880,000 tonnes at 2.86 g/t gold) within two constrained open pits within the Measured and Indicated Mineral Resource categories (Exhibits A and B); and

- 89,000 ounces of gold (1,580,000 tonnes at 1.75 g/t gold) in two constrained open pits within the Inferred Mineral Resource category.

"On the heels of the recently announced significant increase to the Goldboro Mineral Resource and the related positive metallurgical recoveries, we are excited to initiate a further round of infill drilling with the aim of upgrading Inferred resources to Measured and Indicated that fall within the open pits at Goldboro, so that they might be incorporated into the ongoing Feasibility Study, which is anticipated in Q4 2021. The current inferred open pit resources, lying within the constrained pit shells provide an immediate opportunity to increase the amount of Measured and Indicated resources included in the open pits. As we advance a Preliminary Economic Assessment, anticipated in Q2 and in parallel with the Feasibility Study, we expect there will be other opportunities to optimize and expand the open pit resource and economics of the Project, and demonstrate the Goldboro's ability to support the Company's growth strategy to become a 150,000 ounce per year gold producer."

~Kevin Bullock, President and CEO, Anaconda Mining Inc.

Mineral Resource Statement for the Goldboro Gold Project

Resource Type | Gold Cut-off (g/t) | Category | Tonnes ('000) | Gold Grade (g/t) | Troy Ounces |

Open Pit | 0.44 | Measured | 6,137 | 2.73 | 538,500 |

Indicated | 5,743 | 2.99 | 551,300 | ||

Measured + Indicated | 11,880 | 2.86 | 1,089,900 | ||

Inferred | 1,580 | 1.75 | 89,000 | ||

Underground | 2.60 | Measured | 1,384 | 7.36 | 327,700 |

Indicated | 2,772 | 5.93 | 528,600 | ||

Measured + Indicated | 4,156 | 6.41 | 856,200 | ||

Inferred | 3,726 | 5.92 | 709,100 | ||

Combined* | 0.44/2.60 | Measured | 7,521 | 3.58 | 866,200 |

Indicated | 8,515 | 3.95 | 1,079,900 | ||

Measured + Indicated | 16,036 | 3.78 | 1,946,100 | ||

Inferred | 5,306 | 4.68 | 798,100 |

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.44 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.60 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.44 g/t gold that is based on a gold price of CAD

$2,000 /oz (~US$1,550 /oz) and a gold processing recovery factor of96% . - Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of CAD

$2,000 /oz (~US$1,550 /oz) and a gold processing recovery factor of97% . - Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Mineral Resource effective date February 7, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Drill Program and any other programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

A Technical Report prepared in accordance with NI 43-101 for the Goldboro Gold Project will be filed on SEDAR (www.sedar.com) before March 31, 2021. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The Mineral Resource estimate was independently prepared under the supervision of Mr. Glen Kuntz, P.Geo. (Ontario) of Nordmin Engineering Ltd., a "Qualified Person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Verification included a site visit to inspect drilling, logging, density measurement procedures and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with original records.

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

A version of this press release will be available in French on Anaconda's website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going Feasibility Study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2019, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc. | Reseau ProMarket Inc. |

Exhibit A. The location of the Goldboro Gold Project showing the Goldboro deposit and open pits that constrain the open pit portion of the Mineral Resource.

Exhibit B. A map and two cross sections showing the Mineral Resource as resource categories within and outside of the constrained open pits. The western cross section illustrates an example of the high priority Inferred Resources that will be drilled during the Drill Program with the aim of upgrading to Measured and Indicated Resources.

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/633108/Anaconda-Mining-Initiates-Further-Infill-Drilling-at-Goldboro-Following-Resource-Update-Targeting-Growth-in-MI-Resources

FAQ

What is the purpose of the diamond drill program at Goldboro by Anaconda Mining (ANXGF)?

How much gold is estimated in the Goldboro Gold Project according to Anaconda Mining's recent report?

When is the Feasibility Study for Goldboro Gold Project expected to be completed?

What are the highlights of the mineral resource estimate for Goldboro by Anaconda Mining (ANXGF)?