Silver X Reports Strong Q2 2024 Financial Results

Rhea-AI Summary

Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF) reported strong Q2 2024 financial results for its Nueva Recuperada Project in Peru. Key highlights include:

- Revenue of $6.2 million, up 31% from Q1 2024 and 34% from Q2 2023

- Operating income of $0.5 million vs $0.4 million loss in Q2 2023

- Positive EBITDA of $1.9M and Adjusted EBITDA of $0.8M

- Cash costs of $18.8 per AgEq ounce produced

- AISC of $25.9 per AgEq ounce produced

The company processed 362,714 oz AgEq in Q2, in line with Q1 production. Management is focused on cost reduction and increasing production to over 700 tonnes per day. Silver X completed a C$5.0M private placement in April 2024 to support ongoing development.

Positive

- Revenue increased 31% quarter-over-quarter and 34% year-over-year to $6.2 million

- Achieved operating income of $0.5 million compared to a loss in Q2 2023

- Positive EBITDA of $1.9M and Adjusted EBITDA of $0.8M

- Production remained stable at 362,714 oz AgEq processed in Q2

- Completed C$5.0M private placement to support mine development

Negative

- AISC remains relatively high at $25.9 per AgEq ounce produced

- Net loss before tax of $0.5M for the six months ended June 30, 2024

- Increase in cost of sales to $10.5M from $10.0M in prior period

News Market Reaction 1 Alert

On the day this news was published, AGXPF declined 5.72%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

(All dollar amounts expressed in US dollars unless otherwise noted)

VANCOUVER, BC / ACCESSWIRE / August 29, 2024 / Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company") is pleased to report its financial results for the three and six months ended June 30, 2024 for the Nueva Recuperada Project (the "Project") in Central Peru.

Q2 2024 Financial Highlights

Generated revenues of

$6.2 million , representing a31% increase when compared to the quarter ended March 31, 2024 ("Q1 2024") and34% increase when compared to the quarter ended June 30, 2023 ("Q2 2023").Operating income of

$0.5 million compared with an operating loss of$0.4 million in Q2 2023.Positive EBITDA of

$1.9M and Positive Adjusted EBITDA of$0.8M compared to Negative EBITDA of$0.6M and Negative Adjusted EBITDA of$0.9M in Q2 2023.Cash costs of

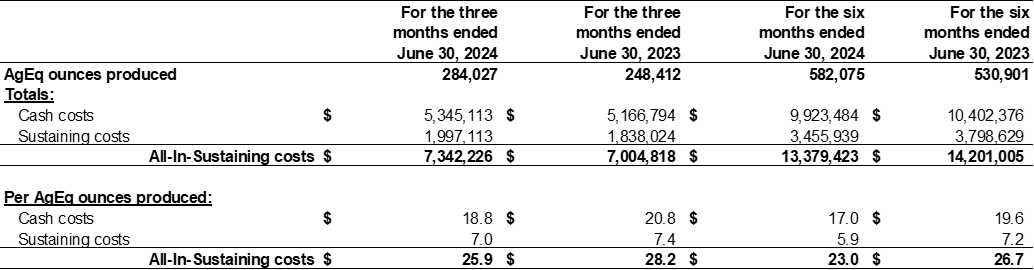

$18.8 per Silver Equivalent ("AgEq") ounce produced (1)(2) and All-In-Sustaining Cost ("AISC") (1)(2) of$25.9 per AgEq ounce produced, reflective of the sustaining capital expenditure invested in the development of the Tangana mining unit ($0.8 million adding$2.8 per AgEq ounce produced to the AISC).

Jose Garcia, Silver X Mining's CEO, commented: "Nueva Recuperada is producing steadily with improved operating and financial results. Our dedicated team is concentrating its efforts on continuing to increase production and improve margins, as is made clear with the results from the second quarter and, indeed, the entire first half of 2024. The improvement is even more notorious compared to a year ago.

Our team's focus is on cost reduction now: We are reviewing head grade distribution, mine design and the possibility to adapt different mining methods to the various mining widths; all with the objective of reducing our cost substantially and to improve our margins. We recently released our Q2 2024 production results, with 362,714 oz AgEq processed, in line with Q1 2024 production, demonstrating stability and reliability of our operation. Nueva Recuperada remains on track to produce more than 700 tonnes per day with good grades. We are confident that we will continue along this trajectory for the remainder of 2024, driving growth and shareholder value creation."

Notes:

1. Cash costs per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS financial ratios. These are based on non- IFRS financial measures that do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the "Non-IFRS Measures" section of this news release for further information.

2. AgEq ounce produced was calculated using the average sales prices of each metal for each month, and revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

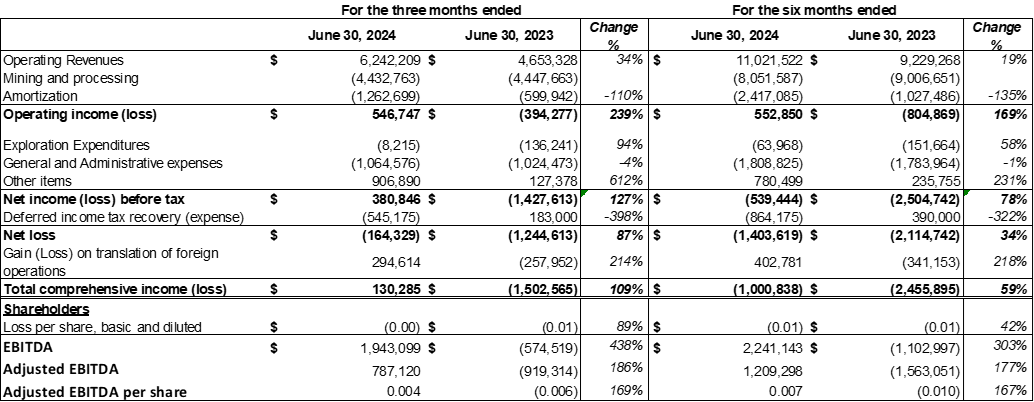

Summary of Selected Financial Results

The information provided below are excerpts from the Company's unaudited interim Financial Statements and Management's Discussion and Analysis ("MD&A"), which can be found on the Company's website at www.silverxmining.com/investor#report or on SEDAR+ at www.sedarplus.ca.

Note:

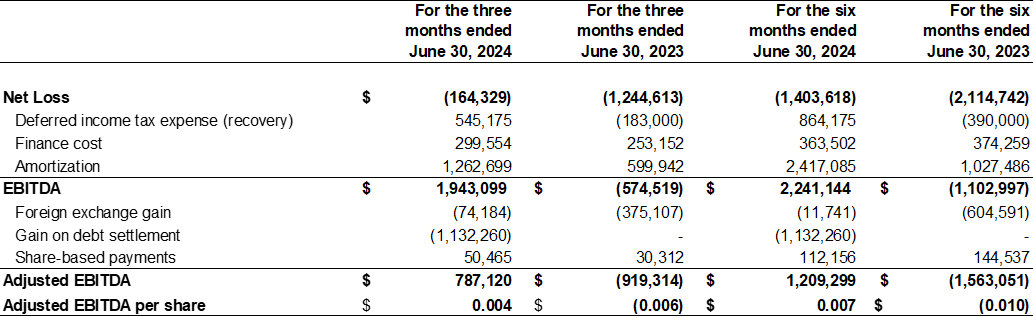

1. EBITDA, Adjusted EBITDA, and Adjusted EBITDA per share are non-IFRS ratios with no standardized meaning under IFRS, and therefore may not be comparable to similar measures presented by other issuers. For further information, including detailed reconciliations to the most directly comparable IFRS measures, see "Non-IFRS Measures" in this news release and the MD&A.

Three months ended June 30, 2024 vs. 2023

For the three months ended June 30, 2024, the Company recorded:

Net income before tax of

$0.4M , compared to a net loss before tax of$1.4M in the three months ended June 30, 2023.EBITDA income of

$1.9M , compared to an EBITDA loss of$0.6M in the three months ended June 30, 2023.Adjusted EBITDA income of

$0.8M , compared to an Adjusted EBITDA loss of$0.9M in the three months ended June 30, 2023.

The increase in income in the current period was primarily due to increased operating revenues from the sale of mineral production of

Six months ended June 30, 2024 vs. 2023

For the six months ended June 30, 2024, the Company recorded:

Net loss before tax of

$0.5M , compared to a net loss before tax of$2.5M in the six months ended June 30, 2023.EBITDA income of

$2.2M , compared to an EBITDA loss of$1.1M in the six months ended June 30, 2023.Adjusted EBITDA income of

$1.2M , compared to an Adjusted EBITDA loss of$1.6M in the six months ended June 30, 2023.

The increase in income in the current period was primarily due to increased operating revenues from the sale of mineral production of

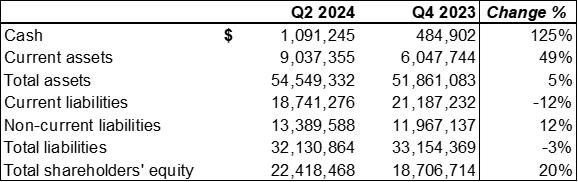

Financial Position

The available cash during the period increased by

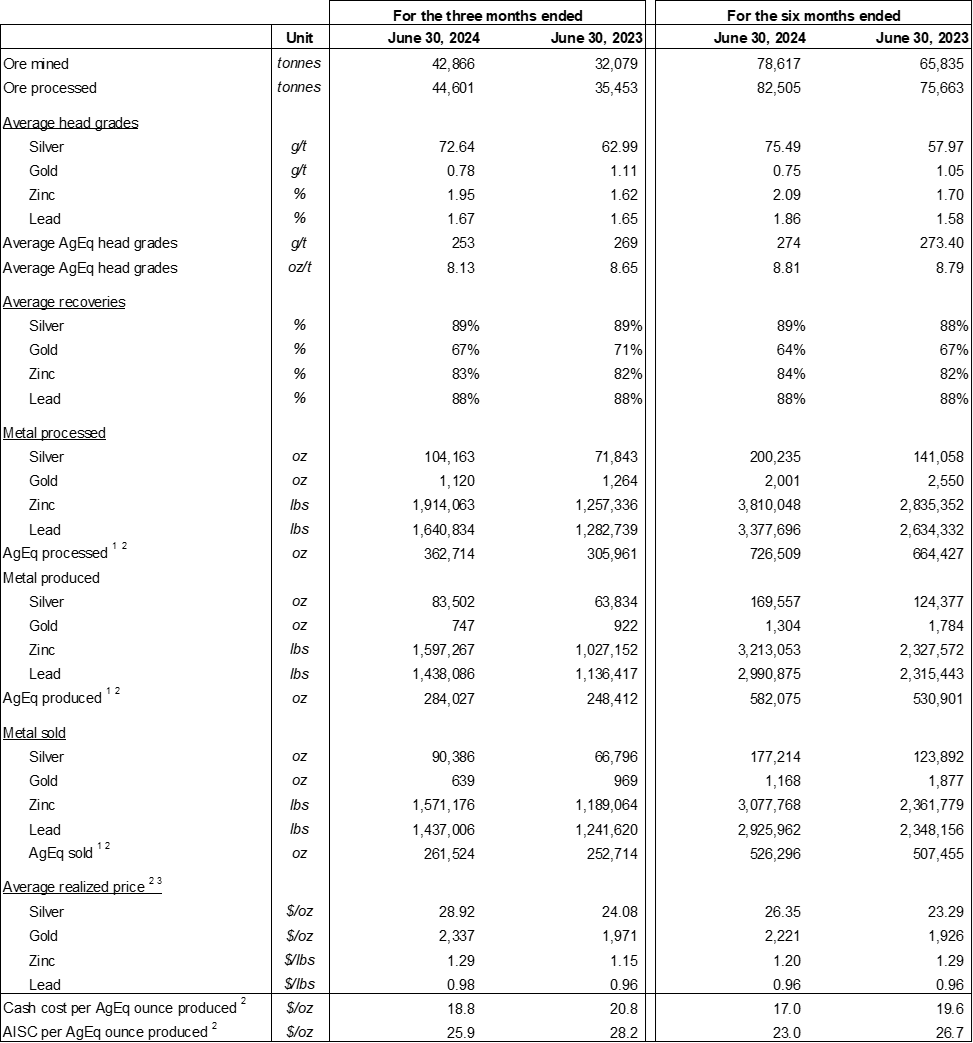

Operational Results

Notes:

1. Average Realized Price, production cost per tonne processed, AgEq sold, cash cost per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS ratios with no standardized meaning under IFRS, and therefore may not be comparable to similar measures presented by other issuers. For further information, including detailed reconciliations to the most directly comparable IFRS measures, see "Non-IFRS Measures" in this news release and the MD&A.

2. AgEq ounces processed and produced were calculated based on all metals processed and produced using the average sales prices of each metal for each month during the period. Revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

3. Average realized price corresponds to the average prices for each metal on the following month after delivery, used to calculate the final value of the concentrate delivered in a given month before any deductions.

Non-IFRS Measures

The Company has included certain non-IFRS financial measures and ratios in this news release, as discussed below. The Company believes that these measures, in addition to measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

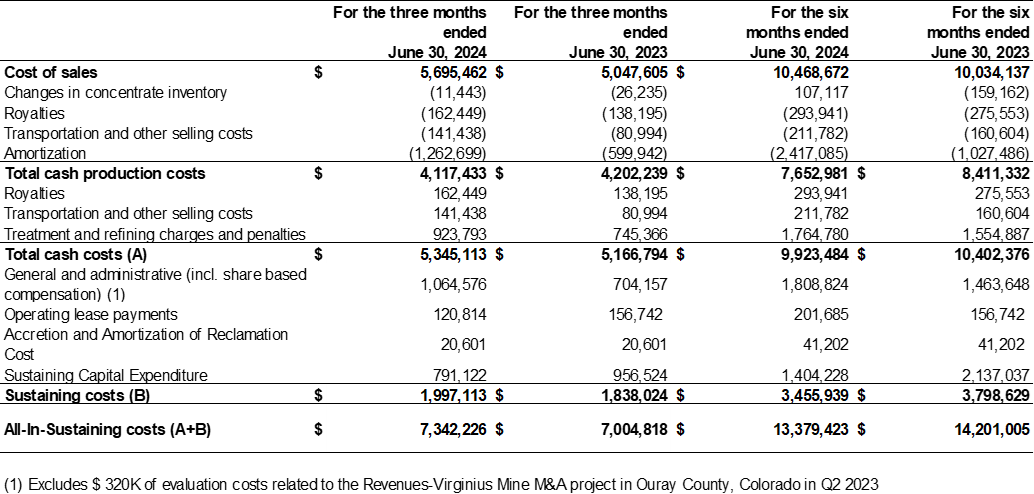

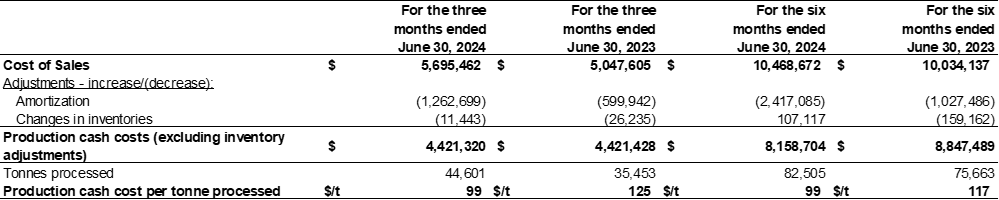

Cash Costs, All-In Sustaining Cost, EBITDA, and Adjusted EBITDA

The Company uses cash costs, cash cost per AgEq ounce produced, AISC, AISC per AgEq ounce produced, EBITDA and Adjusted EBITDA to manage and evaluate its operating performance in addition to IFRS measure because the Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. The Company understands that certain investors use these measures to determine the Company's ability to generate earnings and cash flows for use in investing and other activities. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

Cash costs is calculated by starting with cost of sales, and then adding treatment and refining charges, and changes in depreciation and amortization.

Total cash production costs include cost of sales, changes in concentrate inventory, changes in amortization, less transportation and other selling costs and royalties. Cash costs per AgEq ounce produced is calculated by dividing cash costs by the AgEq ounces produced.

AISC and AISC per AgEq ounce produced are calculated based on guidance published by the World Gold Council (and used as a standard of the Silver Institute). The Company presents AISC on the basis of AgEq ounces produced. AISC is calculated by taking the cash costs and adding sustaining costs. Sustaining costs are defined as capital expenditures and other expenditures that are necessary to maintain current production. Management has exercised judgment in making this determination.

The following table reconciles cash costs, cash costs per AgEq ounce, AISC and AISC per AgEq ounce produced to cost of sales, the most directly comparable IFRS measure:

The following table reconciles the Net Loss to the EBITDA and Adjusted EBITDA:

The following table shows the calculation of the cash costs and AISC per AgEq ounce produced:

The Company has revised its methodology for calculating AISC related to sustaining capital expenditures. This change involves eliminating growth-related costs to better reflect the expenses necessary for maintaining mining operations. For comparative purposes the prior period were also recalculated based on the new methodology. The revision results in AISC of

Production Cost Per Tonne Processed

A reconciliation between production cost per tonne (excluding amortization and changes in inventories) and the cost of sales is provided below. Changes in inventories are excluded from the calculation of Production Cost per Tonne Processed. Changes in inventories reflect the net cost of concentrate inventory (i) sold during the current period but produced in a previous period or (ii) produced but not sold in the current period. The Company uses Production Cost Per Tonne Processed to evaluate its operating performance in addition to IFRS measure because Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

During the period, cash cost per tonne decreased with the increase of the level of tonnage of ore processed, amounting to 44,601 tonnes for Q2 2024 compared to 35,453 tonnes for Q2 2023. Overall operating efficiencies improved resulting in a lower production cash cost per tonne of

The capital expenditure deployed in the development of the Tangana mining unit during the period was the main cost contributor to AISC. Investment in sustainable CAPEX will enable the Company to access new production fronts and transition to higher head-grade areas.

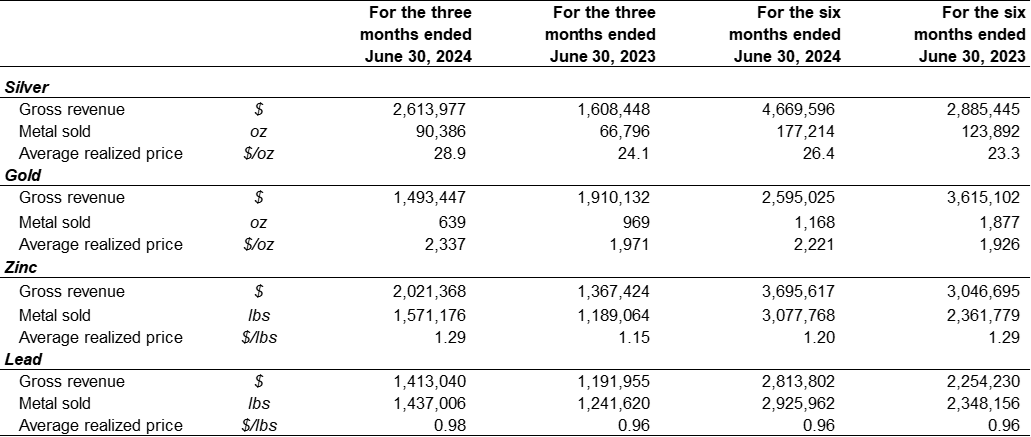

Average Realized Price

Average realized price is a non-IFRS financial measure. The Company uses "average realized price per ounce of silver", "average realized price per ounce of gold", "average realized price per ounce of zinc" and "average realized price per ounce of lead" because it understands that in addition to conventional measures prepared in accordance with IFRS, certain investors and analysts use this information to evaluate the Company's performance as compared with "average market prices" of metals for the period.

Average realized metal prices represent the sale price of the metal. Average realized price corresponds to the average prices for each metal on the following month after delivery, used to calculate the final value of the concentrate delivered in a given month before any deductions:

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of measured, indicated and inferred mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a current NI 43-101 compliant technical report that demonstrates economic and technical viability and allows classification of some measured and indicated resources to be classified as mineral reserves.

Refer to the Company's MD&A for more details of the financial results and for reconciliations of the Company's non- IFRS performance measures to the nearest IFRS measure. The full version of the unaudited interim financial statements and accompanying management discussion and analysis can be viewed on the Company's website at www.silverxmining.com and on SEDAR+ at www.sedarplus.ca. All financial information is prepared in accordance with International Financial Reporting Standards ("IFRS") and all dollar amounts are expressed in US dollars unless otherwise stated.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. A. David Heyl is a consultant for Silver X.

About Silver X Mining Corp.

Silver X is a rapidly expanding silver developer and producer. The Company owns the 20,000-hectare Nueva Recuperada Silver District in Central Peru and produces silver, gold, lead and zinc from its Tangana Project. We are building a premier silver company that aims to deliver outstanding value to all stakeholders, consolidating and developing undervalued assets, adding resources and increasing production while aspiring to social and environmental excellence. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. García President and CEO

For further information, please contact:

David Gleit

Chief Financial Officer

+1 778 323 0959

E: d.gleit@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward- looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at Recuperada Silver Project (the "Project"), the ability of the new zones at the Project to feed production at the Company's Nueva Recuperada Plant in the near term, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedarplus.ca from time to time. Forward- looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View the original press release on accesswire.com