Slow Adoption of Next Generation Payment Solutions Could Put Up to $89 Billion in Bank Revenues at Risk by 2025, According to Research from Accenture

Amid evolving consumer behaviors and economic turbulence, payment methods that offer more choice and control are rapidly gaining traction

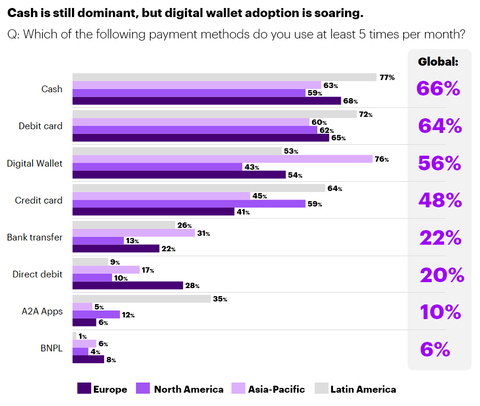

While cash remains the dominant payments method, next-generation payments solutions — including digital wallets, A2A Apps and buy now pay later — are becoming more popular. (Photo: Business Wire)

The report, “Payments Gets Personal,” is based on a survey of more than 16,000 consumers in 13 countries across

Breaking down the payment revenue risk by geographic region, the report identified that

Although traditional payment methods still dominate the consumer payments landscape, next-generation offerings are rapidly gaining traction. The survey identified high usage of traditional payments methods such as cash (used by

More disruption is expected from biometrics payments (authentication of physical characteristics such as retinas, palm/fingerprints and faces). More than four in 10 respondents (

The research also found that external macroeconomic factors including inflation and rising interest rates are shaping consumers’ payment choices as they look to reduce debt interest. Almost one third (

The report recommends several strategies for banks seeking to deliver seamless payments experiences, including:

- Embracing partnerships to scale – Collaboration with other banks and fintechs can help defend core payments revenue and lock out new entrants.

- Offering simplicity and speed – Apps and digital wallets can replace physical branch interactions and digitize payments while offering deeper insights into customers’ behaviors and needs.

- Moving beyond payments – Online marketplaces and “super-apps” can position banks at the center of consumers’ digital lives.

“Now is the time for banks to put a stake in the ground and implement a strategy to defend their core payments revenue,” Agarwal said. “Banks that make bold moves to embrace next-generation payment methods offering people more choice and control could unlock higher levels of customer engagement and drive growth in a rising-interest-rate environment.”

Read the full report, “Payments Gets Personal,” to understand how banks and payments providers can ensure their future growth and relevance in payments.

Methodology

The report draws on insights from the Accenture 2022 Global Consumer Payments study, based on a survey of 16,000 customers in 13 countries across

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Technology and Operations services and Accenture Song — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 721,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221213005802/en/

Accenture

+1 312 693 5707

m.mcginn@accenture.com

Accenture

+44 7746 277759

v.ancell@accenture.com

Source: Accenture