American Workforce Burnout Reaches Tipping Point

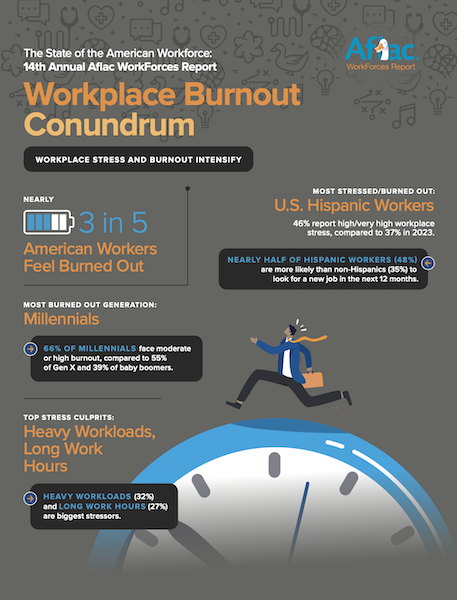

Aflac's 14th annual WorkForces Report reveals increasing workplace stress and burnout affecting nearly 3 in 5 American workers. Millennials show the highest burnout rates at 66%, compared to Gen X (55%) and baby boomers (39%). Employee stress levels rose to 38% in 2024 from 33% in 2023, with Hispanic workers experiencing significantly higher rates. The report highlights growing financial vulnerability, with 51% of employees unable to afford $1,000 in unexpected medical expenses. Notably, 93% of employees see an increasing need for supplemental insurance, while 62% would consider leaving their jobs for better benefits even with a pay cut.

Il 14° Rapporto annuale WorkForces di Aflac rivela un aumento dello stress lavorativo e dell'esaurimento che colpisce quasi 3 lavoratori su 5 negli Stati Uniti. I Millennial mostrano i tassi di burnout più elevati, al 66%, rispetto alla Gen X (55%) e ai baby boomer (39%). I livelli di stress tra i dipendenti sono aumentati al 38% nel 2024, rispetto al 33% nel 2023, con i lavoratori ispanici che registrano tassi di stress significativamente più alti. Il rapporto evidenzia una crescente vulnerabilità finanziaria, con il 51% dei dipendenti incapace di far fronte a spese mediche inaspettate di 1.000 dollari. È notevole che il 93% dei dipendenti percepisca un crescente bisogno di assicurazione supplementare, mentre il 62% prenderebbe in considerazione l'idea di lasciare il proprio lavoro per migliori benefici, anche a costo di una riduzione salariale.

El 14° Informe Anual de WorkForces de Aflac revela un aumento en el estrés laboral y el agotamiento que afecta a casi 3 de cada 5 trabajadores estadounidenses. Los Millennials muestran las tasas de agotamiento más altas, con un 66%, en comparación con la Generación X (55%) y los baby boomers (39%). Los niveles de estrés entre los empleados aumentaron al 38% en 2024, en comparación con el 33% en 2023, siendo los trabajadores hispanos los que presentan tasas de estrés significativamente más altas. El informe destaca la creciente vulnerabilidad financiera, con el 51% de los empleados incapaces de afrontar gastos médicos inesperados de 1.000 dólares. Notablemente, el 93% de los empleados ve una creciente necesidad de seguro complementario, mientras que el 62% consideraría dejar su trabajo por mejores beneficios, incluso con una reducción salarial.

Aflac의 14번째 연례 WorkForces 보고서는 미국 근로자 5명 중 거의 3명이 겪고 있는 직장 내 스트레스와 탈진이 증가하고 있음을 보여줍니다. 밀레니얼 세대가 66%로 가장 높은 탈진율을 보이며, X세대는 55%, 베이비붐 세대는 39%입니다. 2024년 직원 스트레스 수준은 2023년 33%에서 38%로 증가했으며, 특히 히스패닉 근로자들이 상대적으로 높은 스트레스를 경험하고 있습니다. 이 보고서는 재정 취약성이 증가하고 있음을 강조하며, 51%의 직원이 갑작스러운 1,000달러의 의료비를 감당하지 못한다고 합니다. 특히, 93%의 직원이 추가 보험의 필요성을 느끼고 있으며, 62%는 급여 삭감이 있어도 더 나은 복지를 위해 직장을 떠날 것을 고려할 것입니다.

Le 14ème Rapport Annuel WorkForces d'Aflac révèle une augmentation du stress au travail et de l'épuisement touchant près de 3 travailleurs américains sur 5. Les Millennials affichent les taux d'épuisement les plus élevés à 66 %, contre 55 % pour la Génération X et 39 % pour les baby boomers. Les niveaux de stress des employés ont grimpé à 38 % en 2024, contre 33 % en 2023, les travailleurs hispaniques connaissant des taux significativement plus élevés. Le rapport met en évidence une vulnérabilité financière croissante, avec 51 % des employés incapables de faire face à des dépenses médicales imprévues de 1 000 dollars. Notamment, 93 % des employés ressentent un besoin croissant d'assurance complémentaire, tandis que 62 % envisageraient de quitter leur emploi pour de meilleurs avantages, même avec une réduction de salaire.

Der 14. jährliche WorkForces-Bericht von Aflac zeigt einen Anstieg von Stress und Burnout am Arbeitsplatz, der fast 3 von 5 amerikanischen Arbeitnehmern betrifft. Millennials haben mit 66% die höchsten Burnout-Raten, gefolgt von der Generation X (55%) und den Babyboomern (39%). Der Stresspegel der Mitarbeiter stieg 2024 auf 38% von 33% im Jahr 2023, wobei Hispanics deutlich höhere Raten aufweisen. Der Bericht hebt die zunehmende finanzielle Verletzlichkeit hervor, da 51% der Mitarbeiter nicht in der Lage sind, unerwartete medizinische Ausgaben in Höhe von 1.000 Dollar zu decken. Bemerkenswert ist, dass 93% der Mitarbeiter einen steigenden Bedarf an Zusatzversicherungen sehen, während 62% in Erwägung ziehen würden, ihren Job für bessere Leistungen zu kündigen, selbst wenn dies mit einem Gehaltsverzicht verbunden wäre.

- 93% of employees recognize the need for supplemental insurance (highest in 14 years)

- 91% of employees report positive impact from corporate social responsibility efforts

- 77% consider CSR initiatives important for employment decisions

- Employee stress levels increased to 38% in 2024 (from 33% in 2023)

- 51% of employees cannot afford $1,000 in unexpected medical expenses

- 50% of employees admit to 'quiet quitting' behaviors

- 64% of employees cannot go more than one month without a paycheck

- Rising employee turnover risk with 62% willing to leave for better benefits

Insights

The Aflac WorkForces Report reveals significant trends impacting the insurance industry and workplace benefits market. The 93% demand for supplemental insurance - an all-time high in 14 years - signals strong market opportunities for AFL and its competitors. The finding that 62% of employees would take a pay cut for better benefits (up from 53%) indicates a shifting market dynamic favoring supplemental insurance providers.

The report exposes critical market segments, particularly among Hispanic workers and younger generations, showing higher stress levels and financial vulnerability. With 51% of employees unable to afford $1,000 in unexpected medical expenses, this creates a compelling case for Aflac's supplemental insurance products. The significant gap between perceived and actual cancer treatment costs (

The workforce burnout data presents both challenges and opportunities for employers and insurance providers. The dramatic increase in workplace stress (

The "quiet quitting" behaviors identified in

14th annual Aflac WorkForces Report uncovers very high levels of burnout are nearly twice as likely among U.S. Hispanic employees than non-Hispanics

Originally published on Aflac Newsroom

COLUMBUS, GA / ACCESSWIRE / November 20, 2024 / American employers and employees are facing a conundrum: heightened levels of workplace stress and burnout. This concern is exacerbated by ongoing rising costs of health care, financial vulnerability and looming worry about the future of their families, according to the 14th annual Aflac WorkForces Report1 released by Aflac Incorporated, a leading provider of supplemental health insurance and products in the U.S. The report has been tracking for more than a decade the state of the American workplace among employees and employers - capturing trends, attitudes, needs and experiences in health care and benefits administration.

Workplace stress and burnout intensify

The Aflac WorkForces Report uncovers that burnout is affecting nearly 3 in 5 American workers - with a notable generational gap. Far more millennials, ages 28-43 (

Heavy workloads (

"In an ever-changing ecosystem, the results of the Aflac WorkForces Report reinforce the importance of employers doubling down on their understanding of what drives stress and potential signs of burnout among their employees. With a keen grasp of the pain points, employers can proactively develop programs and put measures in place to ensure employees feel supported both on and off the clock," said Jeri Hawthorne, senior vice president and Chief Human Resources Officer, Aflac Incorporated.

Counterproductive behavior poses new challenges for employers

According to the report, among all employees across all workplace models,

Not doing everything required in job descriptions:

14% remote;15% hybrid;8% on-site.Taking on secondary work without permission from employers:

22% remote;14% hybrid;11% on-site.

"Understanding performance dynamics of all workplace models is crucial for employers as they try to create work environments that will satisfy their employees and keep productivity at peak levels," said Hawthorne. "At the same time, employees may need to understand that decreases in productivity will signal to employers that their current model, whether on-site, remote or hybrid, is not working and they will likely consider changes."

Financial vulnerability fueled by anxiety, looming worry

American workers who have experienced some anxiety when thinking about the impact of an unexpected serious medical condition is on the rise:

The report also revealed that most employees do not understand the costs associated with a serious medical diagnosis such as cancer. More than three-quarters (

The youngest generation of workers, Gen Z, ages 18 to 27, continues to be the most financially vulnerable, with

Looking for a lifeline

With ongoing feelings of financial fragility - and stress and worry about the rising costs of health care - both employers and employees are eager for solutions, noting supplemental insurance as a viable step to help toward financial stability and added peace of mind. Benefits continue to be critical to employee retention, in part because employees consider benefits packages to be important to their physical, financial and mental well-being. In fact, in 2024, the importance of benefits to overall loyalty, workplace engagement and willingness to refer a friend to their organization reached an all-time high.

The study found a growing number of employees would consider leaving their jobs for better benefits, even if it meant taking a pay cut (

"When

U.S. Hispanic employees eager for benefits that address family illnesses and family history

In the survey, U.S. Hispanic employees expressed a strong interest in supplemental insurance that addresses illnesses that run in their families (

U.S. Hispanic employees' overall work experience and satisfaction are influenced by benefits options more often than non-Hispanic employees: productivity (

A sense of purpose drives well-being

The study shows employees benefit significantly from participating in employers' corporate social responsibility (CSR) efforts, with

CSR efforts also can boost employee recruitment and retention, as

The 2024-2025 Aflac WorkForces Report highlights the vital role of comprehensive benefits in employees' well-being, satisfaction, resilience and retention. Additional survey findings, an infographic, trends and more can be found in the 2024-2025 Aflac WorkForces Report at Aflac.com/AWR.

ABOUT THE 2024-2025 AFLAC WORKFORCES REPORT

The 2024-2025 Aflac WorkForces Report, conducted by Kantar on behalf of Aflac, is the 14th annual study examining benefits trends, attitudes and use of employee benefits in the U.S. workforce in various industries and business sizes. The employee survey took place online June 6-July 10, 2024, and the employer survey took place online June 6-21, 2024. Throughout this report, some percentages may not add up to

ABOUT AFLAC INCORPORATED

Aflac Incorporated (NYSE: AFL), a Fortune 500 company, has helped provide financial protection and peace of mind for nearly seven decades to millions of policyholders and customers through its subsidiaries in the U.S. and Japan. In the U.S., Aflac is the No. 1 provider of supplemental health insurance products.3 In Japan, Aflac Life Insurance Japan is the leading provider of cancer and medical insurance in terms of policies in force. The company takes pride in being there for its policyholders when they need us most, as well as being included in the World's Most Ethical Companies by Ethisphere for 18 consecutive years (2024), Fortune's World's Most Admired Companies for 23 years (2024) and Bloomberg's Gender-Equality Index for the fourth consecutive year (2023). In addition, the company became a signatory of the Principles for Responsible Investment (PRI) in 2021 and has been included in the Dow Jones Sustainability North America Index (2023) for 10 years. To find out how to get help with expenses health insurance doesn't cover, get to know us at aflac.com or aflac.com/espanol. Investors may learn more about Aflac Incorporated and its commitment to corporate social responsibility and sustainability at investors.aflac.com under "Sustainability."

Media contact: Jon Sullivan, 706.573.7610 or jsullivan@aflac.com

Analystandinvestorcontact: David A. Young, 706.596.3264 or dyoung@aflac.com

1 Aflac.com/AWR

2National Cancer Institute's Financial Burden of Cancer Care/Cancer Trends Progress Report

3 LIMRA 2023 US Supplemental Health Insurance Total Market Report.

SOURCE Aflac

View additional multimedia and more ESG storytelling from Aflac Incorporated on 3blmedia.com.

Contact Info:

Spokesperson: Aflac Incorporated

Website: https://www.3blmedia.com/profiles/aflac-incorporated

Email: info@3blmedia.com

SOURCE: Aflac Incorporated

View the original press release on accesswire.com