Bank Boardrooms Continue to Lack Technology Experience, Accenture Report Reveals

According to a recent Accenture report, boardrooms of major banks are lacking in technology expertise despite increased digital technology adoption. Analyzing the backgrounds of nearly 2,000 directors across over 100 banks, it reveals that only 10% of board directors possess professional technology experience, up by just 4% from 2015. The report recommends that 25% of bank directors should have such expertise. While there is a 33% representation of women in technology roles today, banks in the U.K. and U.S. lead in technology experience, leaving other regions lagging.

- 33% of directors with technology experience are now women, up from 19% five years ago.

- Increased representation of banks with at least one board member having technology experience from 57% to 67% over five years.

- Only 10% of all board directors and 10% of CEOs have professional technology experience, showing minimal progress.

- One-third of banks still lack board members with professional technology experience.

- The increase in boards with technology directors is slow, only 10% in five years.

Despite the significant increase in the adoption of digital technologies over the past few years, there is a continued lack of technology expertise and digital fluency in the boardrooms of the world’s largest banks, according to a new report from Accenture (NYSE: ACN).

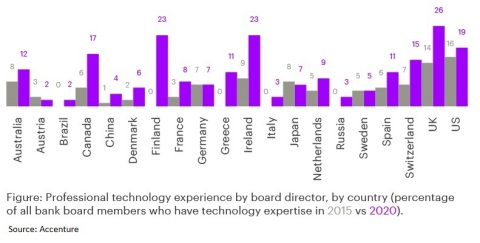

Professional technology experience by board director

Building on a similar report from 2015, the new report, “Boosting the Boardroom’s Technology Expertise – Focus on Banking,” is based on an analysis of the professional backgrounds of nearly 2,000 directors of more than 100 of the world’s largest banks by assets. It finds that while banks are ramping up their technology investments to keep pace with changing consumer demands ― such as the growing need for digital interaction and remote working as a result of the COVID-19 pandemic ― their boards of directors lack the technology expertise to minimize the risks and maximize the benefits of their technology investments.

“Much of the disruption brought about by the pandemic has led to a rapid shift within banking to more digital touchpoints, requiring speedy technology investments,” said Mauro Macchi, who leads Accenture Strategy & Consulting in Europe. “Banks that are accelerating their cloud adoption to better manage change would benefit from a board with technology experience that can help ensure that technology investments are compatible across various business units.”

According to the report, Accenture recommends that

For instance, only

On a positive note, while only

From a geographic perspective, the report found that the boards of banks in the U.K., Finland, Ireland and the U.S. have higher percentages of directors with professional technology experience than those in other countries, with sizeable increases compared with the 2015 findings. However, the percentage of banks’ boards of directors with technology experience is still very low in Brazil, China, Russia and various countries across Europe, including Austria and Italy.

“While it’s not practical for banks to make a rash number of tech-savvy board appointments to fill the gap in technology credentials, they should consider technology expertise as a factor for new appointments, alongside their other evaluation criteria,” Macchi said. “There are also other, more immediate ways to increase technology expertise among board members — for example, coach members on the latest developments on key technologies such as cloud, artificial intelligence and the internet of things to better understand how the combination of technology and human ingenuity unlocks value. Boards can also tap into the expertise of third-party suppliers and make time to specifically discuss the technology strategy during board meetings to get the most out of their investments.”

The full report can be accessed here.

Methodology

Accenture analyzed the professional background of nearly 2,000 executive and non-executive directors of 107 of the largest banks by assets in the world. For the purpose of this analysis, Accenture defines board members with professional technology experience as those who have senior technology responsibilities ― such as serving as chief information officer, chief technology officer or chief digital officer ― at their current company; had such responsibilities in previous companies; or have or had senior responsibilities at a technology firm. The analysis included banks in Australia, Belgium, Brazil, Canada, China, Denmark, France, Germany, Greece, Ireland, Italy, Japan, the Netherlands, Norway, Russia, Spain, Sweden, Switzerland, the U.K. and the U.S.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 514,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Accenture’s Banking industry group helps retail and commercial banks and payments providers boost innovation; address business, technology and regulatory challenges; and improve operational performance to build trust and engagement with customers and grow more profitably and securely. To learn more, visit https://www.accenture.com/us-en/industries/banking-index.

Copyright © 2021 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210311005191/en/

FAQ

What does the recent Accenture report reveal about technology expertise in banks' boardrooms?

How has the representation of women in technology roles on bank boards changed?

What percentage of bank directors does Accenture recommend should have technology experience?

Which regions have higher percentages of bank board members with technology expertise?