Air Canada Reports Second Quarter 2024 Financial Results

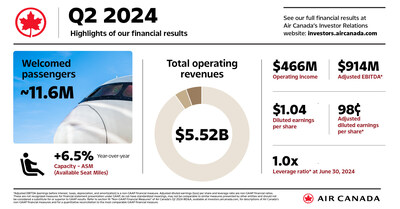

Air Canada reported its second quarter 2024 financial results with operating revenues of $5.5 billion, marking a 2% year-over-year increase. The company generated an operating income of $466 million, a steep decline of $336 million from the previous year. Adjusted EBITDA stood at $914 million, down $306 million year-over-year.

Net income for Q2 2024 was $410 million, translating to $1.04 diluted earnings per share, compared to $838 million or $2.34 respectively in Q2 2023. Adjusted net income was $369 million or $0.98 per share. Operating expenses increased by $428 million to $5.053 billion. Despite these challenges, the company reported healthy demand and a 10-percentage-point improvement in on-time performance.

Air Canada also highlighted plans to increase ASM capacity by 4%-4.5% in Q3 2024 and 5.5%-6.5% for the full year. The company secured eight additional Boeing 737-8 aircraft to further diversify its network.

Air Canada ha riportato i risultati finanziari del secondo trimestre 2024 con ricavi operativi di 5,5 miliardi di dollari, segnando un 2% di incremento rispetto all'anno precedente. L'azienda ha generato un reddito operativo di 466 milioni di dollari, con un forte calo di 336 milioni di dollari rispetto all'anno scorso. L'EBITDA rettificato si è attestato a 914 milioni di dollari, in diminuzione di 306 milioni di dollari rispetto all'anno precedente.

Il reddito netto per il secondo trimestre 2024 è stato di 410 milioni di dollari, pari a 1,04 dollari per azione diluita, rispetto ai 838 milioni di dollari o 2,34 dollari rispettivamente nel secondo trimestre 2023. Il reddito netto rettificato è stato di 369 milioni di dollari o 0,98 dollari per azione. Le spese operative sono aumentate di 428 milioni di dollari raggiungendo 5,053 miliardi di dollari. Nonostante queste sfide, l'azienda ha segnalato una domanda sana e un miglioramento di 10 punti percentuali nella puntualità.

Air Canada ha anche evidenziato i piani per aumentare la capacità ASM dal 4% al 4,5% nel terzo trimestre 2024 e dal 5,5% al 6,5% per l'intero anno. L'azienda ha acquisito otto ulteriori aerei Boeing 737-8 per diversificare ulteriormente la sua rete.

Air Canada presentó los resultados financieros del segundo trimestre de 2024 con ingresos operativos de 5.5 mil millones de dólares, marcando un aumento del 2% en comparación con el año anterior. La empresa generó un ingreso operativo de 466 millones de dólares, una fuerte disminución de 336 millones de dólares en comparación con el año pasado. El EBITDA ajustado se situó en 914 millones de dólares, una caída de 306 millones de dólares en comparación con el año anterior.

El ingreso neto para el segundo trimestre de 2024 fue de 410 millones de dólares, lo que se traduce en 1.04 dólares de ganancia por acción diluida, en comparación con 838 millones de dólares o 2.34 dólares respectivamente en el segundo trimestre de 2023. El ingreso neto ajustado fue de 369 millones de dólares o 0.98 dólares por acción. Los gastos operativos aumentaron en 428 millones de dólares alcanzando 5.053 mil millones de dólares. A pesar de estos desafíos, la empresa reportó una demanda saludable y una mejora de 10 puntos porcentuales en el desempeño a tiempo.

Air Canada también destacó planes para aumentar la capacidad ASM en un 4% - 4.5% en el tercer trimestre de 2024 y 5.5% - 6.5% para todo el año. La compañía aseguró ocho aviones Boeing 737-8 adicionales para diversificar aún más su red.

에어 캐나다는 2024년 2분기 재무 결과를 발표하였으며, 운영 수익은 55억 달러로 전년 대비 2% 증가하였습니다. 회사는 운영 소득으로 4억 6600만 달러를 기록했으며, 이는 전년도 대비 3억 3600만 달러의 큰 감소입니다. 조정된 EBITDA는 9억 1400만 달러로 전년 대비 3억 600만 달러 감소했습니다.

2024년 2분기의 순이익은 4억 1000만 달러로, 희석 주당 순이익은 1.04달러이며, 이는 2023년 2분기의 8억 3800만 달러 또는 2.34달러와 비교됩니다. 조정된 순이익은 3억 6900만 달러 또는 0.98달러로 나타났습니다. 운영 비용은 4억 2800만 달러 증가하여 50억 5300만 달러에 도달했습니다. 이러한 도전에도 불구하고, 회사는 건강한 수요와 10% 포인트의 시간 준수 성능 개선을 보고했습니다.

에어 캐나다는 또한 2024년 3분기에는 ASM 용량을 4%-4.5% 증가시킬 계획과 연간 5.5%-6.5%의 증가가 예정되어 있음을 강조했습니다. 회사는 네트워크를 더욱 다양화하기 위해 보잉 737-8 항공기를 8대 추가로 확보했습니다.

Air Canada a publié ses résultats financiers du deuxième trimestre 2024 avec des revenus opérationnels de 5,5 milliards de dollars, marquant une augmentation de 2% par rapport à l'année précédente. L'entreprise a généré un revenu opérationnel de 466 millions de dollars, une forte baisse de 336 millions de dollars par rapport à l'année précédente. L'EBITDA ajusté s'est élevé à 914 millions de dollars, en baisse de 306 millions de dollars d'une année sur l'autre.

Le revenu net pour le 2e trimestre 2024 était de 410 millions de dollars, soit 1,04 dollar de bénéfice dilué par action, comparé à 838 millions de dollars ou 2,34 dollars respectivement au 2e trimestre 2023. Le revenu net ajusté était de 369 millions de dollars ou 0,98 dollar par action. Les dépenses d'exploitation ont augmenté de 428 millions de dollars pour atteindre 5,053 milliards de dollars. Malgré ces défis, l'entreprise a déclaré une demande soutenue et une amélioration de 10 points de pourcentage en termes de ponctualité.

Air Canada a également mis en avant ses projets d'augmentation de la capacité ASM de 4%-4,5% au 3e trimestre 2024 et de 5,5%-6,5% pour l'année complète. L'entreprise a sécurisé huit avions Boeing 737-8 supplémentaires pour diversifier encore son réseau.

Air Canada hat die Finanzdaten des zweiten Quartals 2024 veröffentlicht, mit Betriebseinnahmen von 5,5 Milliarden Dollar, was einem 2% Anstieg im Vergleich zum Vorjahr entspricht. Das Unternehmen erzielte ein Betriebsergebnis von 466 Millionen Dollar, was einem drastischen Rückgang von 336 Millionen Dollar im Vergleich zum Vorjahr entspricht. Das bereinigte EBITDA betrug 914 Millionen Dollar, was einem Rückgang von 306 Millionen Dollar im Jahresvergleich entspricht.

Der Nettogewinn für das 2. Quartal 2024 betrug 410 Millionen Dollar, was einem 1,04 Dollar verwässerten Gewinn pro Aktie entspricht, verglichen mit 838 Millionen Dollar oder 2,34 Dollar im Vergleich zum 2. Quartal 2023. Der bereinigte Nettogewinn betrug 369 Millionen Dollar oder 0,98 Dollar pro Aktie. Die Betriebskosten stiegen um 428 Millionen Dollar auf 5.053 Milliarden Dollar. Trotz dieser Herausforderungen berichtete das Unternehmen von einer gesunden Nachfrage und einer Verbesserung um 10 Prozentpunkte bei der Pünktlichkeit.

Air Canada hob auch die Pläne hervor, die ASM-Kapazität im 3. Quartal 2024 um 4%-4,5% und für das gesamte Jahr um 5,5%-6,5% zu erhöhen. Das Unternehmen sicherte sich zusätzlich acht Boeing 737-8 Flugzeuge, um sein Netzwerk weiter zu diversifizieren.

- Operating revenues increased 2% to $5.5 billion.

- Reported healthy demand and a 10-percentage-point improvement in on-time performance.

- Plans to increase ASM capacity by 4%-4.5% in Q3 2024 and 5.5%-6.5% for the full year.

- Secured eight additional Boeing 737-8 aircraft.

- Operating income decreased by $336 million to $466 million.

- Adjusted EBITDA declined by $306 million to $914 million.

- Net income decreased from $838 million to $410 million, a 51% decline.

- Adjusted net income fell from $664 million to $369 million.

- Operating expenses increased by $428 million to $5.053 billion.

- Free cash flow decreased by $514 million to $451 million.

- Second quarter operating revenues of

$5.5 billion 2% year over year - Operating income of

$466 million $336 million - Adjusted EBITDA* of

$914 million $306 million - Leverage ratio* of 1.0 as at June 30, 2024, compared to 1.1 at end of 2023

"Air Canada today reported second quarter operating revenues of more than

"When compared to the second quarter of 2023, we increased our capacity 6.5 per cent in the period. Our adjusted unit cost was well contained, increasing 1.7 per cent. This was supported through rigorous cost discipline, which is always a top priority for us. We will continue to adapt to market conditions, manage capacity proactively and contain costs through productivity and other initiatives.

We further diversified our network, including with services to

*Adjusted CASM, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, leverage ratio, net debt, adjusted pre-tax income (loss), adjusted net income (loss), adjusted earnings (loss) per share, and free cash flow are referred to in this news release. Such measures are non-GAAP financial measures, non-GAAP ratios, or supplementary financial measures, are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. Refer to the "Non-GAAP Financial Measures" section of this news release for descriptions of these measures, and for a reconciliation of Air Canada non-GAAP measures used in this news release to the most comparable GAAP financial measure. |

Second Quarter 2024 Financial Results

The following is an overview of Air Canada's results of operations and financial position for the second quarter 2024 compared to the second quarter 2023.

- Operating revenues of

$5.51 9 billion$92 million 2% on6.5% more operated capacity. The year-over-year capacity increase was in line the projection provided in Air Canada's May 2, 2024, news release. - Operating expenses of

$5.05 3 billion$428 million 9% . - Operating income of

$466 million 8.4% , decreased$336 million - Adjusted EBITDA of

$914 million 16.6% , declined$306 million - Net income of

$410 million $1.04 $838 million $2.34 - Adjusted net income of

$369 million $0.98 $664 million $1.85 - Adjusted CASM of

13.53 cents increased1.7% year-over-year, driven by labour, maintenance and information technology expenses increasing at a higher rate than capacity. - Net cash flows from operating activities of

$924 million $566 million - Free cash flow* of

$451 million $514 million - Net debt-to-adjusted EBITDA ratio was 1.0 at June 30, 2024, compared to 1.1 at December 31, 2023.

Outlook

For the third quarter of 2024, Air Canada plans to increase its ASM capacity between

For the full year 2024, Air Canada is confirming the following guidance, which was updated on July 22, 2024:

Metric | 2024 Guidance |

ASM capacity | 5.5 to |

Adjusted CASM | 2.5 to |

Adjusted EBITDA |

Major Assumptions

Air Canada made assumptions in providing its guidance—including moderate Canadian GDP growth for 2024. Air Canada also assumes that the Canadian dollar will trade, on average, at

Non-GAAP Financial Measures

Below is a description of certain non-GAAP financial measures and ratios used by Air Canada to provide readers with additional information on its financial and operating performance. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results.

Air Canada excludes the effect of impairment of assets, if any, when calculating adjusted CASM, adjusted EBITDA, adjusted EBITDA margin, adjusted pre-tax income (loss) and adjusted net income (loss) as it may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful. Air Canada did not record charges for impairment of assets in the first six months of 2024 or in 2023.

Adjusted CASM

Air Canada uses adjusted CASM to assess the operating and cost performance of its ongoing airline business without the effects of aircraft fuel expense, the cost of ground packages at Air Canada Vacations and freighter costs as these items may distort the analysis of certain business trends and render comparative analysis across periods less meaningful and their exclusion generally allows for a more meaningful analysis of Air Canada's operating expense performance and a more meaningful comparison to that of other airlines.

In calculating adjusted CASM, aircraft fuel expense is excluded from operating expense results as it fluctuates widely depending on many factors, including international market conditions, geopolitical events, jet fuel refining costs and

Air Canada also incurs expenses related to the operation of freighter aircraft which some airlines, without comparable cargo businesses, may not incur. Air Canada had six Boeing 767 dedicated freighter aircraft in service as at June 30, 2024 and six as at June 30, 2023. These costs do not generate ASMs and therefore excluding these costs from operating expense results provides for a more meaningful comparison of the passenger airline business across periods.

Adjusted CASM is reconciled to GAAP operating expense as follows:

(Canadian dollars in millions, except | Second Quarter | First Six Months | ||||||||||

2024 | 2023 | Change | 2024 | 2023 | Change | |||||||

Operating expense – GAAP | $ | 5,053 | $ | 4,625 | $ | 428 | $ | 10,268 | $ | 9,529 | $ | 739 |

Adjusted for: | ||||||||||||

Aircraft fuel | (1,333) | (1,187) | (146) | (2,587) | (2,562) | (25) | ||||||

Ground package costs | (137) | (126) | (11) | (472) | (444) | (28) | ||||||

Freighter costs (excluding fuel) | (38) | (39) | 1 | (73) | (70) | (3) | ||||||

Operating expense, adjusted for the | $ | 3,545 | $ | 3,273 | $ | 272 | 7,136 | 6,453 | 683 | |||

ASMs (millions) | 26,203 | 24,606 | 6.5 % | 50,540 | 46,513 | 8.7 % | ||||||

Adjusted CASM (cents) | ¢ | 13.53 | ¢ | 13.30 | ¢ | 0.23 | ¢ | 14.12 | ¢ | 13.87 | ¢ | 0.25 |

EBITDA and Adjusted EBITDA

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) is commonly used in the airline industry and is used by Air Canada as a means to view operating results before interest, taxes, depreciation and amortization as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets.

Adjusted EBITDA margin (adjusted EBITDA as a percentage of operating revenues) is commonly used in the airline industry and is used by Air Canada as a means to measure the operating margin before interest, taxes, depreciation and amortization as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets.

Adjusted EBITDA and adjusted EBITDA margin are reconciled to GAAP operating income (loss) as follows:

Second Quarter | First Six Months | |||||||||||

(Canadian dollars in millions, except where | 2024 | 2023 | Change | 2024 | 2023 | Change | ||||||

Operating income – GAAP | $ | 466 | $ | 802 | $ | (336) | $ | 477 | $ | 785 | $ | (308) |

Add back: | ||||||||||||

Depreciation and amortization | 448 | 418 | 30 | 890 | 846 | 44 | ||||||

Adjusted EBITDA | $ | 914 | $ | 1,220 | $ | (306) | $ | 1,367 | $ | 1,631 | $ | (264) |

Operating revenues | $ | 5,519 | $ | 5,427 | $ | 92 | $ | 10,745 | $ | 10,314 | $ | 431 |

Operating margin (%) | 8.4 | 14.8 | (6.4) pp | 4.4 | 7.6 | (3.2) pp | ||||||

Adjusted EBITDA margin (%) | 16.6 | 22.5 | (5.9) pp | 12.7 | 15.8 | (3.1) pp | ||||||

Adjusted Pre-tax Income (Loss)

Adjusted pre-tax income (loss) is used by Air Canada to assess the overall pre-tax financial performance of its business without the effects of foreign exchange gains or losses, net interest relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on disposal of assets, gains or losses on debt settlements and modifications, as these items may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful.

Adjusted pre-tax income (loss) is reconciled to GAAP income (loss) before income taxes as follows:

(Canadian dollars in millions) | Second Quarter | First Six Months | ||||||||||

2024 | 2023 | $ Change | 2024 | 2023 | $ Change | |||||||

Income before income taxes – GAAP | $ | 404 | $ | 796 | $ | (392) | $ | 339 | $ | 773 | $ | (434) |

Adjusted for: | ||||||||||||

Foreign exchange (gain) loss | 2 | (251) | 253 | (57) | (378) | 321 | ||||||

Net interest relating to employee benefits | (6) | (6) | - | (11) | (12) | 1 | ||||||

(Gain) loss on financial instruments recorded at fair value | (29) | 115 | (144) | (40) | 77 | (117) | ||||||

Loss on debt settlement | - | 2 | (2) | 46 | 2 | 44 | ||||||

Adjusted pre-tax income | $ | 371 | $ | 656 | $ | (285) | $ | 277 | $ | 462 | $ | (185) |

Adjusted Net Income (Loss) and Adjusted Earnings (Loss) Per Share – Diluted

Air Canada uses adjusted net income (loss) and adjusted earnings (loss) per share – diluted as a means to assess the overall financial performance of its business without the after-tax effects of foreign exchange gains or losses, net financing expense relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on debt settlements and modifications, gains or losses on disposal of assets as these items may distort the analysis of certain business trends and render comparative analysis to other airlines less meaningful.

Adjusted net income (loss) and adjusted earnings (loss) per shares are reconciled to GAAP net income as follows:

(Canadian dollars in millions) | Second Quarter | First Six Months | ||||||||||

2024 | 2023 | $ Change | 2024 | 2023 | $ Change | |||||||

Net income – GAAP | $ | 410 | $ | 838 | $ | (428) | $ | 329 | $ | 842 | $ | (513) |

Adjusted for: | ||||||||||||

Foreign exchange (gain) loss | 2 | (251) | 253 | (57) | (378) | 321 | ||||||

Net interest relating to employee benefits | (6) | (6) | - | (11) | (12) | 1 | ||||||

(Gain) loss on financial instruments recorded at fair value | (29) | 115 | (144) | (40) | 77 | (117) | ||||||

Loss on debt settlement | - | 2 | (2) | 46 | 2 | 44 | ||||||

Income tax, including for the above | (8) | (34) | 26 | 6 | (55) | 61 | ||||||

Adjusted net income | $ | 369 | $ | 664 | $ | (295) | $ | 273 | $ | 476 | $ | (203) |

Weighted average number of outstanding | 376 | 358 | 18 | 376 | 358 | 18 | ||||||

Adjusted earnings per share – diluted | $ | 0.98 | $ | 1.85 | $ | (0.87) | $ | 0.73 | $ | 1.33 | $ | (0.60) |

(1) | In 2024, the deferred income tax recovery recorded in other comprehensive income related to remeasurements on employee benefit liabilities is offset by a deferred income tax expense which was recorded through Air Canada's consolidated statement of operations. This expense is removed from adjusted net income for the year 2024. In comparison, a deferred tax recovery was removed from adjusted net income for the second quarter of 2023. |

The table below reflects the share amounts used in the computation of basic and diluted earnings per share on an adjusted earnings per share basis:

(In millions) | Second Quarter | First Six Months | ||

2024 | 2023 | 2024 | 2023 | |

Weighted average number of shares | 358 | 358 | 358 | 358 |

Effect of dilution | 18 | - | 18 | - |

Weighted average number of shares | 376 | 358 | 376 | 358 |

Free Cash Flow

Air Canada uses free cash flow as an indicator of the financial strength and performance of its business, indicating the amount of cash Air Canada can generate from operations and after capital expenditures. Free cash flow is calculated as net cash flows from operating activities minus additions to property, equipment, and intangible assets, and is net of proceeds from sale and leaseback transactions.

The table below reconciles free cash flow to net cash flows from (used in) operating activities for the periods indicated.

Second Quarter | First Six Months | |||||||||||

(Canadian dollars in millions) | 2024 | 2023 | $ Change | 2024 | 2023 | $ Change | ||||||

Net cash flows from operating activities | $ | 924 | $ | 1,490 | $ | (566) | $ | 2,516 | $ | 2,927 | $ | (411) |

Additions to property, equipment, and | (473) | (525) | 52 | (1,009) | (975) | (34) | ||||||

Free cash flow (1) | $ | 451 | $ | 965 | $ | (514) | $ | 1,507 | $ | 1,952 | $ | (445) |

Net Debt

Net debt is a capital management measure and a key component of the capital managed by Air Canada and provides management with a measure of its net indebtedness.

Net Debt to Trailing 12-Month Adjusted EBITDA (Leverage Ratio)

Net debt to trailing 12-month adjusted EBITDA ratio (also referred to as "leverage ratio") is commonly used in the airline industry and is used by Air Canada as a means to measure financial leverage. Leverage ratio is calculated by dividing net debt by trailing 12-month adjusted EBITDA.

The table below reconciles leverage ratio to Air Canada's debt net balances as at the dates indicated.

(Canadian dollars in millions) | June 30, 2024 | December 31, 2023 | Change | |||

Total long-term debt and lease liabilities | $ | 10,858 | $ | 12,996 | $ | (2,138) |

Current portion of long-term debt and lease liabilities | 1,619 | 866 | 753 | |||

Total long-term debt and lease liabilities (including current | 12,477 | 13,862 | (1,385) | |||

Less cash, cash equivalents and short- and long-term | (8,869) | (9,295) | 426 | |||

Net debt (1) | $ | 3,608 | $ | 4,567 | $ | (959) |

Adjusted EBITDA (trailing 12 months) | $ | 3,718 | 3,982 | (264) | ||

Net debt to adjusted EBITDA ratio (1) | 1.0 | 1.1 | (0.1) | |||

For further information on Air Canada's public disclosure file, including Air Canada's 2023 Annual Information Form, dated March 4, 2024, consult SEDAR at www.sedarplus.ca.

Second Quarter 2024 Conference Call

Air Canada will host its quarterly analysts' call today, Wednesday, August 7, 2024, at 8:00 a.m. ET. Michael Rousseau, President and Chief Executive Officer, John Di Bert, Executive Vice President and Chief Financial Officer, and Mark Galardo, Executive Vice President, Revenue and Network Planning and President, Cargo, will present the results and be available for analysts' questions. Immediately following the analysts' Q&A session, Mr. Di Bert and Pierre Houle, Vice President and Treasurer, will be available to answer questions from term loan B lenders and holders of Air Canada bonds.

Media and the public may access this call on a listen-in basis. Details are as follows:

Webcast: | |

By telephone: | +1-647-932-3411 or 1-800-715-9871 (toll-free) |

Conference ID 6478306 | |

Please allow 10 minutes to be connected to the conference call. |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release includes forward-looking statements within the meaning of applicable securities laws. Forward-looking statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may involve, but are not limited to, comments relating to guidance, strategies, expectations, planned operations or future actions. Forward-looking statements are identified using terms and phrases such as "preliminary", "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "predict", "project", "will", "would", and similar terms and phrases, including references to assumptions.

Forward-looking statements, by their nature, are based on assumptions including those described herein and are subject to important risks and uncertainties. Forward-looking statements cannot be relied upon due to, among other things, changing external events and general uncertainties of the business of Air Canada. Actual results may differ materially from results indicated in forward-looking statements due to a number of factors, including those discussed below.

Factors that may cause results to differ materially from results indicated in forward-looking statements include economic conditions as well as geopolitical conditions such as the military conflicts in the

Air Canada has and continues to establish targets, make commitments and assess the impact regarding climate change, and related initiatives, plans and proposals that Air Canada and other stakeholders (including government, regulatory and other bodies) are pursuing in relation to climate change and carbon emissions. The achievement of our commitments and targets depends on many factors, including the combined actions of governments, industry, suppliers and other stakeholders and actors, as well as the development and implementation of new technologies. In particular, our 2030 and 2050 carbon emission related targets are ambitious, and heavily dependent on new technologies, renewable energies and the availability of a sufficient supply of sustainable aviation fuels (SAF) which continues to present serious challenges. In addition, Air Canada has incurred, and expects to continue to incur, costs to achieve its goal of net-zero carbon emissions and to comply with environmental sustainability legislation and regulation and other standards and accords. The precise nature of future binding or non-binding legislation, regulation, standards and accords, on which local and international stakeholders are increasingly focusing, cannot be predicted with any degree of certainty, nor can their financial, operational or other impact. There can be no assurance of the extent to which any of our climate goals will be achieved or that any future investments that we make in furtherance of achieving our climate goals will produce the expected results or meet increasing stakeholder environmental, social and governance expectations. Moreover, future events could lead Air Canada to prioritize other nearer-term interests over progressing toward our current climate goals based on business strategy, economic, regulatory and social factors, and potential pressure from investors, activist groups or other stakeholders. If we are unable to meet or properly report on our progress toward achieving our climate change goals and commitments, we could face adverse publicity and reactions from investors, customers, advocacy groups or other stakeholders, which could result in reputational harm or other adverse effects to Air Canada.

The forward-looking statements contained or incorporated by reference in this news release represent Air Canada's expectations as of the date of this news release (or as of the date they are otherwise stated to be made) and are subject to change after such date. However, Air Canada disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities regulations.

Internet: aircanada.com/media

Read Our Annual Report Here

Sign up for Air Canada news: aircanada.com

Media Resources:

Photos

Videos

B-Roll

Articles

Selected Financial Metrics and Statistics

The financial and operating highlights for Air Canada for the periods indicated are as follows:

(Canadian dollars in millions, except per share data or | Second Quarter | First Six Months | ||||

Financial Performance Metrics | 2024 | 2023 | $ Change | 2024 | 2023 | $ Change |

Operating revenues | 5,519 | 5,427 | 92 | 10,745 | 10,314 | 431 |

Operating income | 466 | 802 | (336) | 477 | 785 | (308) |

Operating margin (1) (%) | 8.4 | 14.8 | (6.4) pp (8) | 4.4 | 7.6 | (3.2) pp |

Adjusted EBITDA (2) | 914 | 1,220 | (306) | 1,367 | 1,631 | (264) |

Adjusted EBITDA margin (2) (%) | 16.6 | 22.5 | (5.9) pp | 12.7 | 15.8 | (3.1) pp |

Income before income taxes | 404 | 796 | (392) | 339 | 773 | (434) |

Net income | 410 | 838 | (428) | 329 | 842 | (513) |

Adjusted pre-tax income (2) | 371 | 656 | (285) | 277 | 462 | (185) |

Adjusted net income (2) | 369 | 664 | (295) | 273 | 476 | (203) |

Total liquidity (3) | 10,203 | 10,551 | (348) | 10,203 | 10,551 | (348) |

Net cash flows from operating activities | 924 | 1,490 | (566) | 2,516 | 2,927 | (411) |

Free cash flow (2) | 451 | 965 | (514) | 1,507 | 1,952 | (445) |

Net debt (2) | 3,608 | 5,330 | (1,722) | 3,608 | 5,330 | (1,722) |

Diluted earnings per share | 1.04 | 2.34 | (1.30) | 0.87 | 2.35 | (1.48) |

Adjusted earnings per share – diluted (2) | 0.98 | 1.85 | (0.87) | 0.73 | 1.33 | (0.60) |

Operating Statistics (4) | 2024 | 2023 | Change | 2024 | 2023 | Change |

Revenue passenger miles (RPMs) (millions) | 22,449 | 21,617 | 3.8 | 42,969 | 40,195 | 6.9 |

Available seat miles (ASMs) (millions) | 26,203 | 24,606 | 6.5 | 50,540 | 46,513 | 8.7 |

Passenger load factor % | 85.7 % | 87.9 % | (2.2) pp | 85.0 % | 86.4 % | (1.4) pp |

Passenger revenue per RPM (Yield) (cents) | 22.2 | 22.7 | (2.0) | 22.0 | 22.4 | (2.0) |

Passenger revenue per ASM (PRASM) (cents) | 19.0 | 19.9 | (4.4) | 18.7 | 19.3 | (3.4) |

Operating revenue per ASM (TRASM) (cents) | 21.1 | 22.1 | (4.5) | 21.3 | 22.2 | (4.1) |

Operating expense per ASM (CASM) (cents) | 19.3 | 18.8 | 2.6 | 20.3 | 20.5 | (0.8) |

Adjusted CASM (cents) (2) | 13.5 | 13.3 | 1.7 | 14.1 | 13.9 | 1.8 |

Average number of full-time-equivalent (FTE) | 37.2 | 35.9 | 3.5 | 37.1 | 35.2 | 5.3 |

Aircraft in operating fleet at period-end | 356 | 354 | 0.6 | 356 | 354 | 0.6 |

Seats dispatched (thousands) | 14,213 | 13,390 | 6.1 | 27,692 | 25,683 | 7.8 |

Aircraft frequencies (thousands) | 97.9 | 93.5 | 4.7 | 188.9 | 178.7 | 5.7 |

Average stage length (miles) (6) | 1,844 | 1,838 | 0.3 | 1,825 | 1,811 | 0.8 |

Fuel cost per litre (cents) | 104.3 | 101.1 | 3.2 | 104.9 | 114.2 | (8.2) |

Fuel litres (thousands) | 1,273,467 | 1,162,714 | 9.5 | 2,458,185 | 2,229,799 | 10.2 |

Revenue passengers carried (thousands) (7) | 11,588 | 11,287 | 2.7 | 22,339 | 21,256 | 5.1 |

(1) | Operating margin is a supplementary financial measure and is defined as operating income (loss) as a percentage of operating revenues. |

(2) | Adjusted pre-tax income (loss), adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, free cash flow, net debt and adjusted CASM are non-GAAP financial measures, capital management measures, non-GAAP ratios or supplementary financial measures. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. Refer to section "Non-GAAP Financial Measures" of this release for descriptions of Air Canada's non-GAAP financial measures and for a quantitative reconciliation of Air Canada's non-GAAP financial measures to the most comparable GAAP measure. |

(3) | Total liquidity refers to the sum of cash, cash equivalents, short- and long-term investments, and the amounts available under Air Canada's credit facilities. Total liquidity, as at June 30, 2024, of |

(4) | Except for the reference to average number of FTE employees, operating statistics in this table include third-party carriers operating under capacity purchase agreements with Air Canada. |

(5) | Reflects FTE employees at Air Canada and its subsidiaries. Excludes FTE employees at third-party carriers operating under capacity purchase agreements with Air Canada. |

(6) | Average stage length is calculated by dividing the total number of available seat miles by the total number of seats dispatched. |

(7) | Revenue passengers are counted on a flight number basis (rather than by journey/itinerary or by leg), which is consistent with the IATA definition of revenue passengers carried. |

(8) | "pp" denotes percentage points and refers to a measure of the arithmetic difference between two percentages. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/air-canada-reports-second-quarter-2024-financial-results-302216126.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/air-canada-reports-second-quarter-2024-financial-results-302216126.html

SOURCE Air Canada