Wells Fargo Completes Investments in 13 Black-Owned Banks, Fulfilling $50 Million Pledge Made in 2020

Wells Fargo (NYSE: WFC) has announced its investment in two additional African American Minority Depository Institutions (MDIs): The Harbor Bank of Maryland and Industrial Bank of Washington, D.C. This brings its total investments to 13 MDIs, fulfilling its commitment of $50 million to Black-owned banks made in March 2020. The investments aim to enhance lending capacity and community support. Wells Fargo will provide access to its ATM network and offer financial and technological support. The initiative is part of Wells Fargo's ongoing commitment to economic equity and community growth.

- Total investment in MDIs reaches 13, showcasing significant commitment to community support.

- Partnerships are designed to enhance lending capacity and provide strategic growth opportunities for MDIs.

- Access to Wells Fargo's nationwide ATM network without fees for MDI customers improves service accessibility.

- None.

Wells Fargo & Company (NYSE: WFC) today announced it has finalized investments in two additional African American Minority Depository Institutions (MDIs): The Harbor Bank of Maryland and Industrial Bank of Washington, D.C. By making these last two equity capital investments, the company has made investments in a total of 13 MDIs and has fulfilled the bank’s March 10, 2020, announcement to commit

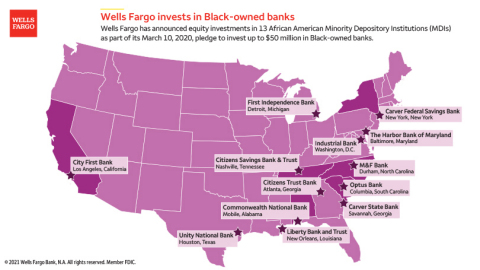

Wells Fargo invests in 13 MDIs in total (Graphic: Wells Fargo)

“We are pleased to announce our investments in the Harbor Bank of Maryland and Industrial Bank, bringing the total number of MDIs in which we’ve made an investment to 13. We are a proud partner to all these banks as each serves as a cornerstone to the communities they serve,” said Gigi Dixon, head of External Engagement for Diverse Segments, Representation and Inclusion at Wells Fargo. “The way we’ve structured this program goes beyond a simple capital investment; we’ve worked to understand these MDIs, their needs, their strategic aspirations, and their challenges. We want to help them grow so they can continue to be important drivers of economic vitality for years to come.”

As part of the investment, Wells Fargo is offering access to a dedicated relationship team that can work with each MDI on financial, technological, and product development strategies to help each institution strengthen and grow. In addition, Wells Fargo will be making its nationwide ATM network available for customers of these 13 MDIs to use without incurring fees.

“Honoring our 86+ year commitment of educating and helping our communities build generational wealth, Industrial Bank is excited to partner with Wells Fargo in expanding these efforts,” said B. Doyle Mitchell, Jr., president and CEO of Industrial Bank. “Being one of only 20 African American banks in the country, this partnership will enhance our ability to grow and create more opportunities to provide capital to those communities we support. We appreciate Wells Fargo for its commitment to invest in minority institutions and partnering to alleviate the negative impact of financial inequalities on communities of color and closing the racial wealth gap.”

Wells Fargo has made investments in the following MDIs:

- City First Bank, in Los Angeles, California

- Carver Federal Savings Bank, in New York, New York

- Carver State Bank, in Savannah, Georgia

- Citizens Trust Bank, in Atlanta, Georgia

- Citizens Savings Bank & Trust, in Nashville, Tennessee

- Commonwealth National Bank, in Mobile, Alabama

- First Independence Bank, in Detroit, Michigan

- The Harbor Bank of Maryland, in Baltimore, Maryland

- Industrial Bank, in Washington, D.C.

- Liberty Bank, in New Orleans, Louisiana

- M&F Bank, in Durham, North Carolina

- Optus Bank, in Columbia, South Carolina

- Unity National Bank, in Houston, Texas

“Wells Fargo has honored their commitment to make meaningful capital investments in Black banks, and they have further extended their resources to help the banks effectively deploy this new capital to the benefit of historically underserved communities. As the National Bankers Association and our members pursue our vision to eliminate the racial wealth gap in America, we look forward to building on this relationship,” said Robert E. James, II, chairman of National Bankers Association.

The structure of Wells Fargo’s investment is in the form of critical equity capital, which is foundational to the MDIs’ ability to expand lending and deposit-taking capacity in their communities. The investments, primarily non-voting positions, are designed to enable the banks to maintain their MDI status. Wells Fargo is also supporting each MDI’s development through a banking relationship in the form of a single touchpoint coverage model that will help them access Wells Fargo’s expertise and pursue strategic priorities like entering new markets, expanding locations, designing new products, and hiring staff to support loan growth.

External partners that assisted Wells Fargo include the National Bankers Association and Sullivan & Cromwell. External advisory committee members are Kim D. Saunders, president and CEO of NBA; Aron Betru, managing director of the Center for Financial Markets at Milken Institute; and John W. Rogers Jr., chairman, co-CEO, and CIO of Ariel Investments.

About Wells Fargo Community Lending and Investment

Wells Fargo Community Lending and Investment (CLI) specializes in offering debt and equity capital to organizations that provide economic development and affordable housing in communities of need nationwide. It is primarily focused on economic redevelopment and housing development nationwide, and is the No. 1 Affordable Housing Investor in the country and No. 2 Affordable Housing Lender. In 2019, CLI provided more than

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately

WF-CF WF-DI WF-SB

View source version on businesswire.com: https://www.businesswire.com/news/home/20210524005139/en/

FAQ

What recent investments has Wells Fargo (WFC) made in minority banks?

How much has Wells Fargo committed to Black-owned banks?

What benefits do the investments from Wells Fargo provide for MDIs?