Six in Seven Consumers Desire Simplicity in Entertainment Experiences, Accenture Report Finds

Accenture's "Reinvent for Growth" report reveals that 86% of global consumers prefer an all-in-one platform for entertainment, indicating a shift in media consumption. The survey of 6,000 consumers found 41% are willing to pay for such services, while 61% desire shared streaming profiles. Key findings show 35% unsubscribed from major streaming services in the past year, and 72% are frustrated with content discovery. The report suggests media companies adopt new roles: audience aggregators, audience cultivators, and content merchants to enhance user experience and drive revenue.

- 86% of consumers prefer an all-in-one entertainment platform, representing a significant market demand.

- 41% of respondents indicated a willingness to pay for comprehensive entertainment services.

- The report identifies three emerging roles for media companies that could lead to profitable growth.

- 35% of consumers unsubscribed from at least one major streaming service in the past year, indicating potential revenue loss.

- 72% of participants expressed frustration in discovering content, which could lead to decreased user engagement.

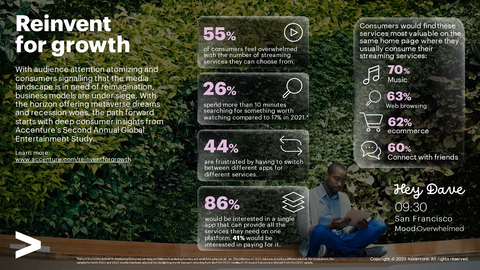

- 55% feel overwhelmed by the number of streaming options, risking customer retention.

“Reinvent for Growth” report highlights how media companies can improve user experiences and drive revenue with new entertainment ecosystems

Six in seven consumers globally (

As part of its second annual global entertainment study, Accenture surveyed 6,000 consumers to understand their preferences and behaviors regarding their online entertainment experiences. Four in 10 respondents (

“Standalone streaming services are running up against some simple facts: There are limits to what consumers will pay for and only a certain amount of complexity and options that they are prepared to deal with,” said

Other findings from the report further highlight the need for media organizations to reconsider their operational and content strategies:

-

More than one-third (

35% ) of consumers unsubscribed from at least one of the top five streaming video-on-demand services in the last 12 months, and26% said that they plan to cut one or more in the next 12 months. -

More than seven in 10 consumers (

72% ) reported frustration at finding something to watch, up 6 percentage points from last year. -

More than half (

55% ) of consumers said they are overwhelmed by the number of streaming services to choose from, with26% saying it can take them more than 10 minutes to settle on a streaming choice (up from17% last year).

Accenture’s report also identifies three emerging roles for entertainment companies that are competing for consumers’ time, attention and money:

- Audience aggregators are platform companies with a diversified business model that monetize attention and engagement directly and indirectly by tying multiple entertainment and other services together in one place.

- Audience cultivators will create and efficiently monetize entertainment in one or multiple forms (e.g., video, music, gaming etc.) by knowing their core audience, focusing on content/cost efficiency, and ensuring that they’re included in audience aggregator platforms and bundles.

- Content merchants will focus on making the best possible content without needing to monetize the engagement their content achieves.

“The future of the media industry is moving toward aggregated platforms,” said

For additional insights and findings on the drivers behind media and entertainment reinvention, click here.

Research Methodology

Accenture conducted research to gain an understanding of consumers’ preferences, beliefs and behaviors on their online entertainment experiences. The online survey of 6,000 consumers aged 18+ in 10 countries (

Oxford Economics assisted in developing the survey, carrying out fieldwork, analyzing the data, and establishing key narratives. The collection of 2021 data was done by a different partner. To ensure appropriate comparisons, the samples for both 2021 and 2022 studies have been adjusted to have a similar structure.

About Accenture

Accenture is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services — creating tangible value at speed and scale. We are a talent and innovation led company with 738,000 people serving clients in more than 120 countries. Technology is at the core of change today, and we are one of the world’s leaders in helping drive that change, with strong ecosystem relationships. We combine our strength in technology with unmatched industry experience, functional expertise and global delivery capability. We are uniquely able to deliver tangible outcomes because of our broad range of services, solutions and assets across Strategy & Consulting, Technology, Operations, Industry X and Accenture Song. These capabilities, together with our culture of shared success and commitment to creating 360° value, enable us to help our clients succeed and build trusted, lasting relationships. We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities. Visit us at www.accenture.com.

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221221005097/en/

Accenture

+1 617 488 5219

melissa.curtis@accenture.com

Source: Accenture

FAQ

What is the main finding of Accenture's report on entertainment?

How many consumers participated in Accenture's entertainment study?

What percentage of consumers are willing to pay for an all-in-one entertainment platform according to Accenture?

What emerging roles for media companies were identified in the report?