Allied Energy Corporation Outlook: Strong Growth and Strategic Developments

Allied Energy (OTC: AGYP) announces significant expansion plans and strategic developments for 2025. The company is expanding its Thiel site power generation capacity to 3.5 MW by Q3 2025, leveraging Texas' competitive electricity rates of 8.73¢ per kWh. At the Gilmer lease, AGYP is upgrading 116 pump jacks to more efficient units, targeting production from Caddo and Strawn formations.

The company is advancing new Saltwater Disposal (SWD) lease negotiations and exploring natural gas reserves. Partnerships with Petroloro and ORO Energy are progressing, with strategic plans expected by Q2 2025. The Enerhash & Sloan project faced operational delays in 2024 but anticipates returns in Q2 2025. AGYP has terminated its Energix partnership due to missed milestones, redirecting focus to more profitable ventures.

Allied Energy (OTC: AGYP) annuncia piani di espansione significativi e sviluppi strategici per il 2025. L'azienda sta aumentando la capacità di generazione di energia del sito Thiel a 3,5 MW entro il terzo trimestre del 2025, sfruttando le tariffe elettriche competitive del Texas di 8,73¢ per kWh. Presso il contratto di Gilmer, AGYP sta aggiornando 116 pompe a più unità efficienti, puntando alla produzione dalle formazioni di Caddo e Strawn.

L'azienda sta avanzando nelle negoziazioni per nuovi contratti di smaltimento di acqua salata (SWD) e sta esplorando riserve di gas naturale. Le collaborazioni con Petroloro e ORO Energy stanno progredendo, con piani strategici attesi entro il secondo trimestre del 2025. Il progetto Enerhash & Sloan ha affrontato ritardi operativi nel 2024, ma prevede ritorni nel secondo trimestre del 2025. AGYP ha terminato la sua partnership con Energix a causa di traguardi mancati, reindirizzando l'attenzione verso iniziative più redditizie.

Allied Energy (OTC: AGYP) anuncia planes de expansión significativos y desarrollos estratégicos para 2025. La compañía está ampliando su capacidad de generación de energía en el sitio Thiel a 3.5 MW para el tercer trimestre de 2025, aprovechando las tarifas eléctricas competitivas de Texas de 8.73¢ por kWh. En el contrato de Gilmer, AGYP está actualizando 116 bombas a unidades más eficientes, con el objetivo de producción de las formaciones Caddo y Strawn.

La compañía está avanzando en las negociaciones para nuevos contratos de eliminación de agua salada (SWD) y explorando reservas de gas natural. Las asociaciones con Petroloro y ORO Energy están progresando, con planes estratégicos esperados para el segundo trimestre de 2025. El proyecto Enerhash & Sloan enfrentó retrasos operativos en 2024, pero anticipa retornos en el segundo trimestre de 2025. AGYP ha terminado su asociación con Energix debido a hitos no cumplidos, redirigiendo el enfoque hacia iniciativas más rentables.

Allied Energy (OTC: AGYP)는 2025년을 위한 중요한 확장 계획과 전략적 개발을 발표했습니다. 이 회사는 텍사스의 경쟁력 있는 전기 요금인 kWh당 8.73¢를 활용하여 Thiel 사이트의 발전 용량을 3.5 MW로 확장하고 있으며, 2025년 3분기까지 완료할 예정입니다. Gilmer 임대에서는 AGYP가 116개의 펌프 잭을 더 효율적인 장치로 업그레이드하여 Caddo 및 Strawn 형성에서의 생산을 목표로 하고 있습니다.

회사는 새로운 염수 처리(SWD) 임대 협상을 진행 중이며, 천연 가스 매장지를 탐색하고 있습니다. Petroloro 및 ORO Energy와의 파트너십이 진행 중이며, 2025년 2분기까지 전략적 계획이 예상됩니다. Enerhash & Sloan 프로젝트는 2024년에 운영 지연을 겪었지만 2025년 2분기에는 수익을 기대하고 있습니다. AGYP는 이정표를 놓쳐 Energix와의 파트너십을 종료하고 더 수익성 있는 사업에 집중하고 있습니다.

Allied Energy (OTC: AGYP) annonce des plans d'expansion significatifs et des développements stratégiques pour 2025. L'entreprise augmente la capacité de production d'énergie de son site Thiel à 3,5 MW d'ici le troisième trimestre 2025, tirant parti des tarifs électriques compétitifs du Texas de 8,73¢ par kWh. Sur le bail de Gilmer, AGYP modernise 116 pompes à des unités plus efficaces, visant la production des formations de Caddo et Strawn.

L'entreprise avance dans les négociations pour de nouveaux contrats d'élimination des eaux salées (SWD) et explore des réserves de gaz naturel. Les partenariats avec Petroloro et ORO Energy progressent, avec des plans stratégiques attendus d'ici le deuxième trimestre 2025. Le projet Enerhash & Sloan a rencontré des retards opérationnels en 2024, mais prévoit des retours au deuxième trimestre 2025. AGYP a mis fin à son partenariat avec Energix en raison de jalons manqués, redirigeant son attention vers des projets plus rentables.

Allied Energy (OTC: AGYP) kündigt bedeutende Expansionspläne und strategische Entwicklungen für 2025 an. Das Unternehmen erweitert die Stromerzeugungskapazität des Thiel-Standorts auf 3,5 MW bis zum dritten Quartal 2025 und nutzt die wettbewerbsfähigen Strompreise in Texas von 8,73¢ pro kWh. Am Gilmer-Pachtgebiet modernisiert AGYP 116 Pumpen zu effizienteren Einheiten und zielt auf die Produktion aus den Caddo- und Strawn-Formationen ab.

Das Unternehmen führt neue Verhandlungen über Salzabwasserentsorgungsverträge (SWD) und erkundet Erdgasvorkommen. Partnerschaften mit Petroloro und ORO Energy schreiten voran, wobei strategische Pläne bis zum zweiten Quartal 2025 erwartet werden. Das Enerhash & Sloan-Projekt hatte 2024 betriebliche Verzögerungen, erwartet jedoch im zweiten Quartal 2025 Rückflüsse. AGYP hat die Partnerschaft mit Energix aufgrund verpasster Meilensteine beendet und konzentriert sich nun auf profitablere Unternehmungen.

- Power generation capacity expansion to 3.5 MW by Q3 2025

- Upgrade of 116 pump jacks to energy-efficient units reducing costs by 30%

- New SWD lease negotiations and natural gas reserves exploration

- Strategic partnerships with Petroloro and ORO Energy progressing

- Operational delays in Enerhash & Sloan project payments from November 2024

- Termination of Energix partnership due to missed milestones

Expands Power Generation & Oil Production in Texas, Strengthens Strategic Partnerships for Sustainable Growth in 2025

Key Points:

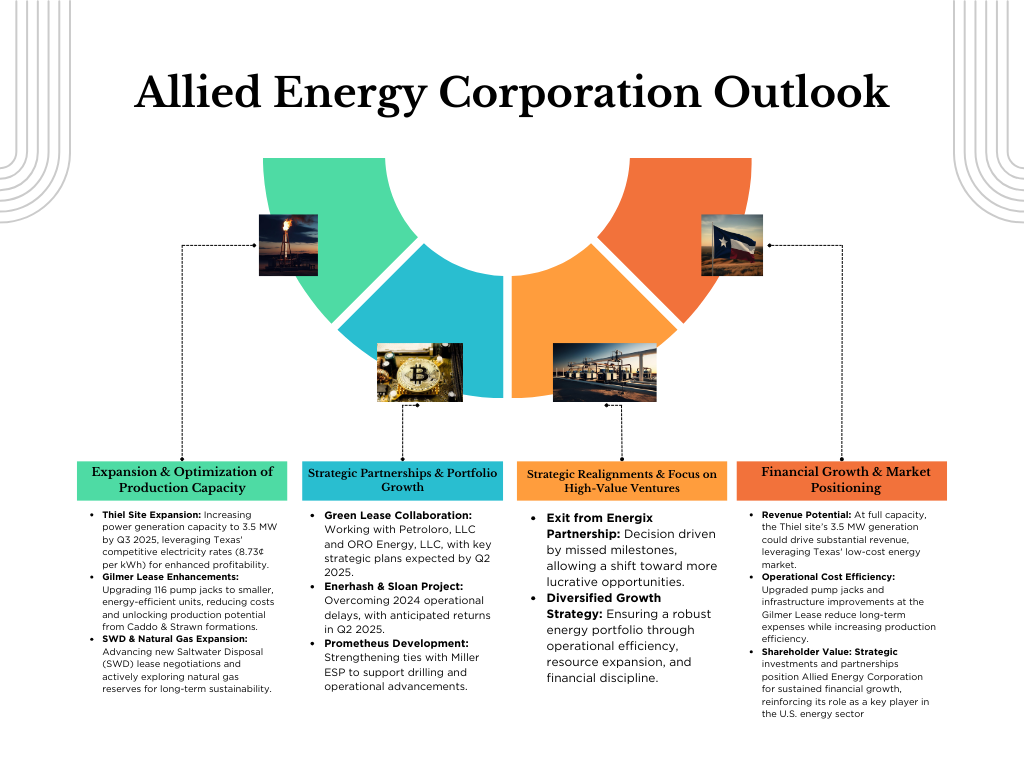

Expansion & Optimization of Production Capacity

- Thiel Site Expansion: Increasing power generation capacity to 3.5 MW by Q3 2025, leveraging Texas' competitive electricity rates (8.73¢ per kWh) for enhanced profitability.

- Gilmer Lease Enhancements: Upgrading 116 pump jacks to smaller, energy-efficient units, reducing costs and unlocking production potential from Caddo & Strawn formations.

- SWD & Natural Gas Expansion: Advancing new Saltwater Disposal (SWD) lease negotiations and actively exploring natural gas reserves for long-term sustainability.

Strategic Partnerships & Portfolio Growth

- Green Lease Collaboration: Working with Petroloro, LLC and ORO Energy, LLC, with key strategic plans expected by Q2 2025.

- Enerhash & Sloan Project: Overcoming 2024 operational delays, with anticipated returns in Q2 2025.

- Prometheus Development: Strengthening ties with Miller ESP to support drilling and operational advancements.

Strategic Realignments & Focus on High-Value Ventures

- Exit from Energix Partnership: Decision driven by missed milestones, allowing a shift toward more lucrative opportunities.

- Diversified Growth Strategy: Ensuring a robust energy portfolio through operational efficiency, resource expansion, and financial discipline.

CARROLLTON, Texas, Feb. 27, 2025 (GLOBE NEWSWIRE) -- Allied Energy Corporation (OTC: AGYP) is excited to announce significant strides in our ongoing projects and production capacity expansion, reinforcing our optimistic outlook for the company’s future. With the momentum of these developments, the company is well-positioned for substantial growth in the coming months.

Production Buildout at Thiel Site: A Game-Changer for Capacity Growth

At our Thiel site, we are making significant strides in expanding operational capacity by constructing and installing two 1.25 MW generators. The new production pad has already been successfully laid, and noise abatement testing is scheduled shortly.

Once the first two generators are running at full capacity, we plan to add a third unit, increasing the site’s total capacity to an impressive 3 to 3.5 MW by the end of Q3 2025. This expansion strategically positions Allied Energy to capitalize on Texas' booming energy sector, where industrial power consumption is projected to grow significantly in the coming years.

Market Potential & Financial Impact

- Dominance in Energy Production: Texas leads the nation in energy production, contributing significantly to U.S. crude oil and natural gas outputs. source: eia.gov

- Competitive Electricity Rates: With commercial electricity rates in Texas averaging 8.73¢ per kWh, our scalable operations can take advantage of low-cost power, maximizing margins. source: chooseenergy.com

- Projected Revenue Growth: At full capacity (approximately 3.5 MW), the Thiel site could generate significant revenues, depending on operational efficiency and market conditions.

“By strengthening our infrastructure now, we are ensuring long-term scalability, improved financial performance, and the ability to compete with industry leaders in power generation and energy solutions. The Thiel is a key site in our portfolio, and we are very pleased with the progress. We expect to see strong returns from these investments, and the addition of the third genset will significantly enhance our operational capabilities,” said George Monteith, CEO of Allied Energy Corporation.

Strategic Development at Gilmer Lease

At our Gilmer lease, Allied Energy continues to optimize operations with the replacement of 116 pump jacks with smaller, more efficient units. We have also placed a packer in the well to cut off Mississippi water, enabling production from the Caddo and possibly the Strawn formations. One well is currently being converted, and depending on its performance, we plan to convert two additional wells in Q3 and Q4.

Strategic Development at Gilmer Lease: Enhancing Efficiency & Maximizing Production

At our Gilmer lease, Allied Energy continues to optimize operations by replacing 116 pump jacks with smaller, more efficient units. This upgrade reduces maintenance costs, energy consumption, and mechanical failures, ensuring greater long-term operational efficiency.

Additionally, we have strategically placed a packer in the well to cut off Mississippi water intrusion, allowing uninterrupted production from the Caddo formation and potentially unlocking reserves from the Strawn formation. Currently, one well is undergoing conversion, and based on its performance, we plan to convert two additional wells in Q3 and Q4.

Advantages of These Operational Activities

- Improved Efficiency & Cost Reduction: Smaller, modern pump jacks consume up to

30% less energy than traditional units, lowering operating costs while maintaining steady production. (source: API) - Maximizing Reserve Potential: Unlocking secondary formations like Strawn could increase overall recoverable reserves, extending the well’s productive lifespan.

- Environmental & Regulatory Benefits: Optimizing operations aligns with state and federal efficiency standards, reducing environmental impact and ensuring compliance with industry best practices. (source: EIA)

“These strategic enhancements position Allied Energy for sustained growth, ensuring higher production efficiency, lower costs, and maximized asset value. We’re committed to ensuring that each well reaches its full potential. Our team is working diligently to implement improvements that will help us achieve optimal production from these properties,” said Monteith.

Green Lease: Collaborating for Future Developments

Allied Energy is in ongoing discussions with partners Petroloro, LLC and ORO Energy, LLC to determine future developments at our Green Lease. We are currently awaiting an outline of activities from ORO Energy, LLC and plan to finalize our strategic plans for this lease in Q2 2025. These discussions represent an exciting avenue for growth and diversification of our portfolio.

Prometheus: Focused on Future SWD Development

We are actively negotiating a new SWD lease and exploring potential new locations for drilling. In addition, our partnership with Miller ESP is evolving as we assess future development opportunities. We remain focused on ensuring long-term sustainability and profitability through strategic planning in the SWD space.

Ongoing Research and Natural Gas Expansion

Our research into future natural gas resources and the identification of expansion opportunities continues to move forward. We are exploring new locations to broaden our operations and strengthen our presence in areas that complement our existing project sites. These initiatives will further enhance Allied Energy’s ability to meet growing demand while maximizing shareholder value.

Enerhash and Sloan Project: Continues to evolve in 2025

Our successful stewardship of the Enerhash and Sloan projects will continue to pay dividends through 2025. However, we were advised in November 2024 that operational issues have caused delays in their scheduled payment. Despite this, Allied Energy anticipates returns from this venture in Q2 of 2025.

Strategic Decision: Parting Ways with Energix for the Time Being

After careful consideration, Allied Energy has made the strategic decision to cut ties with Energix for the time being due to missed critical, time-sensitive milestones. As more lucrative opportunities have emerged, we believe it is in the best interest of the company to focus our resources on these ventures. However, we remain open to the possibility of reigniting a relationship with Energix in the future should the opportunity align with our long-term goals.

“We are constantly seeking the best opportunities to maximize value for our shareholders. While we have decided to part ways with Energix for now, we look forward to exploring future collaborations when the time is right,” said Monteith.

Allied Energy Corporation is well-positioned for growth in 2025 and beyond, with a clear focus on increasing capacity, enhancing production, and making strategic partnerships. We remain committed to delivering value to our shareholders and continuing to build a diversified and robust energy portfolio.

About AGYP:

Allied Energy Corp. is an energy development and production company acquiring oil & gas reserves in some of the most prolific hydrocarbon bearing regions of the United States. The Company specializes in the business of reworking & re-completing 'existing' oil & gas wells located in the thousands of mature oil & gas producing fields across the United States. The Company applies its knowledge, experience, and effective well-remediation technologies to achieve higher production volumes, longer well life, and more efficient recovery of the proven and available oil and gas reserves in the fields/projects in which it has acquired an ownership interest. The Company will utilize updated technologies such as hydraulic fracturing ("fracking"), drilling of lateral ("horizontal") legs in productive zones, and utilizing new cased hole electric logging to locate bypassed pays, all to enhance daily rates and oil & gas recoveries. By acquiring interests in a growing number of selected projects in various regions, Allied Energy Corp. is diversifying its exposure and effectively minimizing risk as it pursues corporate growth, top line & bottom-line revenues to the benefit of all stakeholders. There are proven, recoverable reserves contained in the many aging oil & gas fields that have been bypassed by companies moving away from these fields in search of deeper, more plentiful, but more costly reserves. The Company plans to concentrate on bypassed oil and gas as there is less competition and, as mentioned above, the costs are considerably less. Additionally, the company will acquire interests in marginal wells that can be acquired at minimal cost, of which there are 420,000 wells in the U.S. Quoting Barry Russell, President of the Independent Petroleum Association of America ("IPAA") - "With approximately 20 percent of American oil production and 10 percent of American natural gas production coming from marginal wells, they are America's true strategic petroleum reserve.”

Safe Harbor Statement:

This press release may contain certain forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. The Company has tried, whenever possible, to identify these forward-looking statements using words such as "anticipates," "believes," "estimates," "expects," "plans," "intends," "potential" and similar expressions. These statements reflect the Company's current beliefs and are based upon information currently available to it. Accordingly, such forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause the Company's actual results, performance or achievements to differ materially from those expressed in or implied by such statements. The Company undertakes no obligation to update or advise in the event of any change, addition or alteration to the information catered in this Press Release, including such forward-looking statements.

Contact:

Allied Energy Corporation

Phone: 972-632-2393

Email: info@alliedengycorp.com

Twitter: https://twitter.com/AlliedEnergyCo1

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2612d1fd-1f10-4e95-91f3-d9fa7cca0e78