American Battery Technology Company Releases First Quarter Fiscal Year 2024 Financial Report

- ABTC has commenced operations at its first commercial-scale lithium-ion battery recycling facility, demonstrating a strategic approach to recycling processes and feedstock matching. The company's successful commencement of operations has been de-risked by its prime location, in-house project development expertise, and secured battery recycling feedstock from strategic partnerships.

- The completion of the third drill program at the Tonopah Flats Lithium Project has provided valuable data for the development of the domestic resource towards upgraded Measured and Indicated classifications, reinforcing the company's position as one of the largest known lithium resources in the United States.

- The contracting of additional U.S. Department of Energy grants totaling approximately $70 million further supports the robust development of ABTC's battery recycling and primary lithium manufacturing operations, significantly covering a substantial portion of the company's operating and capital expenses.

- The listing and trading of ABTC's shares on the Nasdaq Exchange represent a long-term strategic move, allowing the company to expand its reach in the capital markets and support its next phases of growth.

- None.

Insights

Analyzing...

Company commences battery recycling operations and the manufacturing of recycled products for near-term revenue generation and continues the development of its primary battery metals resource

- Commencement of operations at commercial lithium-ion battery recycling facility, and successful manufacturing of recycled product for revenue generation;

- Completion of third Tonopah Flats Lithium Project drill program, intended to improve confidence in the mineral resource estimate and upgrade the third-party analysis to include Measured and Inferred classifications;

- Contracting of additional grant awards from

U.S. Department of Energy, bringing total to approximately$70 million - Company listed and began trading under the stock symbol ABAT on the Nasdaq Exchange.

The company continues to implement its market-matched strategic growth trajectory for its lithium-ion battery recycling operations and its diversified business model by also developing and constructing its primary lithium-bearing resource and lithium hydroxide refinery near

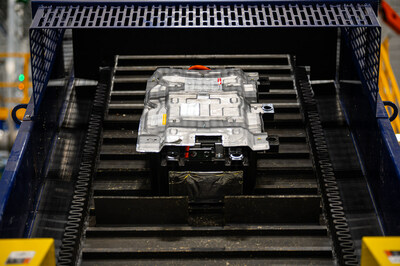

Commencement of Commercial Battery Recycling Operations

ABTC has designed, constructed, commissioned, and now begun operations at its first commercial-scale lithium-ion battery recycling facility with a nominal throughput of 20,000 metric tonnes per year when fully ramped. While other prospective battery recyclers within the

A single battery Gigafactory with a manufacturing capacity of 30-40 GWhr/yr of batteries tends to produce 20,000 – 30,000 metric tonnes per year of waste battery materials. Not coincidentally, ABTC as part of its right-sized phased growth approach, has designed its first commercial recycling facility to match the typical average of battery waste that a single Gigafactory produces. Currently, there is one battery Gigafactory in operation in the

The ABTC team is comprised primarily of engineers, construction managers, and operators of large-scale battery manufacturing facilities, and as such has significant experience managing large construction projects and bringing first-of-kind technologies to market. The ABTC team has successfully managed its internal team and external contractors to bring this first commercial-scale recycling facility to operations in a compressed timeline and under the estimated budget.

ABTC's strategically sized operations, prime location in the Tahoe-Reno Industrial Center (TRIC), and in-house project development expertise greatly de-risked this project and ultimately led to a successful commencement of operations. Securing battery recycling feedstock from sources such as the recently announced strategic partnership with BASF, and the company's participation in a consumer-facing e-waste pilot program sponsored by FedEx, the ABTC recycling facility has now manufactured recycled products that are able to be sold for revenue generating operations through ABTC's already contracted offtake and marketing agreements.

Tonopah Flats Lithium Project – Third Drill Program

ABTC has completed its third exploration drill program at its Tonopah Flats Lithium Project in Big Smoky Valley,

Based on a third-party audited SK-1300-compliant Maiden Resource Report published in February 2023, and before the integration of the data from this third drill program, the Tonopah Flats Lithium Project was one of the largest known lithium resources in

ABTC intends to publish an updated resource report that includes the data from this third drill program in the coming weeks.

Contracting of Additional

ABTC previously had two

These grant awards operate on a cost reimbursable basis, with a portion of expenses reimbursed to ABTC as such expenses are incurred for internal labor hours, equipment, supplies, contracted services, or other expenses. With these four grant projects operating in parallel, a substantial portion of all of ABTC's operating and capital expenses are covered.

Listing on Nasdaq Exchange

ABTC listed its shares and began trading on Nasdaq on September 21, 2023. The listing of its shares on this exchange represents a long-term strategic move for the company, allowing it to expand its reach in the capital markets and support the company's next phases of growth as it works to address the immense shortfall of low-cost and low-environmental impact domestically manufactured battery critical materials.

Financial highlights from first quarter FY2024 include:

- On August 21, 2023, the company finalized the purchase of its commercial-scale, lithium-ion battery recycling facility located in TRIC at 2500 Peru Drive,

McCarran, Nevada . - As of September 30, 2023, the company had total cash on hand of

$5.4 million $7.3 million $4.1 million - Cash used in operations for the three months ended September 30, 2023 was

$4.8 million $0.7 million - Total operating costs for the three months ended September 30, 2023 were

$6.4 million $3.8 million - The company recorded

$2.2 million $1.9 million $0.5 million $0.3 million

About American Battery Technology Company

American Battery Technology Company (ABTC), headquartered in

Inferred Resource

Inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project and may not be converted to a mineral reserve.

Indicated Resource

An Indicated Mineral Resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

Measured Resource

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/american-battery-technology-company-releases-first-quarter-fiscal-year-2024-financial-report-301989233.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/american-battery-technology-company-releases-first-quarter-fiscal-year-2024-financial-report-301989233.html

SOURCE American Battery Technology Company