Affirm Expands Payment Offerings With New Pay in 2 and Pay in 30 Options

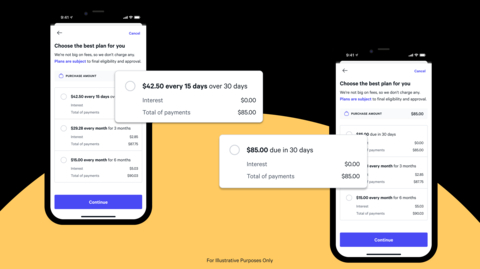

Affirm (NASDAQ: AFRM), a payment network, has introduced two new payment options: Pay in 2 and Pay in 30. These options provide consumers with more flexibility and choice, allowing them to split the cost of their purchase into two interest-free payments per month or pay in full interest-free within 30 days.

Roughly 80% of e-commerce transactions in the United States are for purchases under $150. The new payment options aim to cater to these transactions, enhancing consumer affordability and flexibility.

Affirm has already seen an increase in cart conversion rates due to these new options. The company plans to expand Pay in 2 and Pay in 30 to its integrated merchant partners in the coming months.

Affirm continues to emphasize transparency, with no hidden fees or deferred interest charges.

- Introduction of Pay in 2 and Pay in 30 increases flexibility for consumers.

- No late fees or hidden charges associated with new payment options.

- 80% of US e-commerce transactions are under $150, aligning with new offerings.

- Increase in cart conversion rates observed with new payment options.

- Plans to expand Pay in 2 and Pay in 30 options to integrated merchant partners.

- Potential risk of higher default rates with new payment options.

- No detailed metrics on the increase in cart conversion rates provided.

- New payment options may increase operational and administrative costs.

Insights

Affirm's introduction of the Pay in 2 and Pay in 30 options represents a significant move to broaden its appeal to different consumer segments. The flexibility of these options is likely to attract more users, particularly those looking for short-term, interest-free credit. This could lead to an increase in transaction volumes and higher revenues for Affirm, making it an attractive feature for both consumers and merchants.

From a financial standpoint, the absence of late fees and hidden charges is a strong selling point. It aligns with Affirm's brand promise of transparency and consumer trust, which can enhance customer loyalty. However, it's essential to consider the potential risks. The company's revenue largely depends on merchant fees and interest from longer-term loans. These new short-term, interest-free options might not generate significant revenue directly but could drive overall platform engagement.

In the short term, the announcement could boost investor sentiment, as it showcases Affirm's commitment to innovation and consumer-centric solutions. In the long term, the success of these new payment options will hinge on their ability to drive higher transaction volumes and merchant partnerships.

The launch of Pay in 2 and Pay in 30 options is a strategic response to the growing demand for flexible payment solutions in the e-commerce sector. With 80% of e-commerce transactions in the U.S. being under

This move positions Affirm competitively against other 'Buy Now, Pay Later' (BNPL) providers, particularly in the small to mid-sized transaction range. The expected increase in cart conversion rates is a promising indicator of consumer acceptance and preference for these new payment options. By offering more flexibility, Affirm can attract a broader range of consumers, including those who might be cautious about using traditional credit.

In terms of market strategy, Affirm's ability to integrate these options into its app and expand to merchant partners will be critical. It's not just about offering new payment plans but ensuring seamless integration and user experience. This strategy could potentially lead to increased market share and stronger relationships with merchants.

Provides greater choice and flexibility across a wider range of transaction sizes

(Graphic: Business Wire)

“Roughly

The rollout of Pay in 2 and Pay in 30 will enable consumers to split the cost of their purchase into two interest-free payments per month, or to pay in full interest-free within 30 days of their purchase, without ever revolving. Pay in 2 and Pay in 30 will begin appearing in Affirm’s app, joining Pay in 4 and monthly installments. Affirm has seen an increase in cart conversion within its app since offering its Pay in 2 and Pay in 30 options. Affirm plans to test and roll out its Pay in 2 and Pay in 30 options more broadly to its integrated merchant partners in the coming months.

About Affirm

Affirm’s mission is to deliver honest financial products that improve lives. By building a new kind of payment network – one based on trust, transparency and putting people first – we empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers exactly what they will pay up front, never increase that amount, and never charge any late or hidden fees. Follow Affirm on social media: LinkedIn | Instagram | Facebook | X.

Payment options through Affirm are subject to eligibility, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to California Finance Lender license 60DBO-111681.

AFRM-F

View source version on businesswire.com: https://www.businesswire.com/news/home/20240606791163/en/

Press:

Affirm

Andrea Hackett

press@affirm.com

Source: Affirm