Affirm and Stripe Partner to Help Businesses Grow Their Revenue

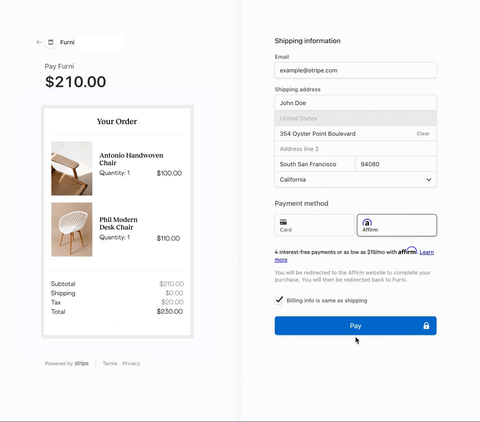

Affirm announced a strategic partnership with Stripe, enabling millions of businesses to incorporate Affirm’s Adaptive Checkout™ into their payment systems. This feature allows users to offer flexible payment options, such as bi-weekly and monthly installments, enhancing customer experience.

Eligible customers can finance purchases between $50 and $30,000, with a maximum credit limit of $17,500. Reports indicate that businesses using Affirm have experienced up to 85% increases in average order values.

- Partnership with Stripe expands Affirm's market reach.

- Businesses using Affirm see up to 85% higher average order values.

- Quick integration allows businesses to adopt Affirm in minutes.

- None.

Insights

Analyzing...

Millions of businesses using Stripe can offer their customers flexible and transparent payment options with Affirm

(Photo: Business Wire)

Now, businesses using Stripe can add this technology to their checkout experience in minutes. Eligible customers will then have the option to use Affirm to split the cost of purchases ranging from

“Businesses who offer Affirm at checkout have reported as much as

Businesses who offer Affirm’s Adaptive Checkout see increased cart conversion, approvals, and sales compared to those who offer monthly payments through Affirm alone.

“We were able to integrate Affirm, test, and then launch in production within one day,” said

"Businesses need to move quickly to keep up with changing consumer preferences," said

Interested Stripe users can learn more about offering Affirm to their customers here.

About Affirm

Affirm’s mission is to deliver honest financial products that improve lives. By building a new kind of payment network — one based on trust, transparency and putting people first — we empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers exactly what they will pay up front, never increase that amount, and never charge any late or hidden fees. Follow Affirm on social media: LinkedIn | Instagram | Facebook | Twitter |

AFRM-F

About Stripe

Stripe is a financial infrastructure platform for businesses. Millions of companies—from the world’s largest enterprises to the most ambitious startups—use Stripe to accept payments, grow their revenue, and accelerate new business opportunities. Headquartered in

Payment options through Affirm are subject to eligibility, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by

View source version on businesswire.com: https://www.businesswire.com/news/home/20220531005246/en/

Press

Affirm

press@affirm.com

(973) 820-1820

Stripe

media@stripe.com

Source: Affirm