Silver X Revises Down Its All-in Sustaining Cost (“AISC”) According to Revised Methodology

Silver X Mining has announced changes to its All-In Sustaining Cost (AISC) calculation methodology, focusing on better operational performance representation. The revision excludes discretionary costs like business development, investor relations, and share-based compensation from General & Administrative Expenses.

Key improvements include: For Q1 2024, sustaining costs decreased by 21% (from $1.4M to $1.1M) and AISC reduced by 5% (from $20.26 to $19.22 per AgEq Oz). For Q2 2024, sustaining costs dropped by 33% (from $2.0M to $1.3M) and AISC decreased by 9% (from $25.85 to $23.54 per AgEq Oz). The company will apply these changes retroactively to early 2023 and will now report both Gross and Net Sales for better margin assessment.

Silver X Mining ha annunciato modifiche alla sua metodologia di calcolo del All-In Sustaining Cost (AISC), concentrandosi su una rappresentazione migliore delle performance operative. La revisione esclude costi discrezionali come sviluppo aziendale, relazioni con gli investitori e compensi basati su azioni dalle spese generali e amministrative.

I principali miglioramenti includono: per il Q1 2024, i costi di mantenimento sono diminuiti del 21% (da 1,4 milioni di dollari a 1,1 milioni di dollari) e l'AISC è sceso del 5% (da 20,26 dollari a 19,22 dollari per oz di AgEq). Per il Q2 2024, i costi di mantenimento sono calati del 33% (da 2,0 milioni di dollari a 1,3 milioni di dollari) e l'AISC è diminuito del 9% (da 25,85 dollari a 23,54 dollari per oz di AgEq). L'azienda applicherà queste modifiche retroattivamente all'inizio del 2023 e ora riporterà sia le vendite lorde che quelle nette per una migliore valutazione dei margini.

Silver X Mining ha anunciado cambios en su metodología de cálculo del All-In Sustaining Cost (AISC), centrándose en una representación mejor del rendimiento operativo. La revisión excluye costos discrecionales como desarrollo empresarial, relaciones con inversionistas y compensación basada en acciones de los gastos generales y administrativos.

Las principales mejoras incluyen: para el Q1 2024, los costos de mantenimiento disminuyeron un 21% (de 1.4 millones de dólares a 1.1 millones de dólares) y el AISC se redujo un 5% (de 20.26 a 19.22 dólares por oz de AgEq). Para el Q2 2024, los costos de mantenimiento cayeron un 33% (de 2.0 millones de dólares a 1.3 millones de dólares) y el AISC disminuyó un 9% (de 25.85 a 23.54 dólares por oz de AgEq). La empresa aplicará estos cambios de manera retroactiva a principios de 2023 y ahora informará tanto las ventas brutas como las netas para una mejor evaluación de los márgenes.

Silver X Mining은 운영 성과를 보다 잘 나타내기 위해 총 지속 비용(AISC) 계산 방법론의 변경 사항을 발표했습니다. 이번 수정은 일반 및 관리비용에서도 사업 개발, 투자자 관계, 주식 기반 보상과 같은 재량 비용을 제외합니다.

주요 개선 사항으로는: 2024년 1분기 동안 지속 비용이 21% 감소했습니다(140만 달러에서 110만 달러로). AISC는 5% 감소했습니다(20.26달러에서 19.22달러로 가격이 떨어졌습니다). 2024년 2분기 동안 지속 비용이 33% 감소했습니다(200만 달러에서 130만 달러로). AISC는 9% 감소했습니다(25.85달러에서 23.54달러로). 회사는 이러한 변경 사항을 2023년 초로 소급 적용할 것이며, 이제 더 나은 마진 평가를 위해 총 매출 및 순 매출을 모두 보고할 것입니다.

Silver X Mining a annoncé des modifications de sa méthodologie de calcul du Coût Total de Maintien (AISC), en se concentrant sur une meilleure représentation de la performance opérationnelle. La révision exclut les coûts discrétionnaires tels que le développement commercial, les relations avec les investisseurs et la rémunération basée sur les actions des frais généraux et administratifs.

Les principales améliorations comprennent : pour le T1 2024, les coûts de maintien ont diminué de 21% (de 1,4 million de dollars à 1,1 million de dollars) et l'AISC a baissé de 5% (de 20,26 dollars à 19,22 dollars par oz d'AgEq). Pour le T2 2024, les coûts de maintien ont chuté de 33% (de 2,0 millions de dollars à 1,3 million de dollars) et l'AISC a diminué de 9% (de 25,85 dollars à 23,54 dollars par oz d'AgEq). L'entreprise appliquera ces changements de manière rétroactive au début de 2023 et fera désormais rapport à la fois sur les ventes brutes et nettes pour une meilleure évaluation des marges.

Silver X Mining hat Änderungen an seiner Berechnungsmethodik für die All-In Sustaining Costs (AISC) angekündigt, um eine bessere Darstellung der operativen Leistung zu gewährleisten. Die Überarbeitung schließt diskretionäre Kosten wie Geschäftsentwicklung, Investorenbeziehungen und aktienbasierte Vergütung von den allgemeinen und administrativen Ausgaben aus.

Zu den wichtigsten Verbesserungen gehören: Im Q1 2024 sanken die Erhaltungskosten um 21% (von 1,4 Millionen Dollar auf 1,1 Millionen Dollar) und AISC reduzierte sich um 5% (von 20,26 Dollar auf 19,22 Dollar pro AgEq Unze). Im Q2 2024 fielen die Erhaltungskosten um 33% (von 2,0 Millionen Dollar auf 1,3 Millionen Dollar) und AISC verringerten sich um 9% (von 25,85 Dollar auf 23,54 Dollar pro AgEq Unze). Das Unternehmen wird diese Änderungen rückwirkend auf Anfang 2023 anwenden und nun sowohl Brutto- als auch Nettoumsätze für eine bessere Margenbewertung berichten.

- None.

- None.

VANCOUVER, BC / ACCESSWIRE / November 5, 2024 / SILVER X MINING CORP. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company"), a growing silver producer and developer in Central Peru, is pleased to announce changes in the methodology and metrics for determining the Company's All-In Sustaining Cost (AISC), aimed at better reflecting its operating performance and efficiency, enhancing the comparability of metrics with its peers.

To improve the accuracy and presentation of AISC calculations, Silver X refined the composition of General & Administrative Expense in sustaining cost, excluding discretionary costs for business development, investor relations and share-based compensation.

Silver X CFO David Gleit stated, "This revision in our AISC methodology provides a clearer, more accurate view of our costs and operational efficiency, enhancing transparency and aligning Silver X with industry standards. We believe this change will allow investors and stakeholders to better assess our operational performance as we continue advancing our projects in Peru."

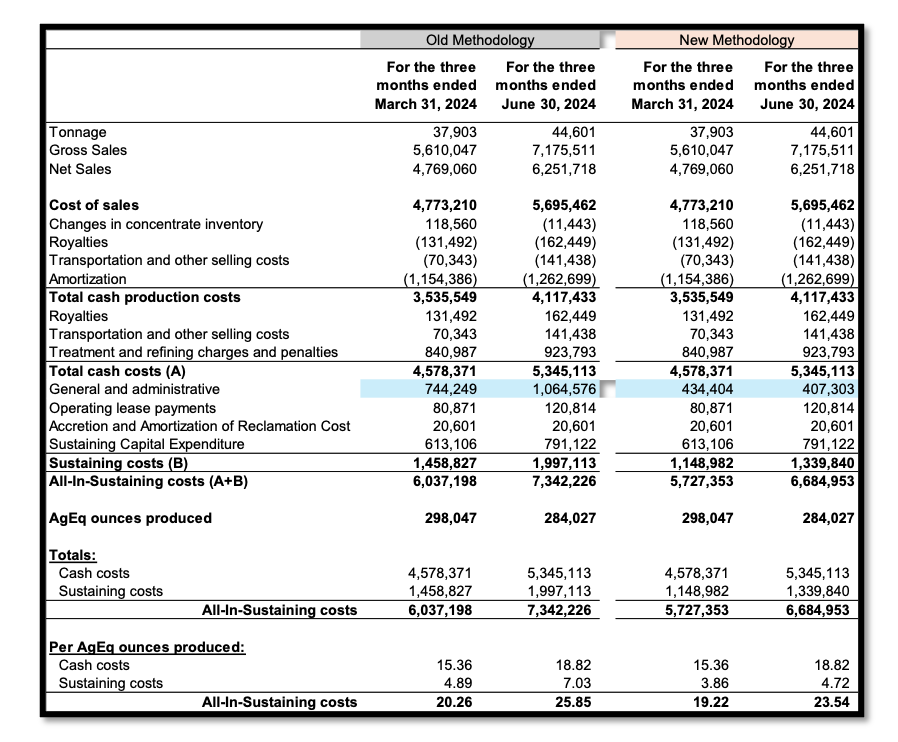

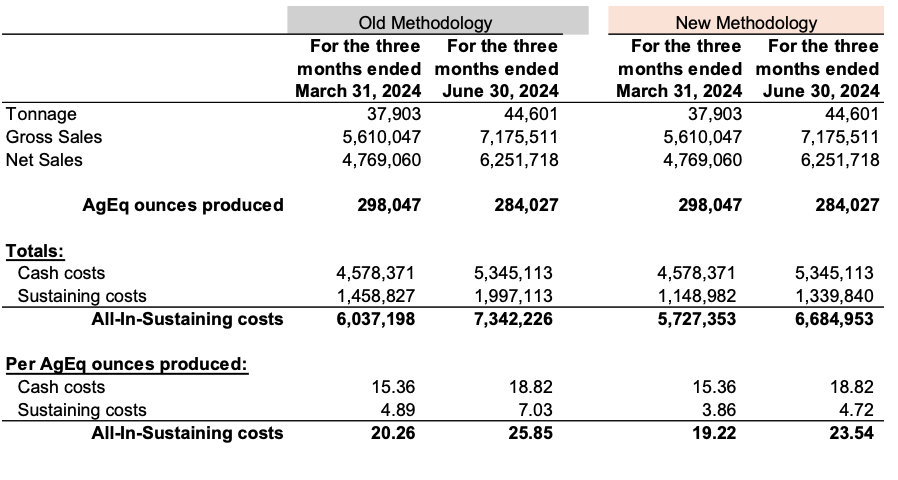

The following table illustrates the impact of these changes for the previously reported three-month period ended March 31, 2024, and June 30, 2024:

Table 1. Silver X Revised AISC Calculation - General and Administrative Expense

Table 2. AISC Reduction - Impact of Methodological Change

As a result of these changes, the following improvements were noted:

Sustaining Costs

For the three-month period ended March 31, 2024, sustaining costs decreased from

$1.4M to$1.1M , representing a$310,000 or21% reductionFor the three-month period ended June 30, 2024, sustaining costs decreased from

$2.0M to$1.3M representing, a$657,000 or33% reduction

AISC

For the three-month period ended March 31, 2024, AISC decreased from

$20.26 t o$19.22 per AgEq Oz, representing a5% reductionFor the three-months period ended June 30, 2024, AISC decreased from

$25.85 t o$23.54 per AgEq Oz, representing a9% reduction

Silver X ensures that the AISC is fully reconcilable with amounts reported under IFRS, thereby upholding transparency and compliance with financial reporting standards.

The change in methodology will be applied retroactively to the beginning of 2023.

Gross Sales Presentation

Note that reported revenues under IFRS are net of concentrate treatment and refining charges and penalties. Under the AISC methodology, these costs are added back to arrive at AISC.

In assessing operating margins, Gross Sales (before treatment and refining charges and penalties) should be compared with AISC. Going forward, AGX will report Gross

as well as Net Sales to facilitate this comparison.

Non-IFRS Measures

Cash costs ($ per Oz sold) and AISC ($ per Oz sold) are non-IFRS financial measures and non-IFRS ratios in this press release. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the Non-IFRS Measures section of the Company's most recently filed Management's Discussion and Analysis which is available on SEDAR+ at www.sedarplus.ca for full details on these measures, which is incorporated by reference into this press release.

Please see "Cautionary Note regarding Production without Mineral Reserves" at the end of this news release.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Heyl is a consultant for Silver X.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a rapidly expanding silver producer and developer. The Company owns the 20,472-hectare Nueva Recuperada Silver Project in Central Peru and produces silver, gold, lead and zinc from its Tangana Mining Unit. We are building a premier silver company that aims to deliver outstanding value to all stakeholders, consolidating and developing undervalued assets, adding resources, and increasing production while aspiring to sustain the communities that support us and stewarding the environment. Current production, paired with immediate development and brownfield expansion opportunities, presents investors with the opportunity to invest in the early stages of a silver producer with strong growth prospects. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. Garcia, CEO and Director

For further information, please contact:

Susan Xu

Investor Relations

ir@silverxmining.com

+1 778 323 0959

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward- looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedarplus.ca from time to time. Forward- looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View the original press release on accesswire.com