ADM Endeavors, Inc. (OTCQB:ADMQ) Announces Record July Revenue

ADM Endeavors, Inc. (OTCQB: ADMQ) reported its subsidiary, Just Right Products Inc., achieved its highest July revenues ever, showing a remarkable increase of over 103% from July 2020, and more than 80% compared to July 2019. The company saw a significant boost in school uniform sales, which surged 999% year-over-year and exceeded 103% from pre-COVID 2019 levels. CEO Marc Johnson expressed surprise at the sales growth, indicating that 2021 could be the company’s best year to date. July 2021 revenues are pending auditor review.

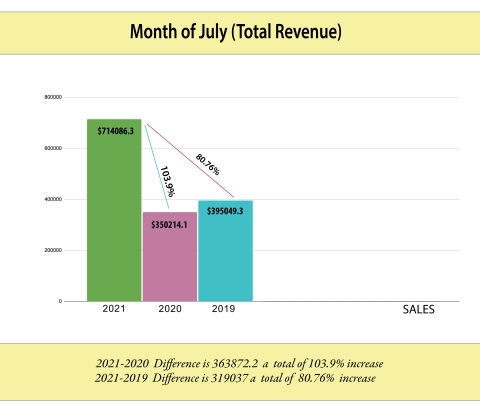

- July 2021 revenues increased over 103% from July 2020.

- Revenues surpassed 80% compared to July 2019.

- School uniform sales rose 999% year-over-year.

- School uniform sales exceeded 103% from 2019 levels.

- July 2021 numbers have not been reviewed by an auditor.

ADM Endeavors, Inc. (OTCQB: ADMQ), announced today its wholly owned subsidiary Just Right Products Inc. had the best July in company history. July 2021 revenues were more than

Month of July Total Revenue Comparison (Graphic: Business Wire).

School uniform sales had the greatest increase which was to be expected. 2021 School uniform revenues were over

ADM Endeavors CEO Marc Johnson said, "We were blown away by the increase in the school uniform numbers. Internally we only projected a 2 to

July 2021 numbers have not been reviewed by our auditor.

About ADMQ: Since 2010, our wholly owned subsidiary, Just Right Products, Inc., has been consistently increasing sales, with sales topping

- www.admendeavors.com

- www.fwpromo.com

- www.justrightproducts.com

- www.uscbdlogo.com

- https://247365threads.com/

- www.facebook.com/groups/admqshareholders

- https://fortworth.academicoutfitters.com/

Forward Looking Statement:

This press release may contain forward-looking information within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Any statements that are not historical facts contained in this press release are "forward-looking statements" that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements. Such forward-looking statements are based on current expectations, involve known and unknown risks, a reliance on third parties for information, transactions that may be cancelled, and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from anticipated results include risks and uncertainties related to the fluctuation of global economic conditions or economic conditions with respect to the retail industry, the COVID-19 pandemic, the performance of management, actions of government regulators, vendors, and suppliers, our cash flows and ability to obtain financing, competition, general economic conditions and other factors that are detailed in our filings with the Securities and Exchange Commission. We intend that all forward-looking statements be subject to the safe-harbor provisions. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210804005793/en/

FAQ

What was the revenue increase for ADMQ in July 2021?

How did school uniform sales perform for ADMQ in July 2021?

What is the comparison of ADMQ's July 2021 revenues to 2019 figures?

What does the CEO of ADMQ say about the company's performance?