Repeat - ALT5 Sigma Reports Strong Q4 and Full-Year 2024 Results, Achieves Milestones with Record Revenue, 1,000+ Customers, and Strategic Leadership Appointments

ALT5 Sigma (NASDAQ:ALTS) reported strong Q4 and full-year 2024 results, with record-breaking Q4 revenue of $5.4 million in their Fintech segment. The company achieved a significant milestone by surpassing 1,000 customers and maintained robust financial metrics with a 50.2% gross margin and 18.2% adjusted EBITDA for the Fintech division.

Key highlights include the appointment of Ron Pitters as Chief Operating Officer, a strategic collaboration with Odoo's suite of systems, and recognition as the 'Best Payment Provider' at SiGMA Eurasia Awards 2025. The company reported working capital improvement of $4.5 million over Q3 and cash equivalents of $7.18 million.

Additionally, ALT5's Biotech segment, Alyea Therapeutics, is preparing for a standalone listing, focusing on developing non-opioid pain treatments under the leadership of Dr. Amol Soin.

ALT5 Sigma (NASDAQ:ALTS) ha riportato risultati forti per il quarto trimestre e l'intero anno 2024, con un fatturato record nel Q4 di 5,4 milioni di dollari nel loro segmento Fintech. L'azienda ha raggiunto un traguardo significativo superando 1.000 clienti e ha mantenuto metriche finanziarie robuste con un margine lordo del 50,2% e un EBITDA rettificato del 18,2% per la divisione Fintech.

Tra i punti salienti ci sono la nomina di Ron Pitters come Chief Operating Officer, una collaborazione strategica con la suite di sistemi di Odoo e il riconoscimento come 'Miglior Fornitore di Pagamenti' agli SiGMA Eurasia Awards 2025. L'azienda ha riportato un miglioramento del capitale circolante di 4,5 milioni di dollari rispetto al Q3 e disponibilità liquide di 7,18 milioni di dollari.

Inoltre, il segmento Biotech di ALT5, Alyea Therapeutics, si sta preparando per una quotazione autonoma, concentrandosi sullo sviluppo di trattamenti non oppioidi per il dolore sotto la guida del Dr. Amol Soin.

ALT5 Sigma (NASDAQ:ALTS) reportó resultados sólidos para el cuarto trimestre y el año completo 2024, con ingresos récord en el Q4 de $5.4 millones en su segmento Fintech. La empresa alcanzó un hito significativo al superar 1,000 clientes y mantuvo métricas financieras robustas con un margen bruto del 50.2% y un EBITDA ajustado del 18.2% para la división Fintech.

Los puntos destacados incluyen el nombramiento de Ron Pitters como Director de Operaciones, una colaboración estratégica con la suite de sistemas de Odoo y el reconocimiento como 'Mejor Proveedor de Pagos' en los SiGMA Eurasia Awards 2025. La empresa reportó una mejora en el capital de trabajo de $4.5 millones en comparación con el Q3 y equivalentes de efectivo de $7.18 millones.

Además, el segmento Biotech de ALT5, Alyea Therapeutics, se está preparando para una cotización independiente, centrándose en desarrollar tratamientos no opioides para el dolor bajo la dirección del Dr. Amol Soin.

ALT5 시그마 (NASDAQ:ALTS)는 2024년 4분기 및 연간 실적이 강력하다고 보고했으며, 핀테크 부문에서 540만 달러의 기록적인 4분기 매출을 달성했습니다. 이 회사는 1,000명 이상의 고객을 초과 달성하며 50.2%의 총 이익률과 18.2%의 조정 EBITDA를 유지하며 강력한 재무 지표를 유지했습니다.

주요 하이라이트로는 론 피터스(Ron Pitters)를 최고운영책임자(COO)로 임명한 것, Odoo의 시스템 제품군과의 전략적 협업, 2025년 SiGMA 유라시아 어워드에서 '최고의 결제 제공업체'로 인정받은 것이 있습니다. 이 회사는 3분기 대비 450만 달러의 운영 자본 개선과 718만 달러의 현금 및 현금성 자산을 보고했습니다.

또한, ALT5의 생명공학 부문인 알리야 테라퓨틱스(Alyea Therapeutics)는 아몰 소인(Dr. Amol Soin) 박사의 지도 아래 비오피오이드 통증 치료 개발에 집중하며 독립 상장을 준비하고 있습니다.

ALT5 Sigma (NASDAQ:ALTS) a rapporté de solides résultats pour le quatrième trimestre et l'année entière 2024, avec un chiffre d'affaires record de 5,4 millions de dollars dans son segment Fintech pour le Q4. L'entreprise a atteint un jalon significatif en dépassant 1 000 clients et a maintenu des indicateurs financiers robustes avec une marge brute de 50,2% et un EBITDA ajusté de 18,2% pour la division Fintech.

Parmi les points forts figurent la nomination de Ron Pitters au poste de directeur des opérations, une collaboration stratégique avec la suite de systèmes d'Odoo et la reconnaissance en tant que 'Meilleur Fournisseur de Paiements' aux SiGMA Eurasia Awards 2025. L'entreprise a signalé une amélioration de son fonds de roulement de 4,5 millions de dollars par rapport au Q3 et des équivalents de liquidités de 7,18 millions de dollars.

De plus, le segment Biotech d'ALT5, Alyea Therapeutics, se prépare à une cotation autonome, en se concentrant sur le développement de traitements antidouleur non opioïdes sous la direction du Dr Amol Soin.

ALT5 Sigma (NASDAQ:ALTS) hat starke Ergebnisse für das vierte Quartal und das gesamte Jahr 2024 gemeldet, mit einem Rekordumsatz im Q4 von 5,4 Millionen Dollar in ihrem Fintech-Segment. Das Unternehmen hat einen bedeutenden Meilenstein erreicht, indem es 1.000 Kunden überschritt und robuste finanzielle Kennzahlen mit einer Bruttomarge von 50,2% und einem bereinigten EBITDA von 18,2% für die Fintech-Sparte aufrechterhielt.

Zu den wichtigsten Höhepunkten gehören die Ernennung von Ron Pitters zum Chief Operating Officer, eine strategische Zusammenarbeit mit der Odoo-Systemsuite und die Auszeichnung als 'Bester Zahlungsanbieter' bei den SiGMA Eurasia Awards 2025. Das Unternehmen berichtete über eine Verbesserung des Betriebskapitals von 4,5 Millionen Dollar im Vergleich zum Q3 und über liquide Mittel in Höhe von 7,18 Millionen Dollar.

Darüber hinaus bereitet sich der Biotech-Sektor von ALT5, Alyea Therapeutics, auf eine eigenständige Börsennotierung vor und konzentriert sich unter der Leitung von Dr. Amol Soin auf die Entwicklung von nicht-opioiden Schmerzbehandlungen.

- Record Q4 revenue of $5.42 million in Fintech segment

- Strong 50.2% gross margin and 18.2% adjusted EBITDA in Fintech division

- Achieved milestone of 1,000+ customers

- Working capital improvement of $4.5 million over Q3

- Healthy cash position of $7.18 million

- Strategic partnership with Odoo reaching 13 million users across 170 countries

- operational history in Fintech (only 2.5 quarters in 2024)

- Upcoming separation of business segments may create operational challenges

- Significant dependence on newly acquired Fintech segment for revenue

Insights

ALT5 Sigma's financial results reflect remarkable momentum with $5.42 million in Q4 Fintech revenue and $12.53 million for fiscal 2024—despite only operating this segment for two and a half quarters following the May acquisition. The back-to-back record quarters and surpassing 2023's total pre-acquisition revenue demonstrate exceptionally strong growth.

The

Surpassing 1,000 customers represents a crucial inflection point in market adoption. The planned separation of Fintech and Biotech segments creates cleaner investment narratives for both entities—the high-margin, fast-growing Fintech operation and the biotech development program centered on non-opioid pain treatment.

The leadership addition of Ron Pitters as COO brings valuable operational expertise that should help scale systems and processes during this high-growth phase. While adjusted EBITDA metrics always warrant careful examination of excluded costs, the fundamental operational metrics—revenue growth, margin profile, and working capital improvement—all point to strengthening business fundamentals.

ALT5's comprehensive blockchain infrastructure approach distinguishes it in the digital asset ecosystem. Rather than focusing on a single element, they've built an integrated technology stack spanning tokenization, trading, clearing, settlement, payment processing, and custody services—creating end-to-end capabilities that maximize their share of the transaction value chain.

The Odoo integration represents a significant distribution breakthrough, instantly embedding ALT5 Pay within the business systems of 13 million users across 170 countries. This B2B partnership leverages existing distribution channels rather than building direct consumer adoption—a far more efficient go-to-market strategy.

Their addition of new cryptocurrency trading pairs, including support for $TRUMP Coin payments, demonstrates market responsiveness and flexibility. The "Best Payment Provider" recognition at SiGMA Eurasia Awards validates their payment technology capabilities within a competitive field.

Most importantly, ALT5 is developing practical real-world applications—enabling cryptocurrency transactions for regulated financial markets and supporting influencer payments in the gig economy. These tangible use cases address genuine market needs rather than theoretical applications, a critical distinction in blockchain technology commercialization.

With strong market traction evidenced by customer growth, industry recognition, and diversified use cases, ALT5 appears well-positioned as blockchain financial infrastructure achieves broader commercial adoption beyond speculative trading.

ALT5 Achieves Record-Breaking Q4 with

$5.4 Million in RevenueCustomer Base Surpasses 1,000 Accounts, a Historic Milestone

Strong Annual Gross Margin of

50.2% and Impressive18.2% Adjusted EBITDA¹ for FintechSignificant Working Capital Improvement of

$4.5 Million Over Q3Ron Pitters Appointed as New Chief Operating Officer

LAS VEGAS, NEVADA / ACCESS Newswire / March 31, 2025 / ALT5 Sigma Corporation (NASDAQ:ALTS) ("ALT5" or the "Company"), a fintech, providing next-generation blockchain-powered technologies for tokenization, trading, clearing, settlement, payment, and safe-keeping of digital assets, announced financial results for its fourth fiscal quarter and full year ended December 28, 2024.

"ALT5 Sigma's Fintech segment delivered outstanding performance in Q4, building on the momentum from a record Q3 with another record-breaking quarter," said Peter Tassiopoulos, CEO of ALT5Sigma. "With a robust

In a key leadership development, Ron Pitters, a Director of the Company, has been appointed as Chief Operating Officer. Ron brings a wealth of experience in technology, fintech, and global business leadership, having held senior roles at Axos Financial, Inc. His extensive expertise spans technology, capital markets, product development, and business innovation, making him the ideal fit to help drive ALT5's global growth.

"We are thrilled to welcome Ron to the management team as our new COO," Tassiopoulos added. "Having worked with Ron as a director, I am confident that his vast experience and strategic vision will be instrumental in scaling ALT5 to new heights as we capitalize on the tremendous growth opportunities ahead."

Recent Highlights for the Company's Three- and Twelve-Months Ended December 28, 2024, and Subsequent Events

May 2024: Successfully completed the acquisition of our new wholly owned subsidiary, ALT5 Sigma, Inc.

July 2024: Rebranded from JanOne Inc. to ALT5 Sigma Corporation, with the Nasdaq ticker symbol updated to "ALTS".

October 2024: Board approved the separation of the Company's Fintech and Biotech segments into two independent entities. The Biotech entity (Alyea Therapeutics Corporation or "Alyea") commenced funding in Q4 and is pursuing plans for a future independent listing.

Q4 2024: Strengthened the Company's intellectual property portfolio with a strategic acquisition.

January 2025: Announced a key collaboration to integrate ALT5 Pay with Odoo's suite of POS, eCommerce, and ERP systems, enabling Odoo's 13 million users across 170 countries to enhance their payment solutions.

Over the last few months: Introduced a suite of new cryptocurrency pairs, offering customers greater flexibility in trading and cryptocurrency payments, including the ability for merchants to accept $TRUMP Coin, via ALT5 Pay.

February 2025: Honored as the "Best Payment Provider" at the SiGMA Eurasia Awards 2025, recognizing ALT5's leadership in the payment sector.

Post year-end: Continued innovation with new use cases, including real-time cryptocurrency transactions for investments in regulated financial markets and support for influencers in the gig economy to accept crypto payments for social media promotions.

As ALT5 accelerates its growth and expands its customer base, the Company remains focused on leveraging its cutting-edge blockchain technology to reshape the digital asset landscape, driving value for its customers and stakeholders alike.

Alyea's Upcoming Standalone Listing and Key Leadership Additions

"Led by Dr. Amol Soin, Alyea has made some key additions to their team as they ramp up for a planned standalone listing and prepare for the pivotal study on their novel formulation of low-dose naltrexone (LDN), Alyea's lead candidate for a non-opioid pain killer to treat Chronic Regional Pain Syndrome," said Tassiopoulos. Dr. Soin has been instrumental in building this team, and I am actively collaborating with him in finalizing the team and board as they move forward on this very exciting opportunity to unlock value for all ALT5 and future Alyea shareholders."

Alyea Leadership Team

Dr. Amol Soin, CEO - Dr. Soin is a nationally recognized thought leader and innovator in pain management, dedicated to advancing safe, non-opioid solutions for chronic pain. He has served as President of the American Society of Interventional Pain Physicians and several other national and state organizations, helping shape clinical standards and policy. Dr. Soin holds five academic degrees-including from Dartmouth and Brown-and has authored a medical textbook and more than 100 peer-reviewed publications. He holds several dozen global patents for medical devices and pharmaceutical compounds aimed at breaking the cycle of opioid dependence. A former President of the Ohio Medical Board, Dr. Soin played a key role in passing statewide opioid regulations. His leadership continues to drive Alyea's mission to redefine pain care through innovation and compassion.

Dr. Anthony (Tony) Giordano, Chief Scientific Officer - Tony brings over 30 years of leadership in biotechnology, drug development, and translational science. He has held executive roles across multiple life sciences companies, where he successfully advanced therapies from early-stage discovery into clinical trials. With more than 20 U.S. patents, Tony work spans neurodegenerative diseases, oncology, and cardiovascular health. He has a strong track record of securing funding and building research-driven organizations. Prior to joining us, he served as President and CEO of NeuroTherapia and Abcon Therapeutics. Tony holds a Ph.D. in Molecular Genetics from The Ohio State University.

Dr. Stacey Alexander, Chief Technical Officer - Dr. Stacey Alexander has built a career at the intersection of science and strategy, leading the development of innovative drug products across multiple modalities and delivery systems. Over the past 20 years, he has brought more than 70 pharmaceutical products to life, from early formulation through full-scale manufacturing and regulatory submission. His expertise spans complex generics, sterile injectables, biologics, and nanotechnology-based therapies. A collaborative leader with deep technical insight, he has guided teams across R&D, CMC, and clinical operations. Dr. Alexander earned his Ph.D. in Chemical Engineering from the University of Alabama and has held senior positions at organizations including Akorn, Berg Health, and Adpen Pharmaceuticals.

Russ Belden, Chief Commercial Advisor - Russ Belden brings over 37 years of biotech commercialization and operational leadership experience, with a focus on guiding emerging biotech companies from preclinical stages to first launch. He began his career at Genentech, where he played a pivotal role in launching their BioOncology franchise-including Rituxan and Herceptin-and rose to become Director of Hematology Sales. As Founder and CEO of Bridge, Russ has supported more than 125 early-stage biotech companies, delivering hands-on commercialization strategy and interim leadership. He is also a recognized educator, having co-developed industry courses on drug valuation and commercialization readiness. Russ holds a B.S. in Pharmacy from the University of New York at Buffalo.

Q4 and Fiscal Year Financial Highlights (Stated in USD)

Fintech Q4 Revenues of

$5.42 million and$12.53 million for Fiscal 2024 (Fintech only includes the period of May 15 to year end- see footnote)Adjusted Q4 EBITDA¹ of Fintech division of approximately

$1.03 million Working Capital improvement Q3 to Q4 of

$4.5 million Cash and cash equivalents of

$7.18 million

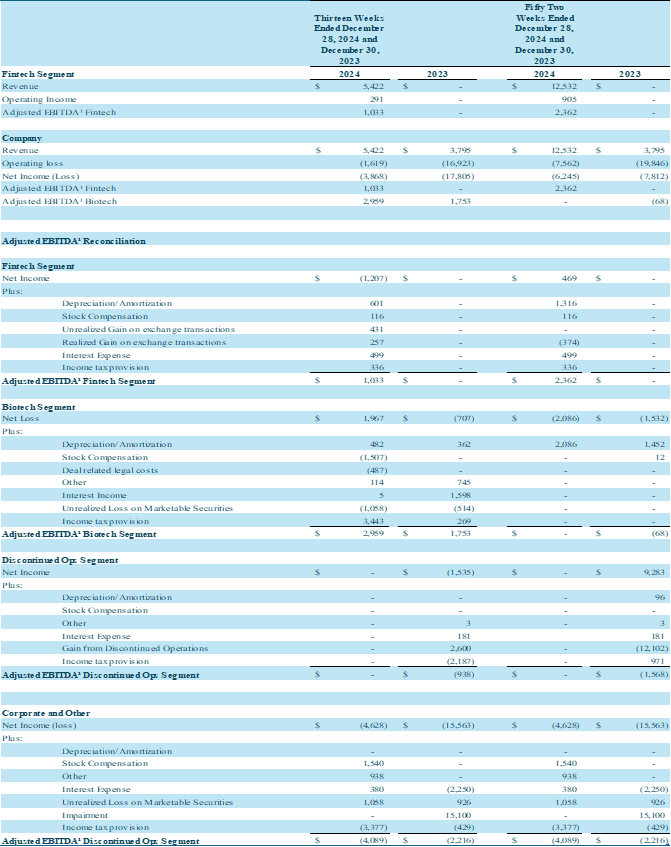

Adjusted EBITDA¹

Non-GAAP Financial Information

We evaluate the performance of our operations based on financial measures, such as "Adjusted EBITDA," which is a non-GAAP financial measure. We define Adjusted EBITDA as net income (loss) before interest expense, interest income, income taxes, depreciation, amortization, stock-based compensation, and other non-cash or nonrecurring charges.

Adjusted EBITDA does not represent cash flows from operations, as defined by generally accepted accounting principles ("GAAP"), and should not be construed as an alternative to net income or loss, and is indicative neither of our results of operations, nor of cash flow available to fund our cash needs. Adjusted EBITDA, as calculated by ALT5 Sigma Corporation, should not be compared to any similarly titled measures reported by other companies.

Our fiscal second quarter only includes initial revenue, profits, and cashflows from our Fintech business from May 15, 2024, forward, representing the date on which the acquisition of Alt5 Sigma, Inc. closed. As a result, the 52-weeks ended December 28, 2024, only includes the period that commenced on May 15, 2024 for the Fintech business.

The Company changed its corporate name from JanOne Inc. to ALT5 Sigma Corporation effective July 15, 2024.

The Company encourages all readers of this press release also to review Management's Discussion and Analysis contained in the Company's Annual Report on Form10-K filed with the Securities and Exchange Commission on March 28, 2025.

About ALT5 Sigma Corporation

ALT5 Sigma Corporation (Nasdaq:ALTS) is a unique Nasdaq-listed multidisciplinary organization with a focus on fintech and healthcare. The Company is one of the constituents of the Russell Microcap Index, as of June 28, 2024.

Launched in 2018, ALT5 Sigma, Inc. (a wholly owned subsidiary of ALT5 Sigma Corporation), is a fintech company that provides next-generation blockchain-powered technologies to enable a migration to a new global financial paradigm. ALT5 Sigma, Inc., through its subsidiaries, offers two main platforms to its customers: "ALT5 Pay" and "ALT5 Prime." ALT5 Sigma, Inc. processed over

ALT5 Pay is an award-winning cryptocurrency payment gateway that enables registered and approved global merchants to accept and make cryptocurrency payments or to integrate the ALT5 Pay payment platform into their application or operations using the plugin with WooCommerce and or ALT5 Pay's checkout widgets and APIs. Merchants have the option to convert to fiat currency(s) automatically or to receive their payment in digital assets.

ALT5 Prime is an electronic over-the-counter trading platform that enables registered and approved customers to buy and sell digital assets. Customers can purchase digital assets with fiat and, equally, can sell digital assets and receive fiat. ALT5 Prime is available through a browser-based access mobile phone application named "ALT5 Pro" that can be downloaded from the Apple App Store, from Google Play, through ALT5 Prime's FIX API, as well as through Broadridge Financial Solutions' NYFIX gateway for approved customers.

Through its biotech activities, the Company is focused on bringing to market drugs with non-addictive pain-relieving properties to treat conditions that cause chronic or severe pain. Our patented product, a novel formulation of low-dose naltrexone ("JAN123"), is being initially developed for the treatment of Complex Regional Pain Syndrome ("CRPS"), an indication that causes severe, chronic pain generally affecting the arms or legs. The FDA has granted Jan123 Orphan Drug Designation for treatment of CRPS. The Company is working on the separation of our biotech business that will move forward under "Alyea Therapeutics Corporation."

Forward Looking Statements

This press release contains statements that are forward-looking statements as defined within the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements relating to the profitability and prospective growth of ALT5's platforms and business, that may include, but are not limited to, international currency risks, third-party or customer credit risks, liability claims stemming from ALT5's services, and technology challenges for future growth or expansion. This press release also may contain statements and links relating to risks that JAN 101 will treat PAD, that JAN 123 will treat CRPS, the timing of the commencement of clinical trials, that the FDA will permit approval through a 505(b)(2) pathway for JAN 123, that upon approval JAN 101 will immediately disrupt the PAD market, and other statements, including words such as "continue", "expect", "intend", "will", "hope", "should", "would", "may", "potential", and other similar expressions. Such statements reflect the Company's current view with respect to future events, are subject to risks and uncertainties, and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, and social uncertainties, and contingencies.

Many factors could cause the Company's actual results, performance, or achievements to be materially different from any future results, performance, or achievements described in this press release. Such factors could include, among others, those detailed in the Company's periodic reports filed with the Securities and Exchange Commission (the "SEC"). Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the sections entitled "Risk Factors" in the Company's filings with the SEC underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this press release and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law. The Company cannot assure that such statements will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Individuals are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

Media/Investor Relations Contact

IR@alt5sigma.com

1-800-400-2247

SOURCE: ALT5 Sigma Corp

View the original press release on ACCESS Newswire