Silver X Reports Q3 2024 Financial Results

Silver X Mining reports Q3 2024 financial results with revenues of $5.0 million, up from $2.1 million in Q3 2023. The company showed improved financial metrics with Adjusted EBITDA loss narrowing to $0.1M from $1.0M year-over-year. Cash costs decreased to $21.5 per AgEq ounce produced, while AISC was $26.2 per AgEq ounce. Notable improvements include a 32.3% reduction in cash cost per tonne to $100 in Q3 2024 from $148 in Q3 2023. The company invested $1.0 million in the development of the Tangana mining unit, contributing $3.9 per AgEq ounce to the AISC.

Silver X Mining ha riportato i risultati finanziari per il terzo trimestre 2024 con ricavi di 5,0 milioni di dollari, in aumento rispetto ai 2,1 milioni di dollari del terzo trimestre 2023. L'azienda ha mostrato un miglioramento dei parametri finanziari con una perdita di EBITDA rettificato che si è ridotta a 0,1 milioni di dollari rispetto a 1,0 milioni di dollari dell'anno precedente. I costi in contante sono diminuiti a 21,5 dollari per oncia AgEq prodotta, mentre l'AISC era di 26,2 dollari per oncia AgEq. I miglioramenti significativi includono una riduzione del 32,3% dei costi in contante per tonnellata a 100 dollari nel terzo trimestre 2024, rispetto ai 148 dollari del terzo trimestre 2023. L'azienda ha investito 1,0 milione di dollari nello sviluppo dell'unità mineraria Tangana, contribuendo con 3,9 dollari per oncia AgEq all'AISC.

Silver X Mining reporta los resultados financieros del tercer trimestre de 2024 con ingresos de 5,0 millones de dólares, un aumento desde los 2,1 millones de dólares en el tercer trimestre de 2023. La empresa mostró métricas financieras mejoradas, con la pérdida de EBITDA ajustado reduciéndose a 0,1 millones de dólares desde 1,0 millones de dólares interanual. Los costos en efectivo disminuyeron a 21,5 dólares por onza de AgEq producida, mientras que el AISC fue de 26,2 dólares por onza de AgEq. Las mejoras notables incluyen una reducción del 32,3% en los costos en efectivo por tonelada, bajando a 100 dólares en el tercer trimestre de 2024 desde 148 dólares en el tercer trimestre de 2023. La empresa invirtió 1,0 millón de dólares en el desarrollo de la unidad minera Tangana, contribuyendo con 3,9 dólares por onza de AgEq al AISC.

실버 X 마이닝은 2024년 3분기 재무 결과를 보고하며 수익이 500만 달러에 달하고, 이는 2023년 3분기의 210만 달러에서 증가한 수치입니다. 회사는 조정된 EBITDA 손실이 전년 대비 100만 달러에서 10만 달러로 축소되는 등 재무 지표가 개선되었음을 보여주었습니다. 현금 비용은 생산된 AgEq 온스당 21.5달러로 감소했으며, AISC는 AgEq 온스당 26.2달러였습니다. 주목할 만한 개선 사항으로는 2023년 3분기의 148달러에서 2024년 3분기에는 톤당 100달러로 현금 비용이 32.3% 감소한 것이 있습니다. 회사는 Tangana 광산 단위 개발에 100만 달러를 투자하여 AISC에 AgEq 온스당 3.9달러를 기여했습니다.

Silver X Mining rapporte des résultats financiers pour le troisième trimestre 2024 avec des revenus de 5,0 millions de dollars, en hausse par rapport à 2,1 millions de dollars au troisième trimestre 2023. L'entreprise a affiché une amélioration de ses indicateurs financiers, avec une perte d'EBITDA ajusté réduite à 0,1 million de dollars contre 1,0 million de dollars d'une année sur l'autre. Les coûts de production en espèces ont diminué à 21,5 dollars par once AgEq produite, tandis que l'AISC s'élevait à 26,2 dollars par once AgEq. Parmi les améliorations notables, on note une réduction de 32,3 % des coûts de production en espèces par tonne, s'élevant à 100 dollars au troisième trimestre 2024 contre 148 dollars au troisième trimestre 2023. L'entreprise a investi 1,0 million de dollars dans le développement de l'unité minière Tangana, contribuant à hauteur de 3,9 dollars par once AgEq à l'AISC.

Silver X Mining berichtet über die finanziellen Ergebnisse für das 3. Quartal 2024 mit Einnahmen von 5,0 Millionen Dollar, im Vergleich zu 2,1 Millionen Dollar im 3. Quartal 2023. Das Unternehmen zeigte verbesserte Finanzkennzahlen, wobei der bereinigte EBITDA-Verlust von 1,0 Millionen Dollar im Vorjahr auf 0,1 Millionen Dollar gesenkt wurde. Die Barkosten sanken auf 21,5 Dollar pro produzierter AgEq-Unze, während der AISC bei 26,2 Dollar pro AgEq-Unze lag. Zu den bemerkenswerten Verbesserungen gehört eine Reduzierung der Barkosten pro Tonne um 32,3 % auf 100 Dollar im 3. Quartal 2024, verglichen mit 148 Dollar im 3. Quartal 2023. Das Unternehmen investierte 1,0 Millionen Dollar in die Entwicklung der Bergbaueinheit Tangana, was mit 3,9 Dollar pro AgEq-Unze zum AISC beitrug.

- Revenue increased by $2.9M to $5.0M in Q3 2024 vs Q3 2023

- Adjusted EBITDA loss improved to -$0.1M from -$1.0M YoY

- Cash cost per tonne decreased 32.3% to $100 from $148 YoY

- Nine-month net loss improved by $1.7M compared to 2023

- Nine-month EBITDA improved by $4.6M to $1.7M vs -$2.9M in 2023

- Net loss before tax of $1.9M in Q3 2024

- Negative Adjusted EBITDA of $0.1M in Q3 2024

- Cost of sales increased by $2.8M to $5.7M in Q3 2024

- Cash decreased by $0.2M during the period

(All dollar amounts expressed in US dollars unless otherwise noted)

VANCOUVER, BC / ACCESSWIRE / November 28, 2024 / Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company") is pleased to report its financial results for the three and nine months ended September 30, 2024 for the Nueva Recuperada Project (the "Project") in Central Peru.

Q3 2024 Financial Highlights

Revenues of

$5.0 million (3Q24) vs.$2.1 million (3Q23), an increase of$2.9 million .Significant EBITDA improvement: Adjusted EBITDA of negative

$0.1M (3Q24) vs. Adjusted EBITDA of negative$1.0M (3Q23).Cash costs of

$21.5 per AgEq ounce produced and AISC of$26.2 per AgEq ounce produced, reflective of the sustaining capital expenditure invested in the development of the Tangana mining unit ($1.0 million adding$3.9 per AgEq ounce produced to the AISC). (1)(2)Cash cost per tonne was

$100 in 3Q24 compared to$148 per tonne in 3Q23, a reduction of32.3% .

Jose Garcia, Silver X Mining's CEO, commented: "I am pleased to see our mine developing in the right way, accessing new ore-shoots, expanding the orebody both horizontally and at depth, and opening up the terrific potential of our Tangana veins. The team is making significant improvements at the operation and despite some of our challenges, we manage to compete with much larger operations. This is especially notable when comparing year-to-date results with the same period last year. We are convinced our performance will improve substantially in 2025."

Notes:

Cash costs per Silver Equivalent ounce (AgEq) ounce produced and All-In-Sustaining Cost (AISC) per AgEq ounce produced are non-IFRS financial ratios. These are based on non- IFRS financial measures that do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the "Non-IFRS Measures" section of this news release for further information.

AgEq ounce produced was calculated using the average sales prices of each metal for each month, and revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

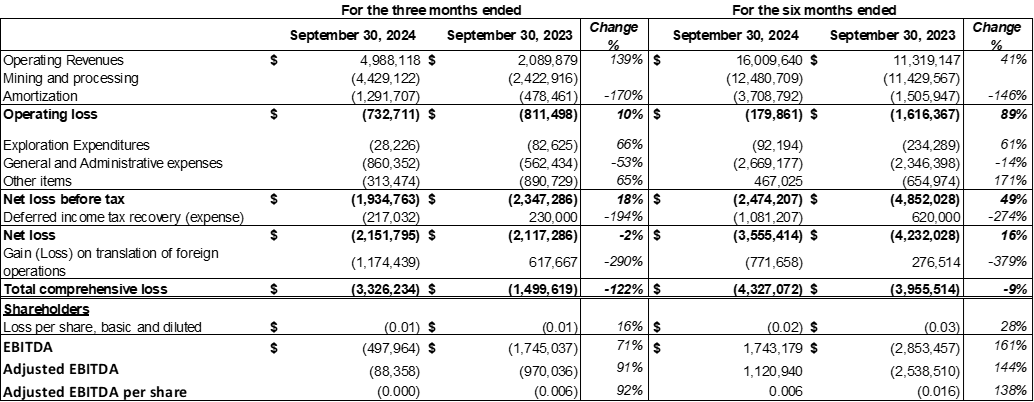

Summary of Selected Financial Results

The information provided below are excerpts from the Company's unaudited interim Financial Statements and Management's Discussion and Analysis ("MD&A"), which can be found on the Company's website at www.silverxmining.com/investor#report or on SEDAR+ at www.sedarplus.ca.

Note:

EBITDA, Adjusted EBITDA, and Adjusted EBITDA per share are non-IFRS ratios with no standardized meaning under IFRS, and therefore may not be comparable to similar measures presented by other issuers. For further information, including detailed reconciliations to the most directly comparable IFRS measures, see "Non-IFRS Measures" in this news release and the MD&A.

Three months ended September 30, 2024 vs. 2023

For the three months ended September 30, 2024, the Company recorded:

Net loss before tax of

$1.9M , compared to a net loss before tax of$2.3M in the three months ended September 30, 2023.EBITDA loss of

$0.5M , compared to an EBITDA loss of$1.7M in the three months ended September 30, 2023.Adjusted EBITDA loss of

$0.09M , compared to an Adjusted EBITDA loss of$1.0M in the three months ended September 30, 2023.

The decrease in losses in the current period was primarily due to increased operating revenues from the sale of mineral production of

Nine months ended September 30, 2024 vs. 2023

For the nine months ended September 30, 2024, the Company recorded:

Net loss before tax of

$2.5M , compared to a net loss before tax of$4.2M in the nine months ended September 30, 2023, a$1.7M improvement.EBITDA income of

$1.7M , compared to an EBITDA loss of$2.9M in the nine months ended September 30, 2023, a$4.6M improvement.Adjusted EBITDA income of

$1.1M , compared to an Adjusted EBITDA loss of$2.5M in the nine months ended September 30, 2023, a$3.6M improvement.

The increase in income in the current period was primarily due to increased operating revenues from the sale of mineral production of

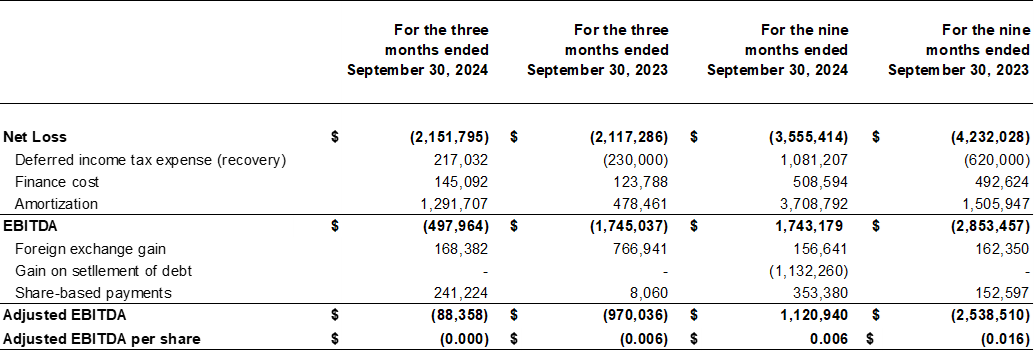

The following table reconciles the Net Loss to the EBITDA and Adjusted EBITDA:

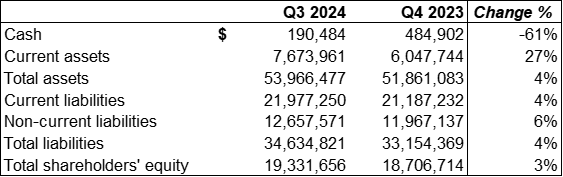

Financial Position

The available cash during the period decreased by

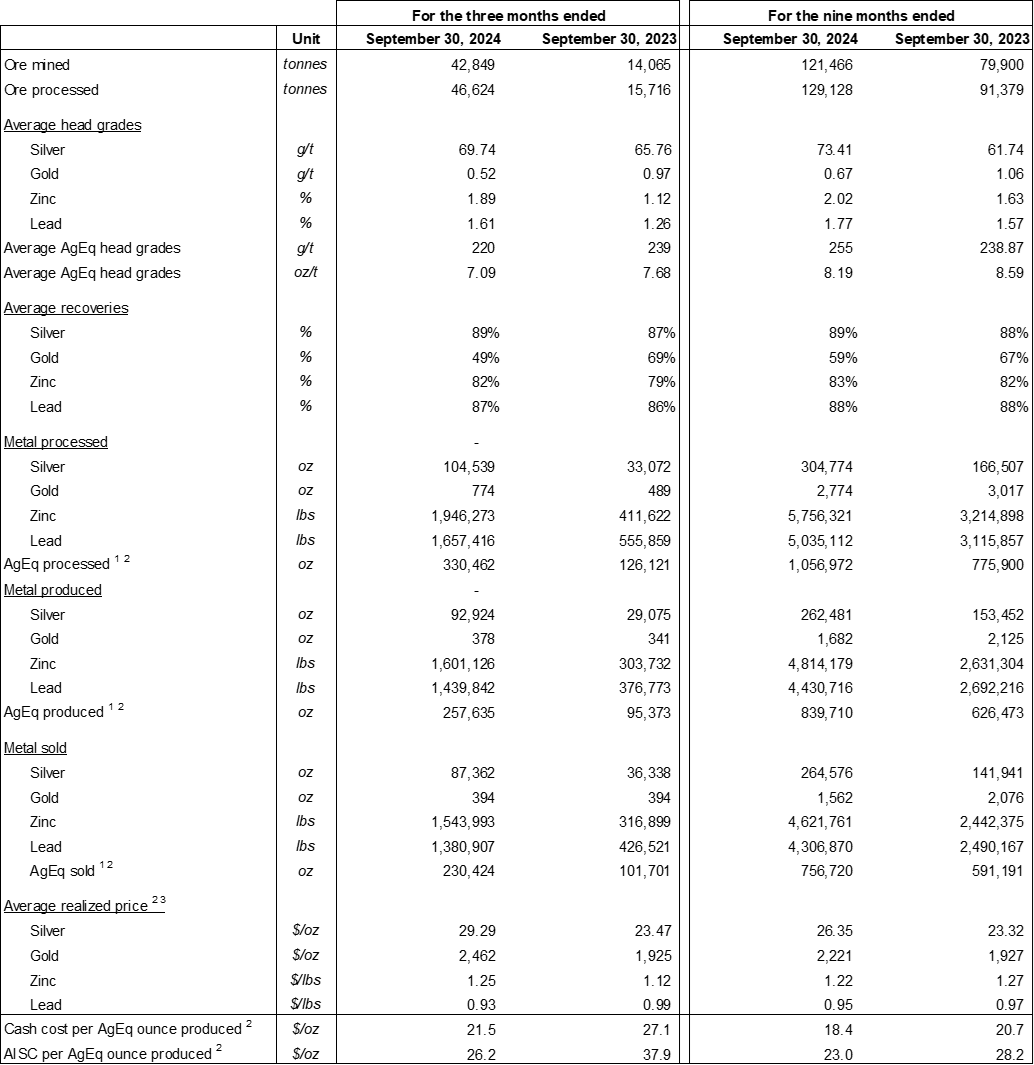

Operational Results

Notes:

Average Realized Price, production cost per tonne processed, AgEq sold, cash cost per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS ratios with no standardized meaning under IFRS, and therefore may not be comparable to similar measures presented by other issuers. For further information, including detailed reconciliations to the most directly comparable IFRS measures, see "Non-IFRS Measures" in this news release and the MD&A.

AgEq ounces processed and produced were calculated based on all metals processed and produced using the average sales prices of each metal for each month during the period. Revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

Average realized price corresponds to the average prices for each metal on the following month after delivery, used to calculate the final value of the concentrate delivered in a given month before any deductions.

Non-IFRS Measures

The Company has included certain non-IFRS financial measures and ratios in this news release, as discussed below. The Company believes that these measures, in addition to measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

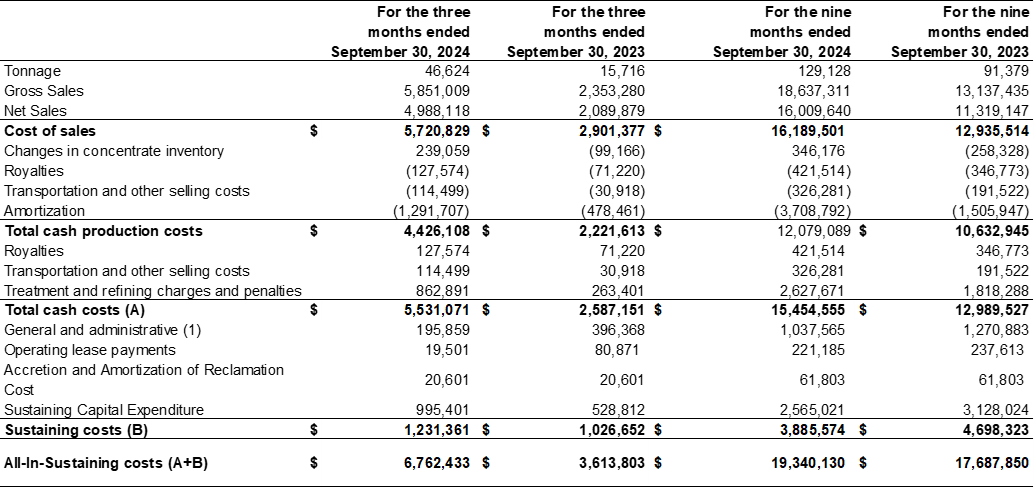

Cash Costs, All-In Sustaining Cost, EBITDA, and Adjusted EBITDA

The Company uses cash costs, cash cost per AgEq ounce produced, AISC, AISC per AgEq ounce produced, EBITDA and Adjusted EBITDA to manage and evaluate its operating performance in addition to IFRS measure because the Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. The Company understands that certain investors use these measures to determine the Company's ability to generate earnings and cash flows for use in investing and other activities. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

Cash costs is calculated by starting with cost of sales, and then adding treatment and refining charges, and changes in depreciation and amortization.

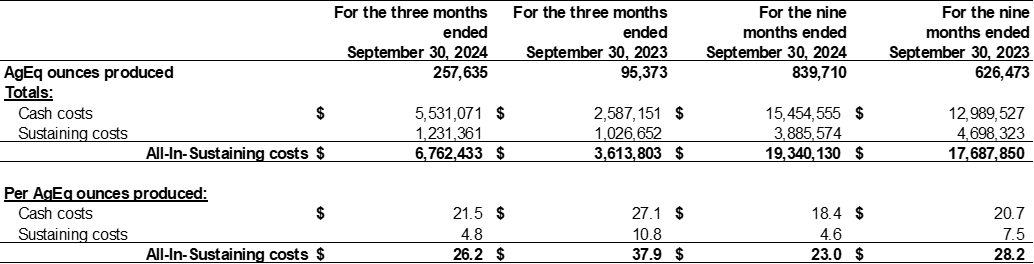

Total cash production costs include cost of sales, changes in concentrate inventory, changes in amortization, less transportation and other selling costs and royalties. Cash costs per AgEq ounce produced is calculated by dividing cash costs by the AgEq ounces produced.

AISC and AISC per AgEq ounce produced are calculated based on guidance published by the World Gold Council (and used as a standard of the Silver Institute). The Company presents AISC on the basis of AgEq ounces produced. AISC is calculated by taking the cash costs and adding sustaining costs. Sustaining costs are defined as capital expenditures and other expenditures that are necessary to maintain current production. Management has exercised judgment in making this determination.

The following table reconciles cash costs, cash costs per AgEq ounce, AISC and AISC per AgEq ounce produced to cost of sales, the most directly comparable IFRS measure:

The following table shows the calculation of the cash costs and AISC per AgEq ounce produced:

To improve the accuracy and presentation of AISC calculations, Silver X refined the composition of General & Administrative Expense in sustaining cost, excluding discretionary costs for business development, investor relations and share-based compensation. For comparative purposes the prior period were also recalculated based on the revised methodology, resulting in AISC of

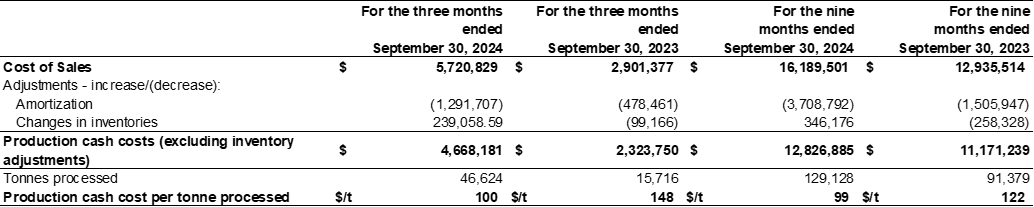

Production Cost Per Tonne Processed

A reconciliation between production cost per tonne (excluding amortization and changes in inventories) and the cost of sales is provided below. Changes in inventories are excluded from the calculation of Production Cost per Tonne Processed. Changes in inventories reflect the net cost of concentrate inventory (i) sold during the current period but produced in a previous period or (ii) produced but not sold in the current period. The Company uses Production Cost Per Tonne Processed to evaluate its operating performance in addition to IFRS measure because Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

During the period, cash cost per tonne decreased with the increase of the level of tonnage of ore processed, amounting to 46,624 tonnes for 3Q24 compared to 15,716 tonnes for 3Q23. Overall operating efficiencies improved resulting in a lower production cash cost per tonne of

The capital expenditure deployed in the development of the Tangana mining unit during the period was the main cost contributor to AISC. Investment in sustainable CAPEX will enable the Company to access new production fronts and transition to higher head-grade areas.

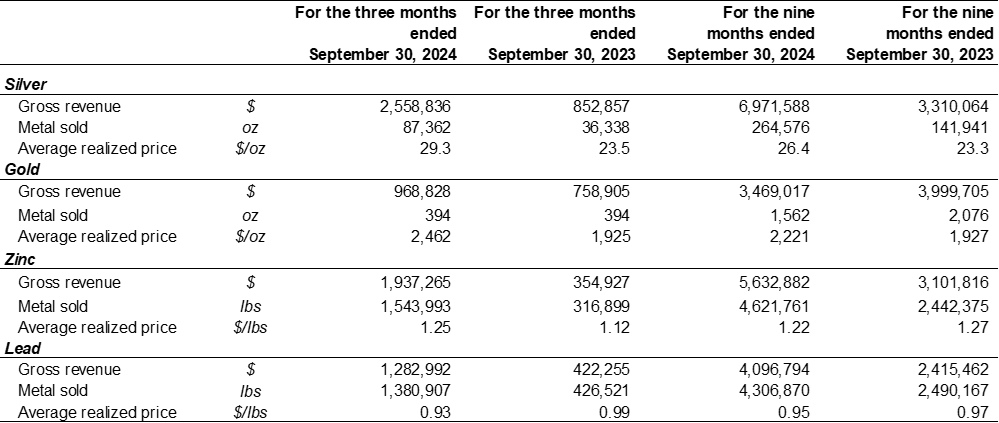

Average Realized Price

Average realized price is a non-IFRS financial measure. The Company uses "average realized price per ounce of silver", "average realized price per ounce of gold", "average realized price per ounce of zinc" and "average realized price per ounce of lead" because it understands that in addition to conventional measures prepared in accordance with IFRS, certain investors and analysts use this information to evaluate the Company's performance as compared with "average market prices" of metals for the period.

Average realized metal prices represent the sale price of the metal. Average realized price corresponds to the average prices for each metal on the following month after delivery, used to calculate the final value of the concentrate delivered in a given month before any deductions:

Non-IFRS Measures

Cash costs ($ per Oz sold) and AISC ($ per Oz sold) are non-IFRS financial measures and non-IFRS ratios in this press release. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the Non-IFRS Measures section of the Company's most recently filed Management's Discussion and Analysis which is available on SEDAR+ at www.sedarplus.ca for full details on these measures, which is incorporated by reference into this press release.

Please see "Cautionary Note regarding Production without Mineral Reserves" at the end of this news release.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Heyl is a consultant for Silver X.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a rapidly expanding silver producer and developer. The Company owns the 20,472-hectare Nueva Recuperada Silver Project in Central Peru and produces silver, gold, lead and zinc from its Tangana Mining Unit. We are building a premier silver company that aims to deliver outstanding value to all stakeholders, consolidating and developing undervalued assets, adding resources, and increasing production while aspiring to sustain the communities that support us and stewarding the environment. Current production, paired with immediate development and brownfield expansion opportunities, presents investors with the opportunity to invest in the early stages of a silver producer with strong growth prospects. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. Garcia, CEO and Director

For further information, please contact:

Susan Xu

Investor Relations

ir@silverxmining.com

+1 778 323 0959

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward-looking information. Forward-looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labourdispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedarplus.ca from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View the original press release on accesswire.com